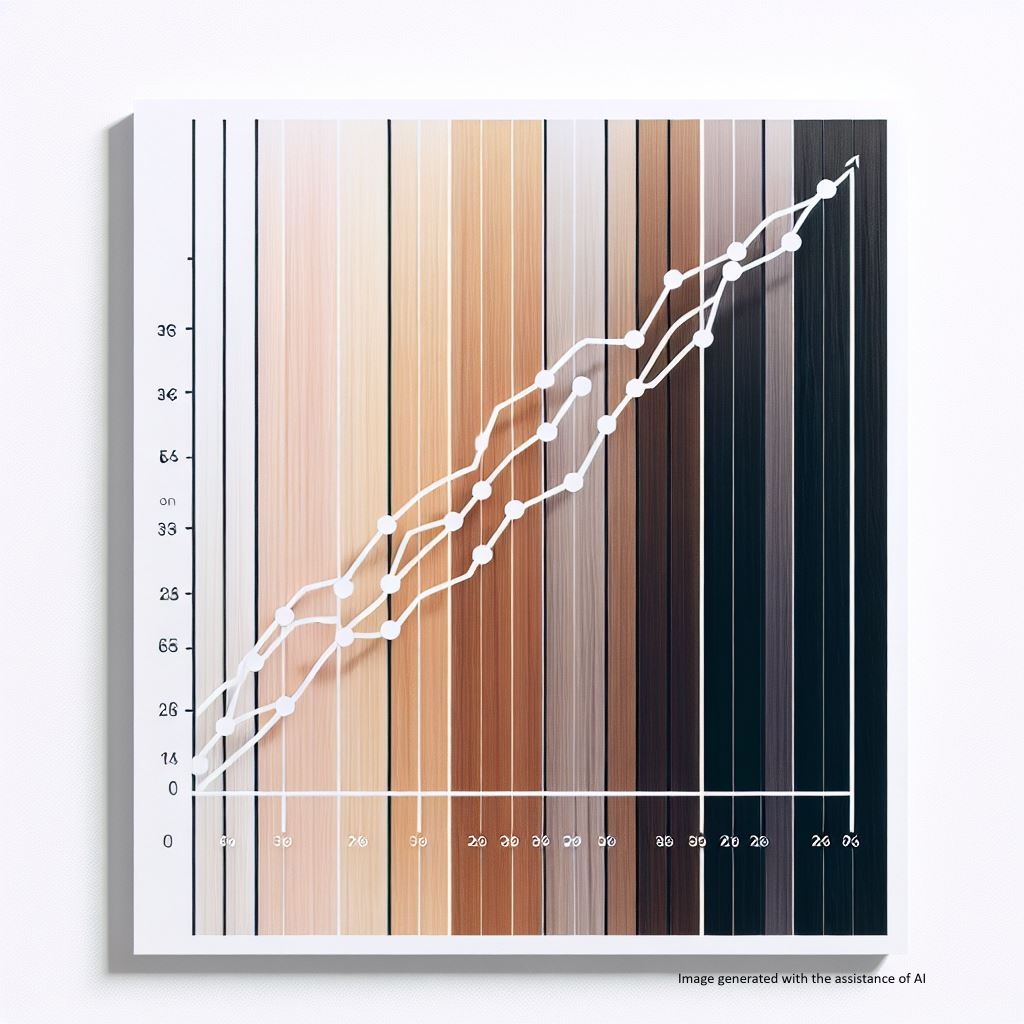

Coloration Is Not Causation

Submitted by Atlas Indicators Investment Advisors on March 28th, 2025

People like concrete explanations for phenomena. For instance, virtually daily financial headlines are filled with reasons various markets behaved the way they did that day, up or down. These explanations are more compelling to readers than something along the lines of “buyers were more urgent than sellers today, so markets increased after the opposite was true yesterday