Friday Fun

eKon 101

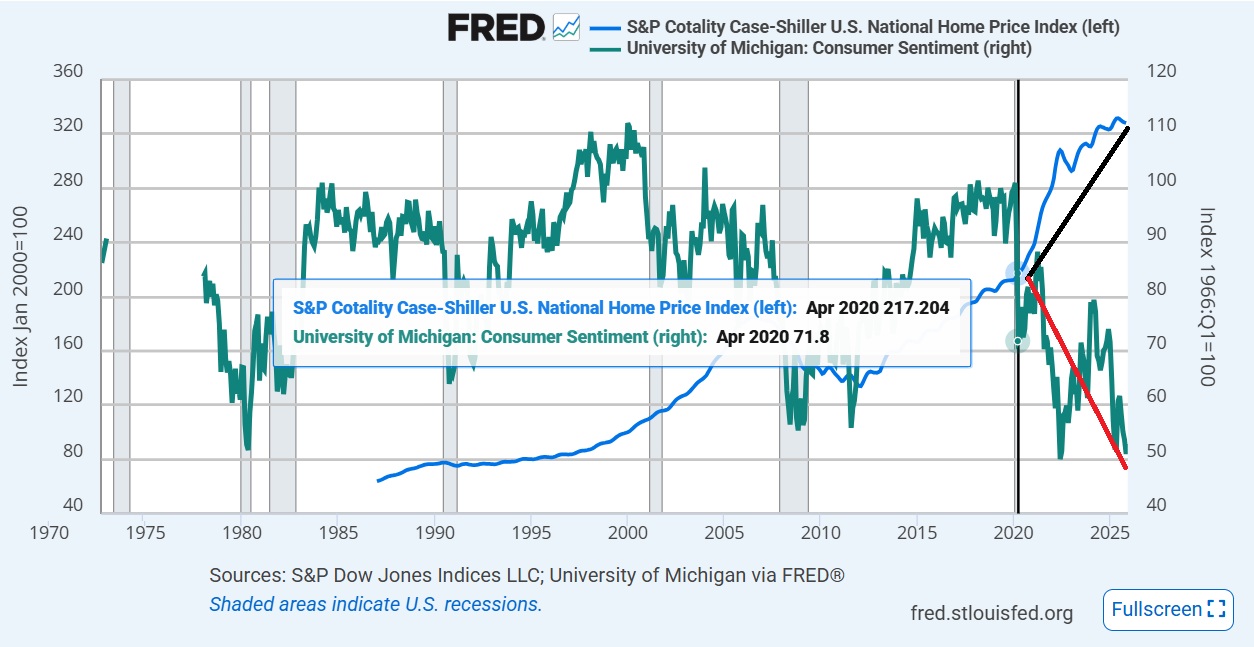

Submitted by Atlas Indicators Investment Advisors on January 31st, 2026Gravity Derailed Prosperity

Submitted by Atlas Indicators Investment Advisors on January 31st, 2026More Fully Understanding Tariffs

Submitted by Atlas Indicators Investment Advisors on January 31st, 2026Re-Boxing Day

Submitted by Atlas Indicators Investment Advisors on December 31st, 2025

Here we are the day after Christmas, and many countries are now celebrating Boxing Day. In nations like the UK, Canada, Hong Kong, and Nigeria, this day was born in the tradition of charity. Wealthy employers would often give servants the day off to enjoy and provide them with boxes containing everything from food and gifts to bonuses. You may have noticed America is not conta

Short-Duration Rose

Submitted by Atlas Indicators Investment Advisors on December 31st, 2025Making Sense Not Cents

Submitted by Atlas Indicators Investment Advisors on November 29th, 2025Pennies have officially been discontinued in the United States, ending more than 230 years of production. The final batch was minted in mid-2025, and no new one-cent coins are planned for circulation. This decision follows years of debate over the rising cost of minting pennies, which now costs about four cents per coin.

