Fed Funds Rate

Far from Camelot

Submitted by Atlas Indicators Investment Advisors on July 24th, 2025Inflated Dissonance

Submitted by Atlas Indicators Investment Advisors on March 9th, 2025

From time to time, Atlas will look at consumer attitude data. Recently, the University of Michigan’s Consumer Sentiment release caught our attention. In particular, inflation expectations made a dramatic move higher. Those surveyed in February 2025 believe inflation will climb 3.5 percent per year over the next five years. This is up from 3.2 percent in January and

Not Mission Accomplished. But…

Submitted by Atlas Indicators Investment Advisors on September 30th, 2024

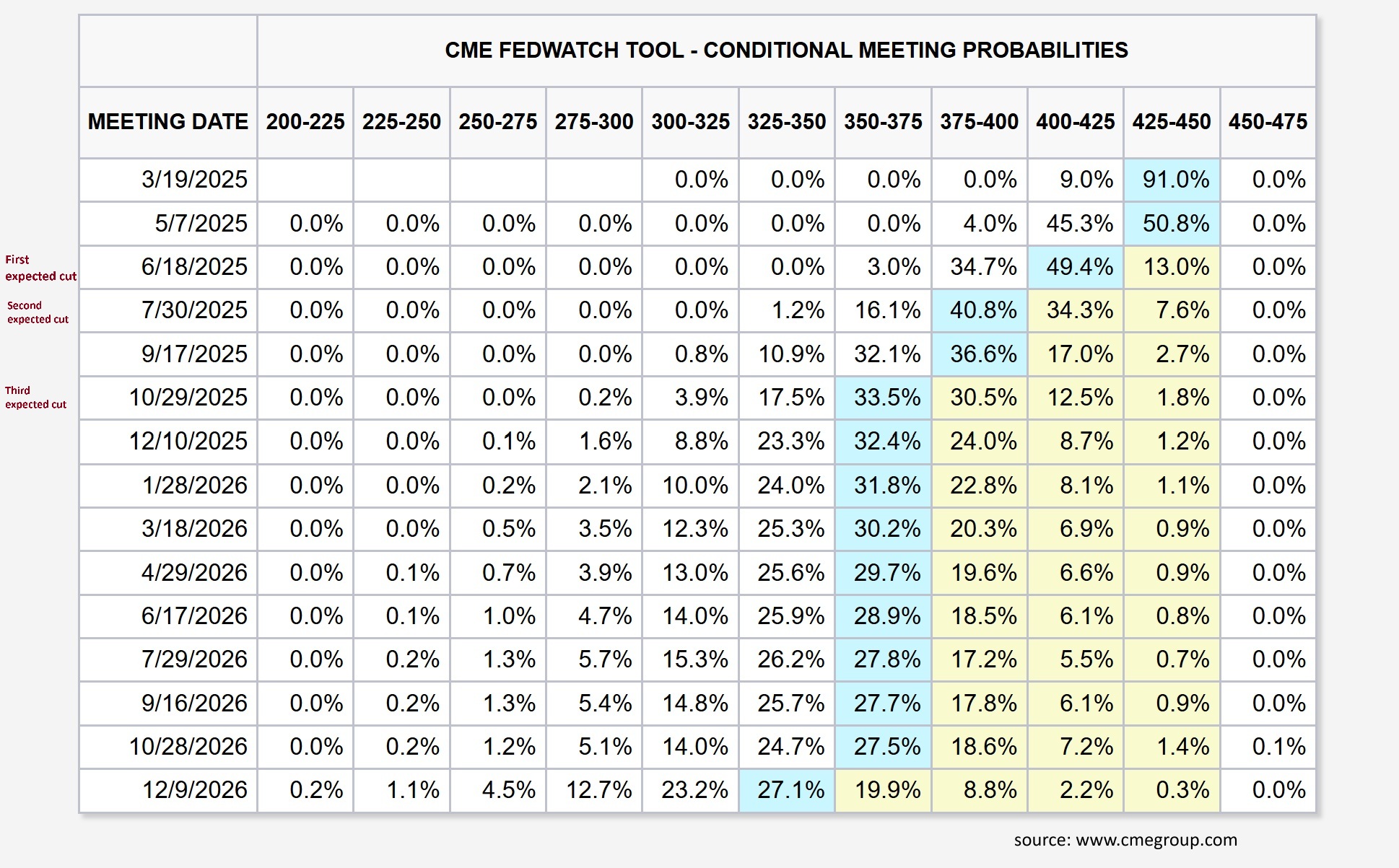

On Wednesday, America’s central bank made its first downward adjustment to its Federal Funds Rate since the pandemic was just getting started back in March 2020. This interest rate is what banks charge each other for overnight loans when their cash reserves aren’t adequate to meet weekly regulatory requirements. While it does not impact other rates directly, the Fed Fund

