Federal Deficit

Priced for Perfection

Submitted by Atlas Indicators Investment Advisors on March 31st, 2024What Decade is This?

Submitted by Atlas Indicators Investment Advisors on February 5th, 2024October 2019 Federal Deficit

Submitted by Atlas Indicators Investment Advisors on November 20th, 2019

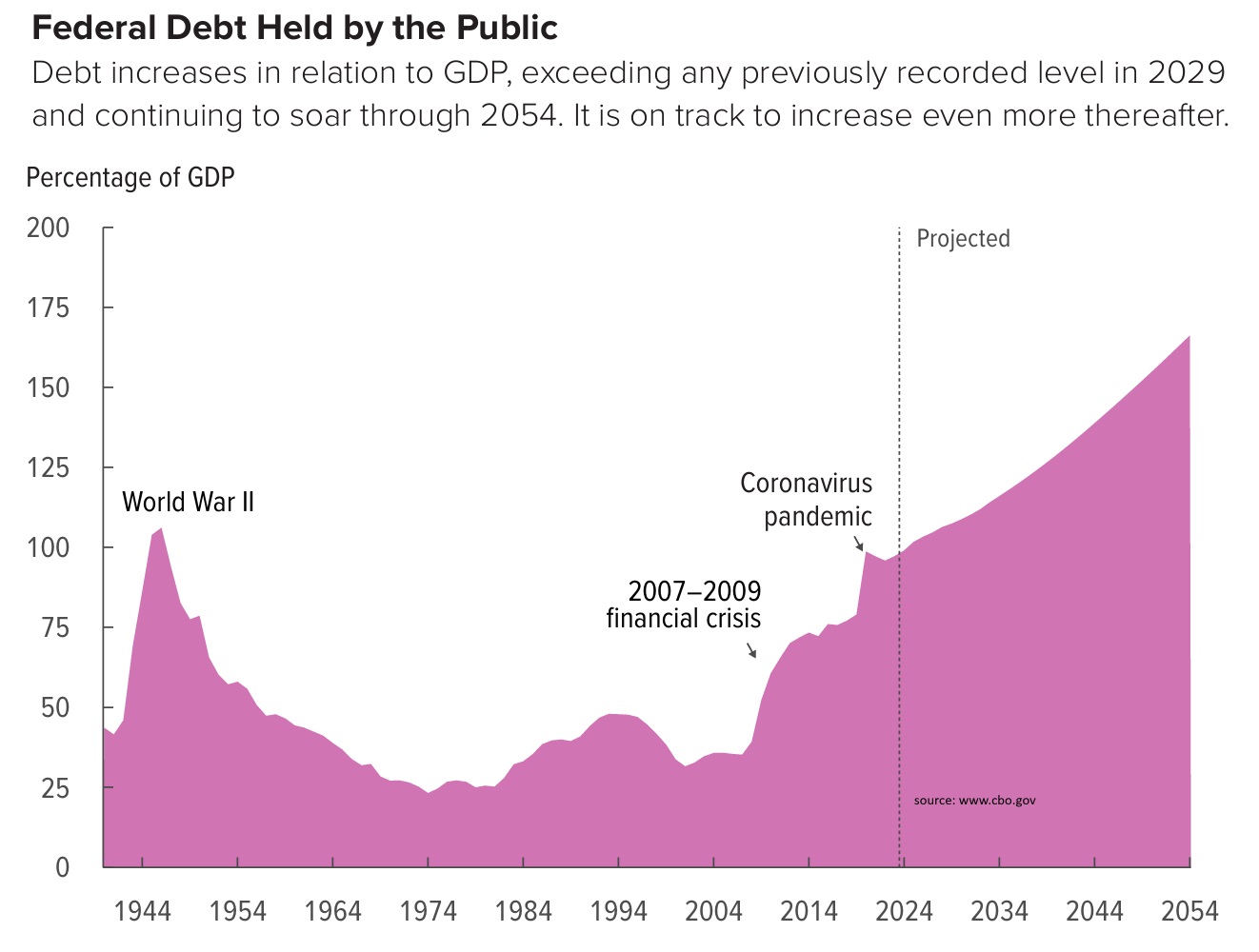

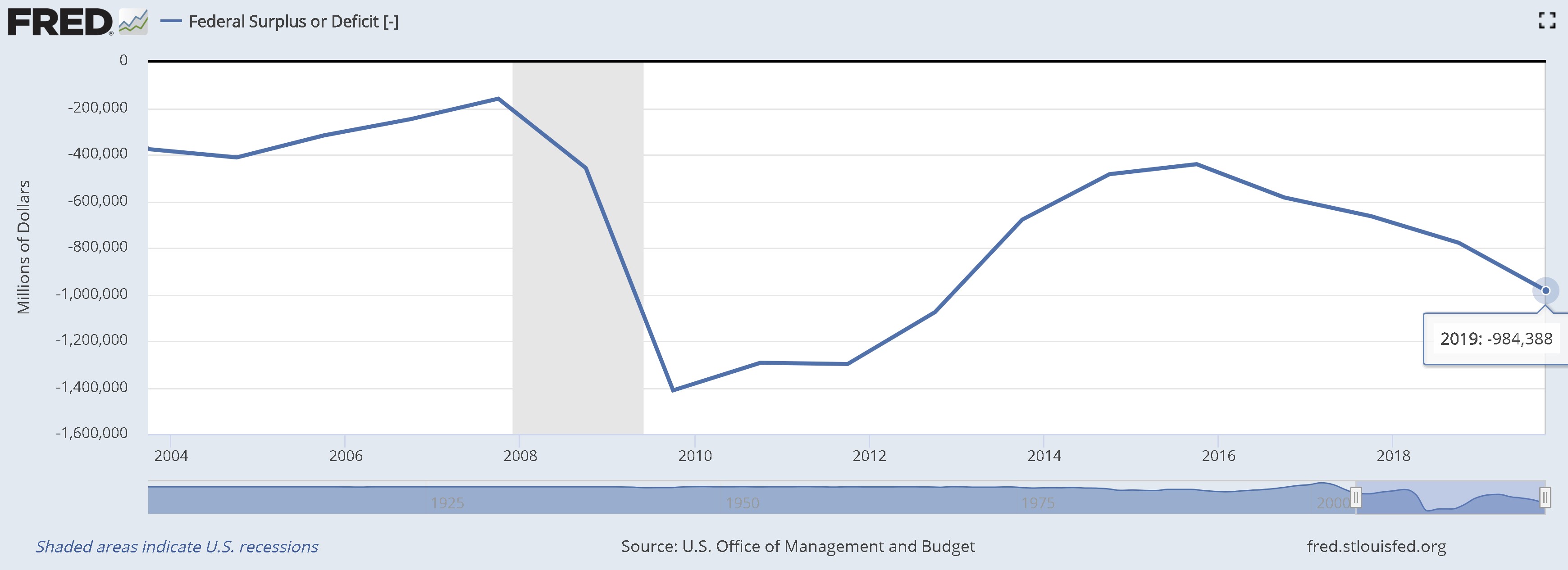

The American Government’s fiscal year has begun, and the start is already deeper into the red than year ago. During the first 31 days of fiscal 2020, our nation’s deficit reached $134.5 billion, rising 33.8 percent! This quick dig deeper into the debt hole follows the nearly $1 trillion shortfall in 2019.

