Non-manufacturing

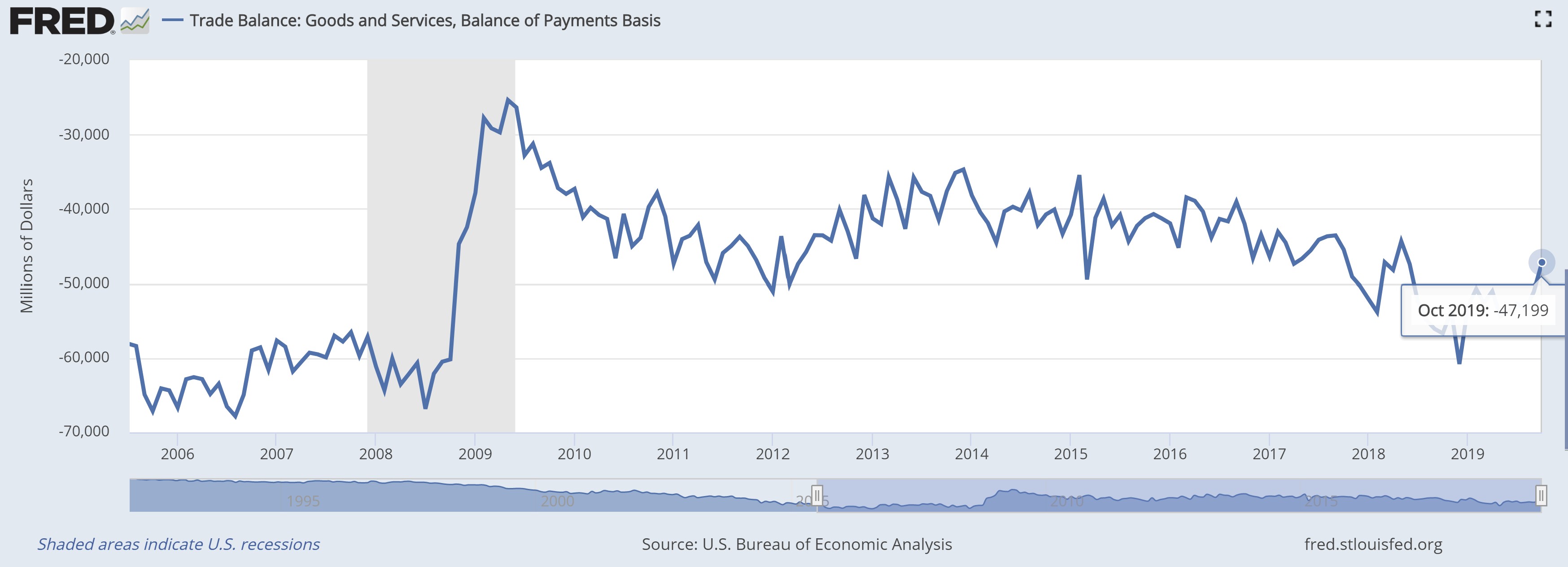

October 2019 Trade Deficit

Submitted by Atlas Indicators Investment Advisors on December 16th, 2019

America’s trade deficit shrank in October 2019 according to the Bureau of Economic Analysis. The shortfall improved to $47.2 billion from the revised $51.1 billion (originally $52.5 billion) chasm in September. While on the surface this indicator looked better, the cause of the improvement is not constructive as both sides of the trade ledger declined in the period.

