Far From Cashless

Submitted by Atlas Indicators Investment Advisors on August 20th, 2020

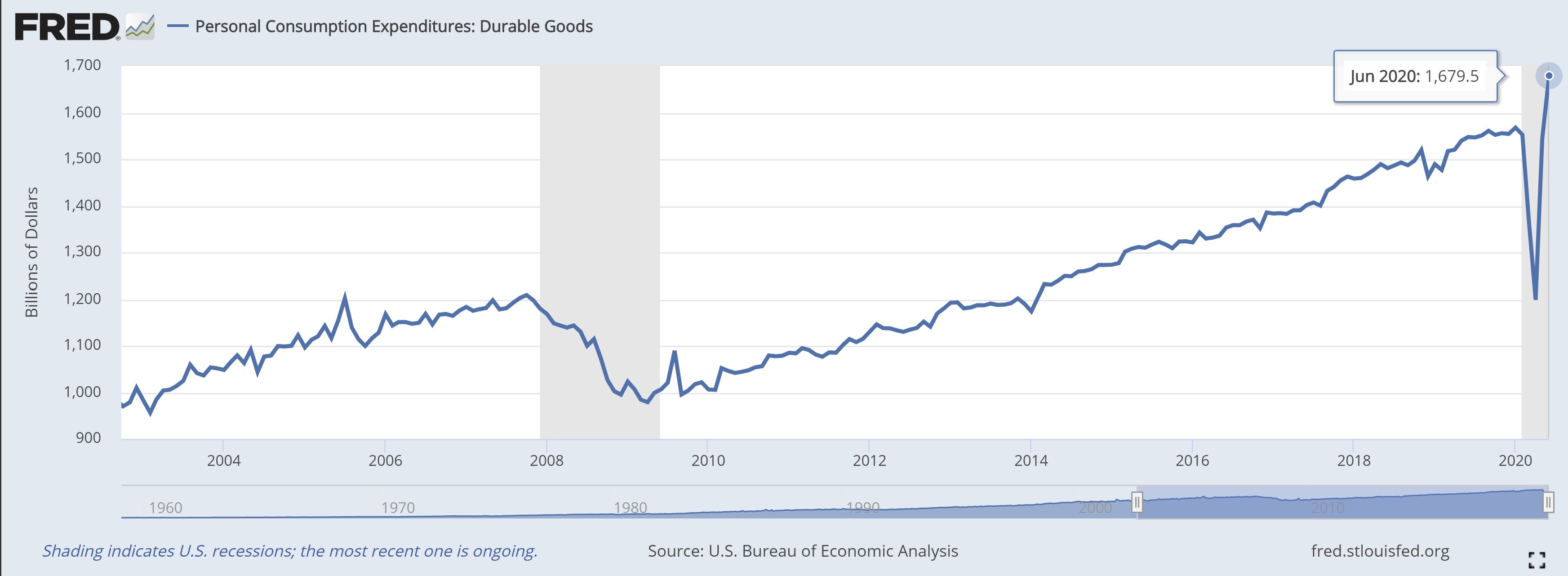

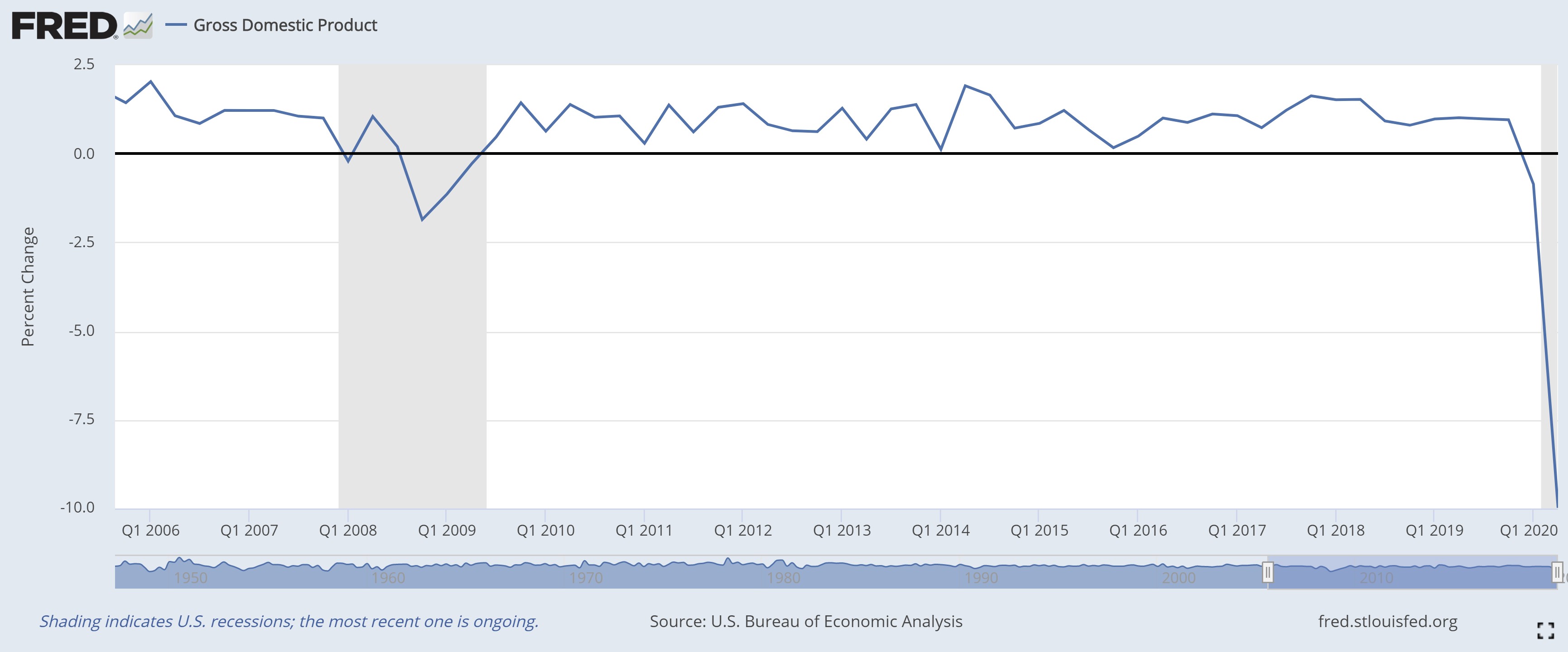

Cash use has been on the decline. Technology has made it easier to spend money without it ever being held in your hands. Consumption is nearly frictionless as mobile technologies allow a person to go from an advertisement on social media to payment in seconds. So, are we headed to a cashless society? The jury is still out but a trend has emerged.