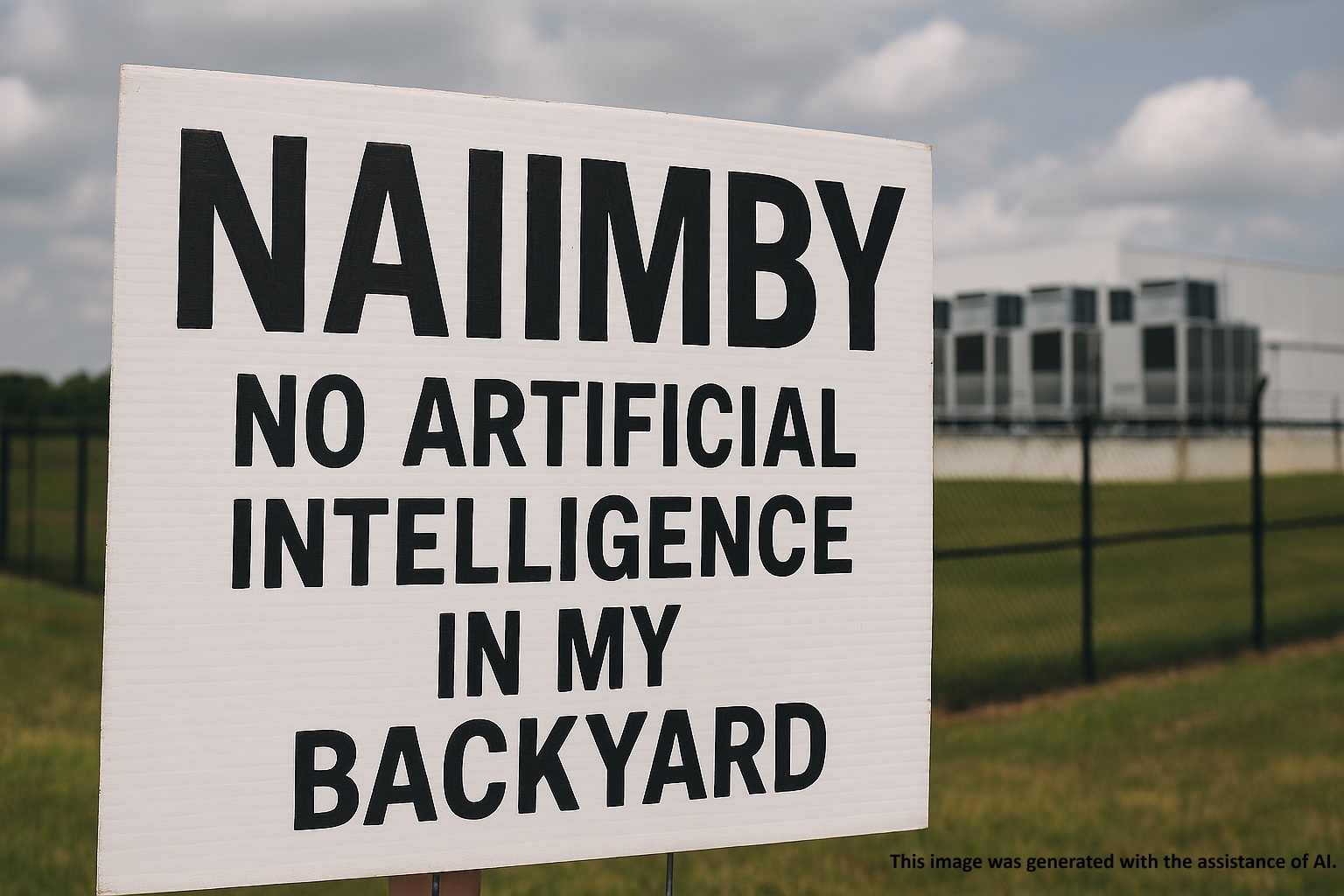

NAIIMBY

Submitted by Atlas Indicators Investment Advisors on November 29th, 2025

Having not seen it elsewhere, Atlas may have coined an acronym: NAIIMBY (No Artificial Intelligence In My Backyard). A movement against AI data centers in American neighborhoods is intensifying. Residents across the country are growing concerned about these massive facilities, which are often sited near homes, schools, and farms. In places like Virginia, Indiana, and Michigan,

Retails from the Crypt

Submitted by Atlas Indicators Investment Advisors on October 31st, 2025

This year, Halloween spending is set to break records, casting a festive but even slightly spooky shadow over consumer wallets. According to the National Retail Federation's annual survey, Americans are projected to shell out a chilling $13.1 billion, a climb from last year's $11.6 billion and surpassing 2023's previous high. Despite concerns about higher prices, especia

Not Sutton’s Heist

Submitted by Atlas Indicators Investment Advisors on October 31st, 2025

“Because that’s where the money is” is an apocryphal quote attributed to Willie Sutton after he was allegedly asked why he robs banks. He went on to deny saying it but also believes that would have been his answer had the question actually been posed. Since his time as a bank robber, banking has changed a lot. Just recently I discovered that the branch I open