November 2019 Institute for Supply Management

Submitted by Atlas Indicators Investment Advisors on December 16th, 2019

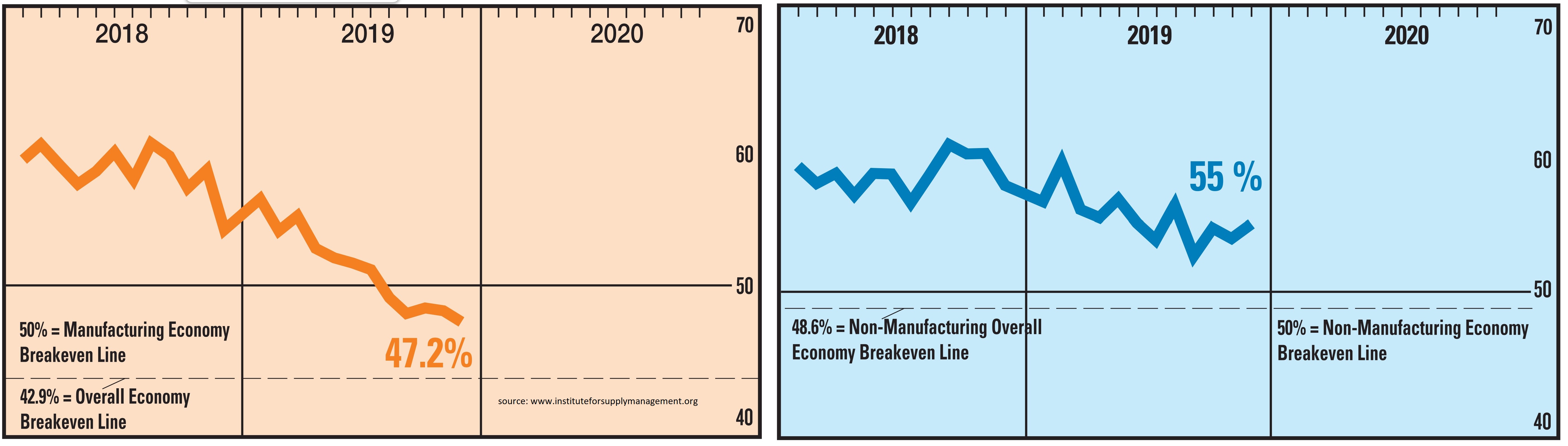

America’s economy was split in November 2019 according to the Institute for Supply Management (ISM). The nation’s manufacturing base continued to contract, falling for a fourth consecutive period. However, non-manufacturing pushed its string of expansions further, reaching 118 months of growth in a row.

Dichonomy

Submitted by Atlas Indicators Investment Advisors on October 23rd, 2019February 2019 Institute for Supply Management

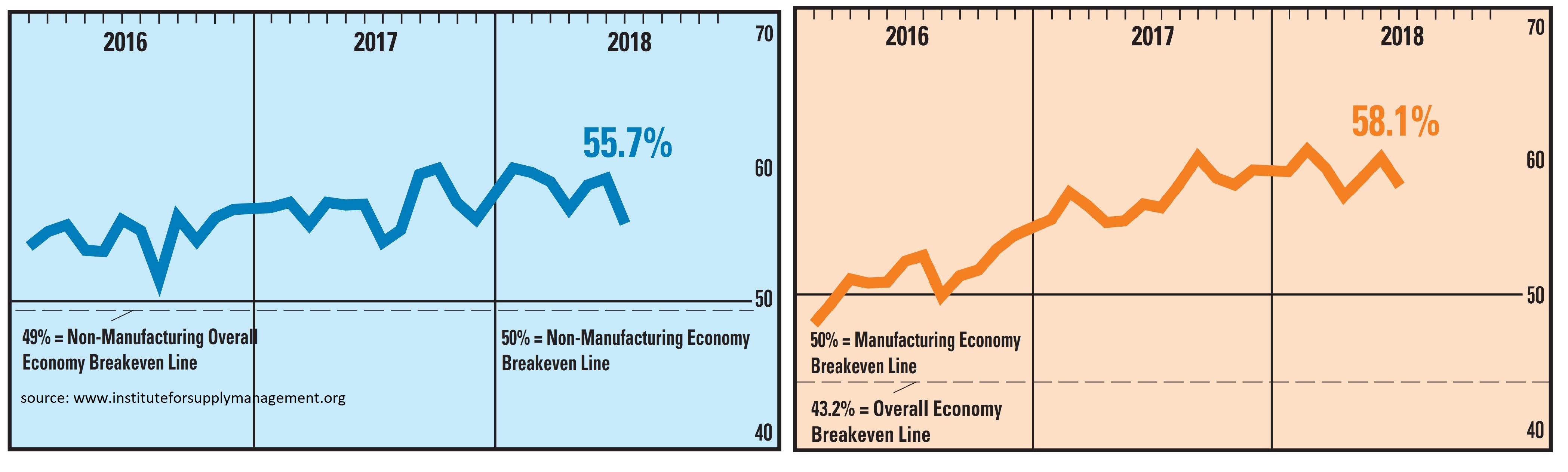

Submitted by Atlas Indicators Investment Advisors on March 5th, 2019America’s economy continued growing in February 2019 according to two indicators from the Institute for Supply Management. Each month they survey purchasing managers from firms representing the manufacturing and services segments of the economy. In this latest survey, each side was well above minimum levels associated with growth.

February 2019 Institute for Supply Management

Submitted by Atlas Indicators Investment Advisors on March 5th, 2019America’s economy continued growing in February 2019 according to two indicators from the Institute for Supply Management. Each month they survey purchasing managers from firms representing the manufacturing and services segments of the economy. In this latest survey, each side was well above minimum levels associated with growth.

December 2018 Institute for Supply Management

Submitted by Atlas Indicators Investment Advisors on January 17th, 2019July 2018 Institute for Supply Management

Submitted by Atlas Indicators Investment Advisors on August 16th, 2018

Economic output seems to have moderated in July 2018 according to the latest from the Institute for Supply Management. Both of their indices (representing manufacturing and services) pulled back from rather elevated levels as the second half of the year got underway. However, output is still growing even if it is decelerating.

April 2018 Institute for Supply Management

Submitted by Atlas Indicators Investment Advisors on May 16th, 2018