January 2019 Federal Budget

Submitted by Atlas Indicators Investment Advisors on March 11th, 2019

December 2018 Treasury Deficit

Submitted by Atlas Indicators Investment Advisors on February 19th, 2019July 2018 Treasury Budget

Submitted by Atlas Indicators Investment Advisors on August 21st, 2018

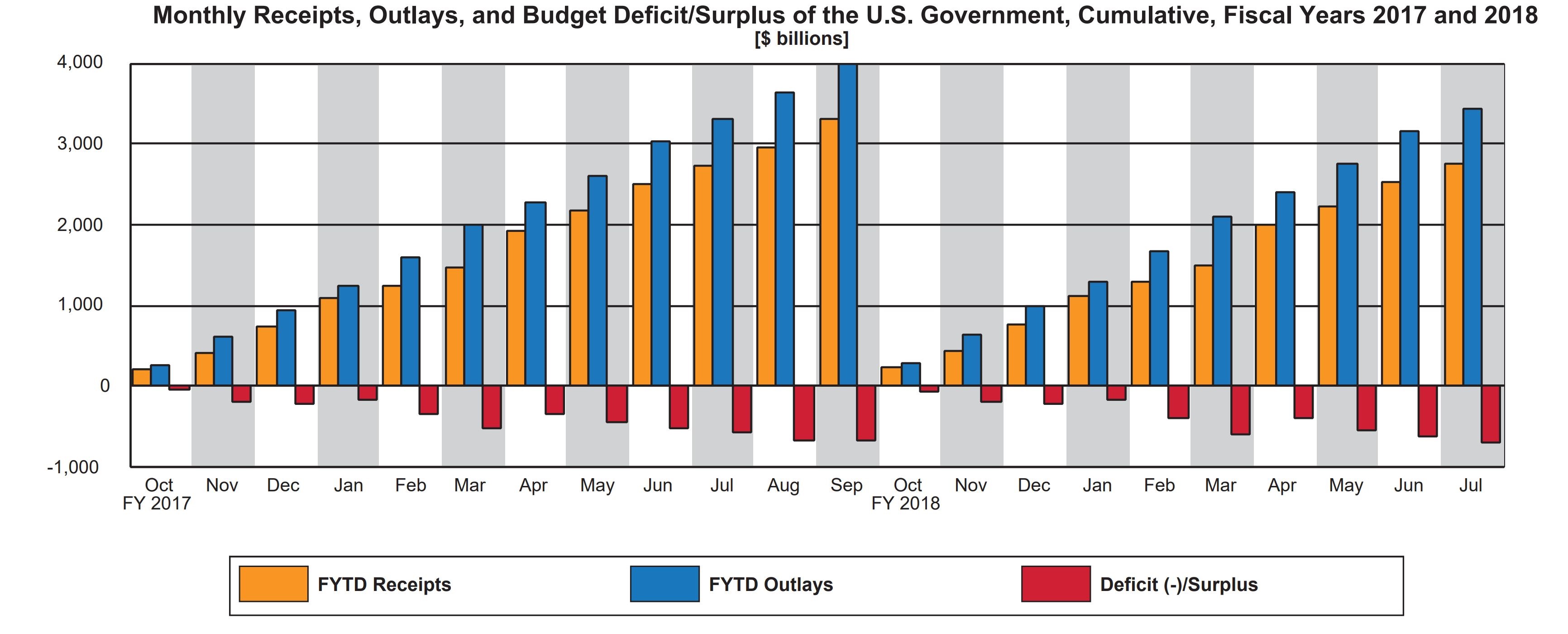

Your federal government went deeper into the hole in July 2018 according to the Treasury Department’s budget release. Spending outpaced revenues by $76.9 billion, increasing the monthly shortfall by $2.0 billion compared to June. Year-to-date, the fiscal deficit is $684.0 billion, 20.8 percent deeper than a year ago.