Keeping Up

Submitted by Atlas Indicators Investment Advisors on July 24th, 2025

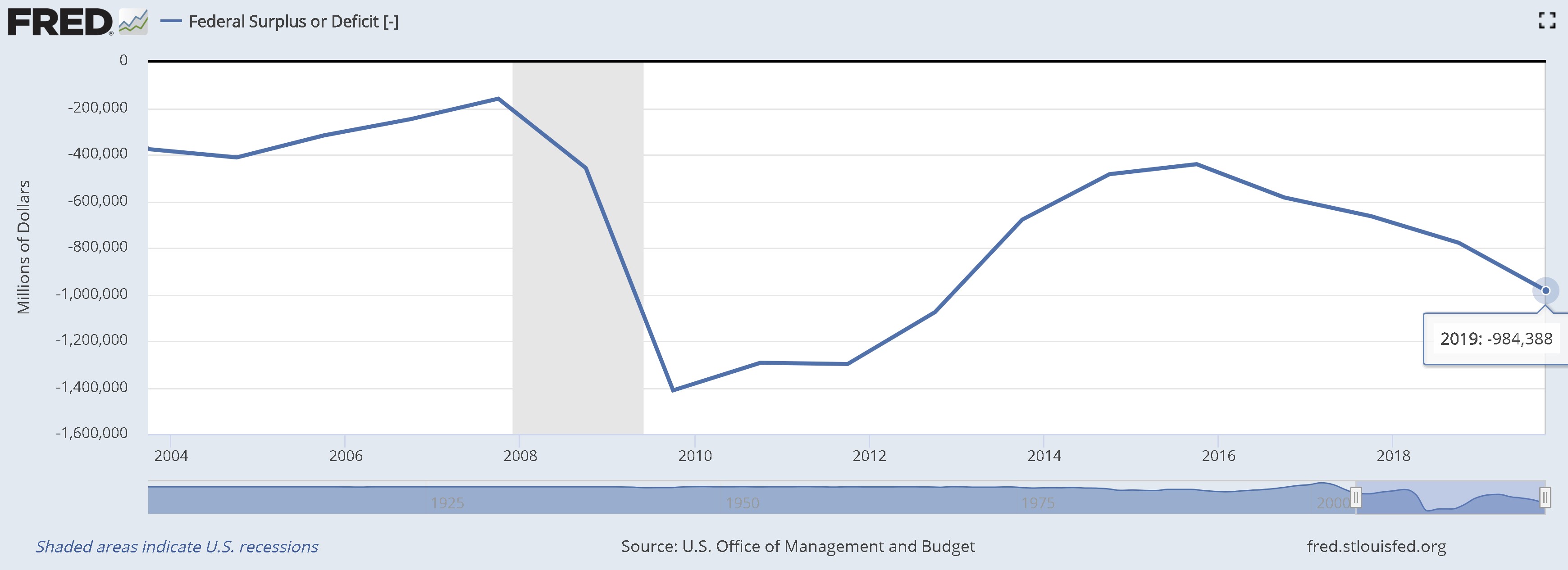

Arthur “Pop” Momand created the comic “Keeping Up with the Joneses,” a strip depicting the McGinnis family who struggle to keep up with the lifestyle of their neighbors. Since its creation in 1913, Americans have been doing just that. Our economy is driven by consumption. Spending on goods and services represents roughly 70% of the nation’s output