Supply Chain

Tender Rejections

Submitted by Atlas Indicators Investment Advisors on February 24th, 2022Shift Happens

Submitted by Atlas Indicators Investment Advisors on December 31st, 2021But Wait! There’s More!

Submitted by Atlas Indicators Investment Advisors on December 31st, 2021Remember when contagion was just the ominous title of a 2011 movie dealing with a deadly disease spreading quickly around the globe while healthcare professionals scrambled to find a cure? The premise was that a previously unseen threat reached a critical level which set off a cascade effect, reaching many facets of life. Could such an event happen outside of Hollywood? In sho

Logjams II

Submitted by Atlas Indicators Investment Advisors on November 27th, 2021

Rivers are useful metaphors to use when thinking about an economy. Don’t take my word for it. Alan Greenspan, the former Chair of the Federal Open Market Committee (FOMC), used the figure of speech in these remarks to the National Association of Home Builders in early 1995, address

Unexpected And Pernicious

Submitted by Atlas Indicators Investment Advisors on May 24th, 2021Log Jams

Submitted by Atlas Indicators Investment Advisors on May 24th, 2021

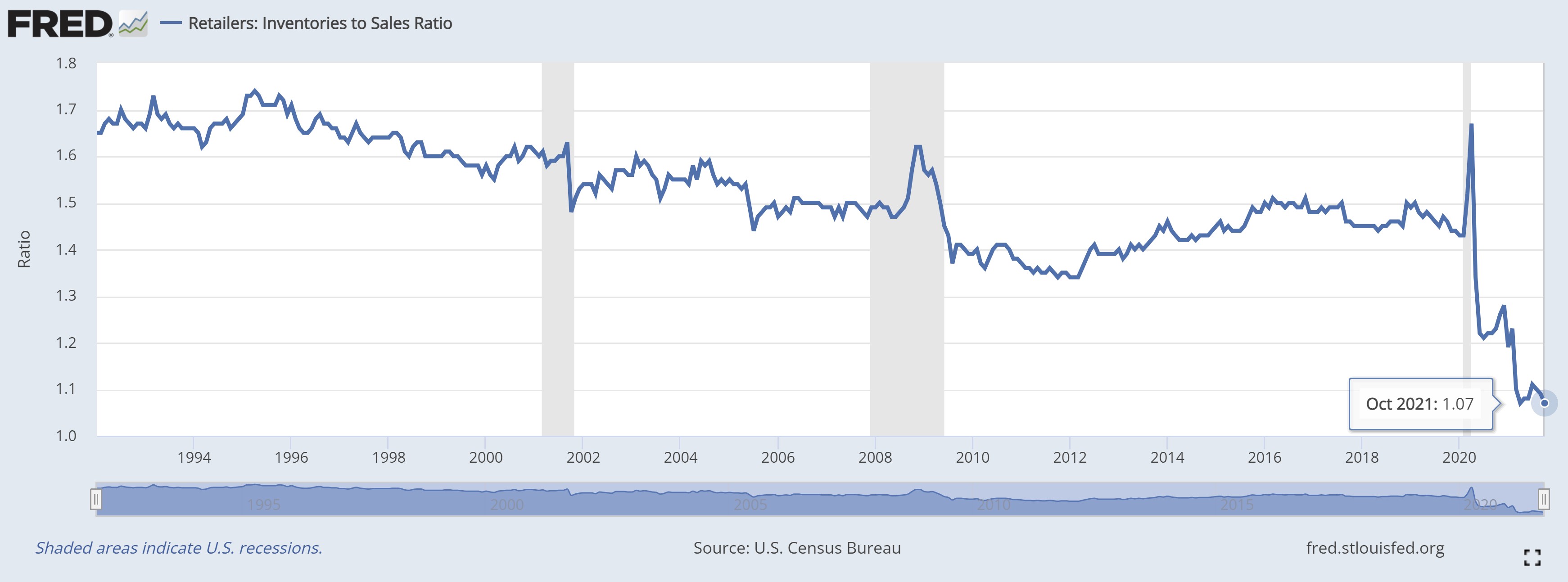

When a collection of tree trunks and other large pieces of wood sprawl across the width of a flowing body of water, we call that a log jam. These naturally occurring blocks alter the flow of water mostly by slowing and/or redirecting it. Sometimes this creates pools where there wouldn’t otherwise be any. As these collections of water fill higher, they can begin to spill