Central Concern

Submitted by Atlas Indicators Investment Advisors on August 31st, 2025

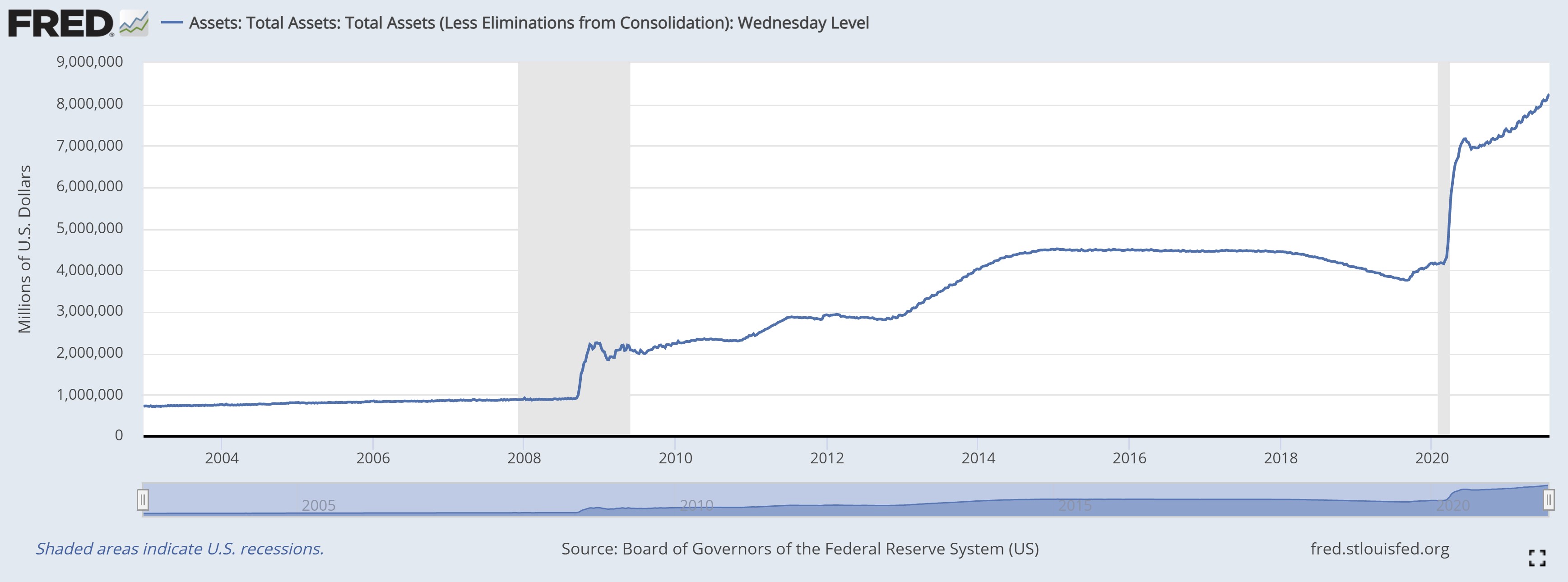

Every August since 1982, the Kansas City Branch of the Federal Reserve System hosts an event in Jackson Hole, Wyoming. It’s like an economic summer camp, although they probably forego the sticky fingers that come with s’mores. The idea is to foster open discussions about the economy, exchanging ideas and probably a few barbs. Typically, the event centers around a s