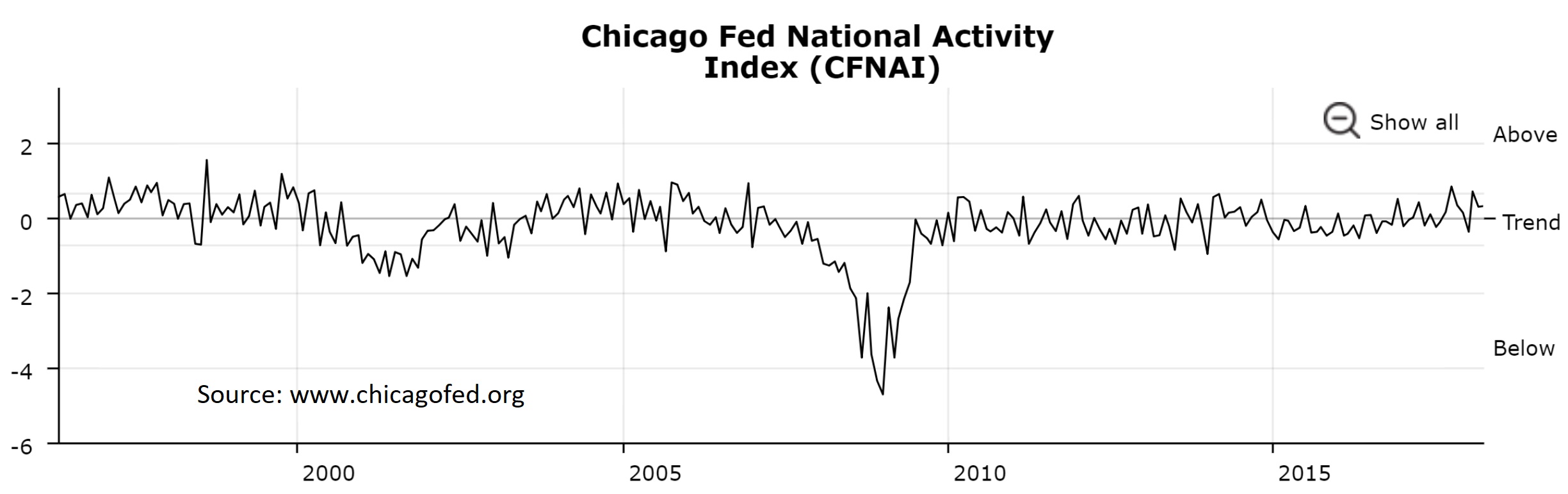

December 2020 Chicago Fed National Activity Index

Submitted by Atlas Indicators Investment Advisors on January 28th, 2021Comprehensive and frequent are two of the best characteristics for an economic indicator. The Chicago Branch of the Federal Reserve produces one that has both attributes: The National Activity Index.