May 2018 Income and Outlays

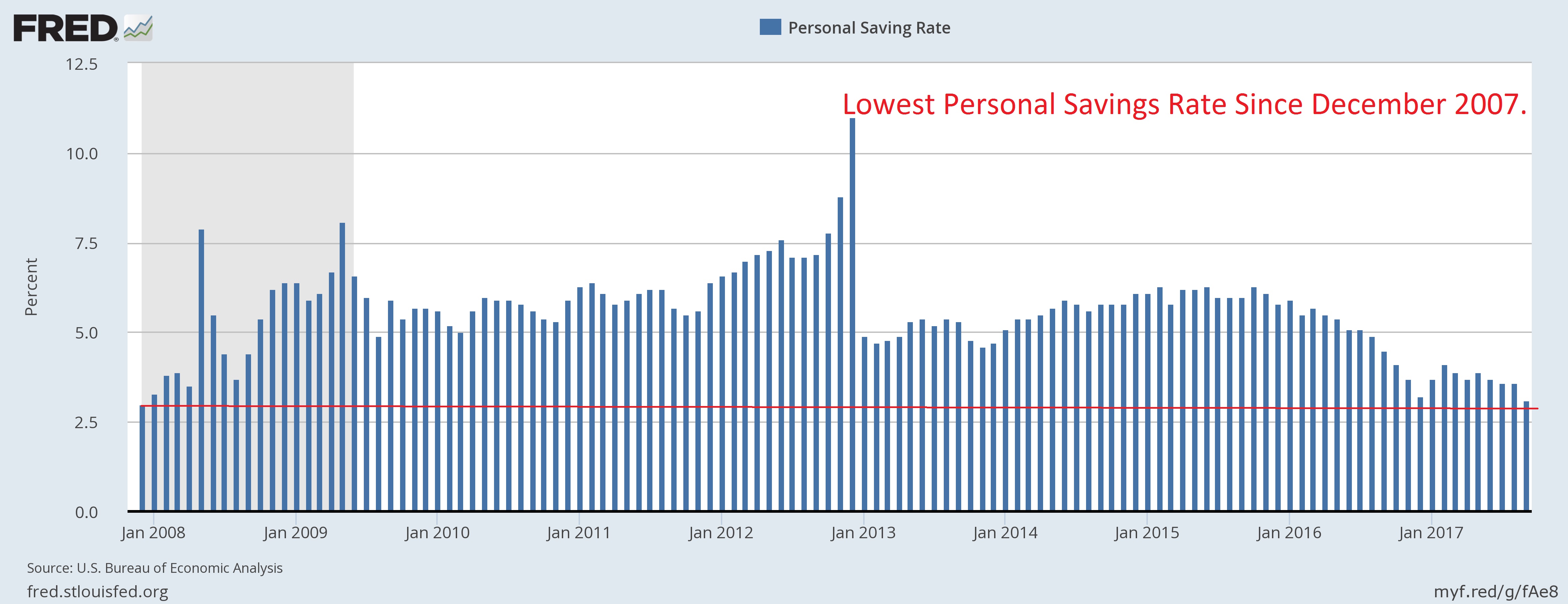

Submitted by Atlas Indicators Investment Advisors on July 11th, 2018May 2018’s iteration for income and outlays from the Bureau of Economic Analysis is one of the most interesting we have seen in a while. Both components of the report improved, and consumers actually increased their savings rate, but none of that captured Atlas’ intrigue. Instead, inflation data stole the show.