Yield Curve

Is Recession Still on the Menu?

Submitted by Atlas Indicators Investment Advisors on September 30th, 2023

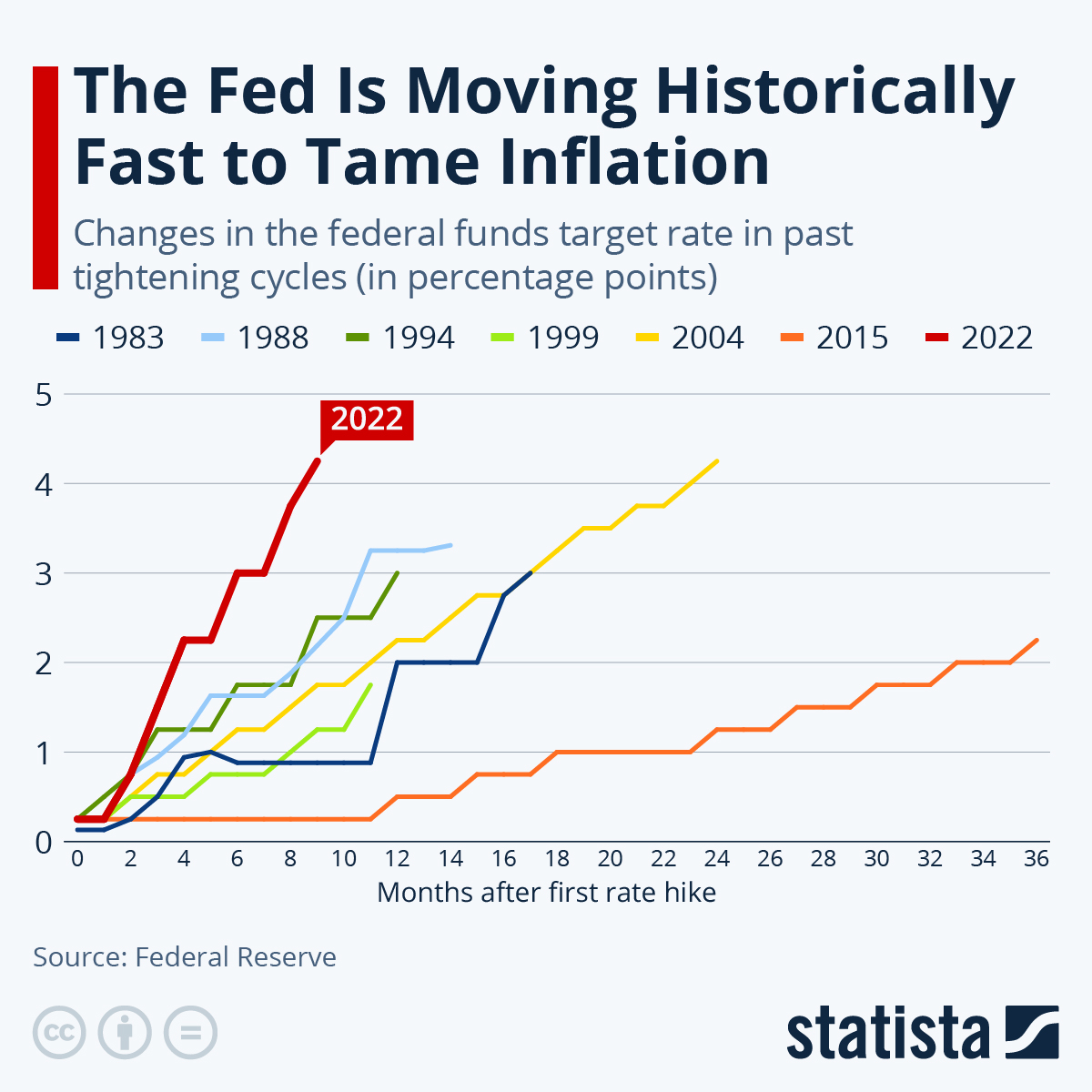

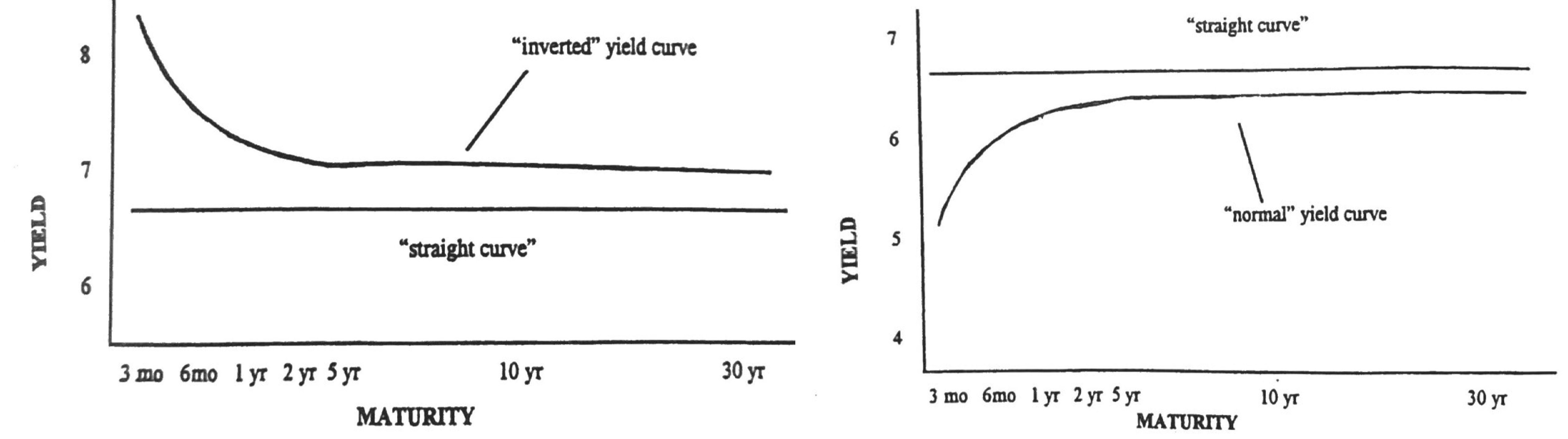

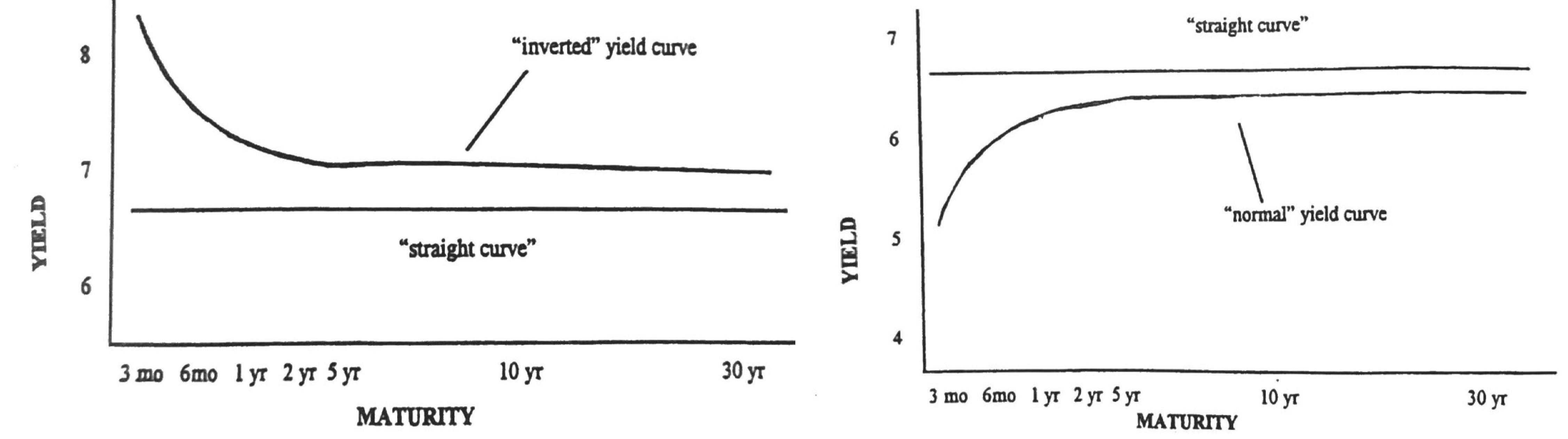

Interest rates are crucial to economic activity. They impact the costs and therefore the incentives of financing the three pillars of the American economy: consumption, investment, and government spending. Borrowing is done over various durations, from short to long. Costs of loans are typically found on a menu known as a yield curve.

How Long Does It Take to Boil an Economy?

Submitted by Atlas Indicators Investment Advisors on September 30th, 2023

We all know the old saw about slowly boiling a frog. It is a cruel idea but demonstrates how the consequences of steady, yet destructive behaviors can sneak up on us if we aren’t careful. America has been growing its levels of debt for years. Some have worried about the outcome while others are more sanguine. For now, those remaining calm have been on the right sid

Passing the Baton

Submitted by Atlas Indicators Investment Advisors on April 11th, 2023Curve Brawl

Submitted by Atlas Indicators Investment Advisors on June 3rd, 2019Sure Thing, Mr. Draghi

Submitted by Atlas Indicators Investment Advisors on April 12th, 2019The curvature of U.S. bond yields has attracted a lot of press of late. Atlas has written about it in some of our blogs, and the significance of a possible inversion has frequently been a subject of discussion at our Pie Parties. Whatever current shape the curve takes or your choice of maturity, the returns are still positive. That's to be expected, right?

Ertragskurve

Submitted by Atlas Indicators Investment Advisors on February 14th, 2019Ertragskurve

Submitted by Atlas Indicators Investment Advisors on February 14th, 2019Under Pressure

Submitted by Atlas Indicators Investment Advisors on August 16th, 2018Queen teamed up with David Bowie in 1981 to create Under Pressure which topped the UK’s singles chart. Search the internet for an interpretation of the lyrics and you’ll find oodles of opinions. When you’re done reading this note, take a listen here and tell us what you think. In the meantime, let’s look at an area of the market for which the s

For a Limited Time

Submitted by Atlas Indicators Investment Advisors on July 28th, 2017

America is quickly approaching its debt limit, and some market participants are concerned. Their worry stems from the possibility that our nation will be unable to pay debts that mature soon. According to projections from the Congressional Budget Office, the Treasury will run out of money in early to mid-October. For the first time since the financial crisis of 2008-2009, the