T-Minus…

Submitted by Atlas Indicators Investment Advisors on June 30th, 2024Adjourned Until Next Year and Straight Lines

Submitted by Atlas Indicators Investment Advisors on December 17th, 2023

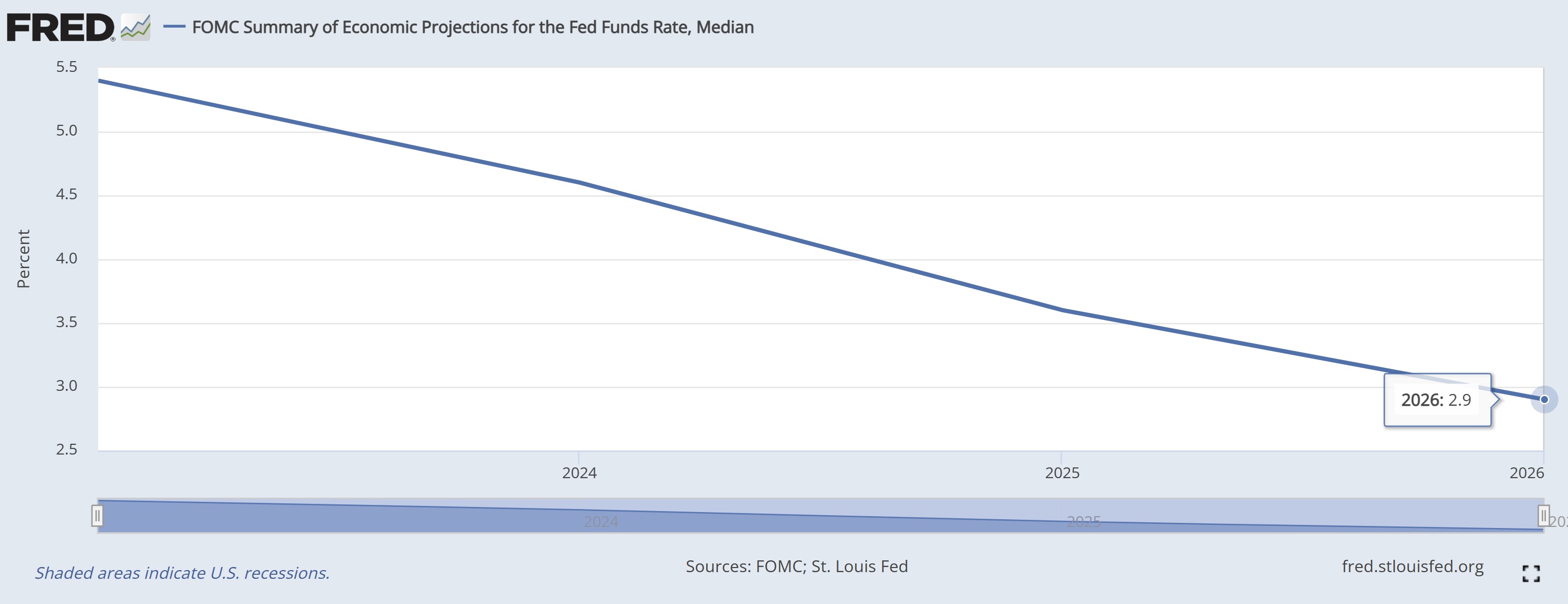

America’s central bank gathered for the final time in 2023 this week. As was widely expected, there was no change in the Fed Funds Rate. This is the rate banks charge each other for overnight lending and is set by the Federal Reserve. Votes in the halls of the Eccles Building were unanimous, something we can’t say about ballots in other halls within our nation&rsqu

Lettin’ It Marinate

Submitted by Atlas Indicators Investment Advisors on November 3rd, 2023

American cuisine is complicated. The nation doesn’t exactly have a uniform palette. Instead we have regional differences. Take marinades for instance. In the Northeast, a common marinade is made with apple cider vinegar, maple syrup, mustard, garlic, and herbs. In the South, a traditional marinade is made with buttermilk, hot sauce, garlic, and onion powder.

I Know It When I See It

Submitted by Atlas Indicators Investment Advisors on September 30th, 2023

Macroeconomics can be very personal. Those observing the changes in its machination are often watching the same or similar factors, yet their description of an economy can be very different. While decorum is often kept in the field, sometimes things are said which evoke thoughts of obscenity. This happened Wednesday as the Chair of the Federal Reserve, Jerome Powell, responded

Is It Wednesday Yet?

Submitted by Atlas Indicators Investment Advisors on March 15th, 2023

Wednesday Morning, 3 A.M. is the first album released by Simon and Garfunkel. The Sound of Silence is the last track on side one. This hit song is about the inability of people to communicate and all the difficulties that accompany it. America is facing such an episode now with our central bank.

Holding Down Expectations

Submitted by Atlas Indicators Investment Advisors on November 6th, 2022

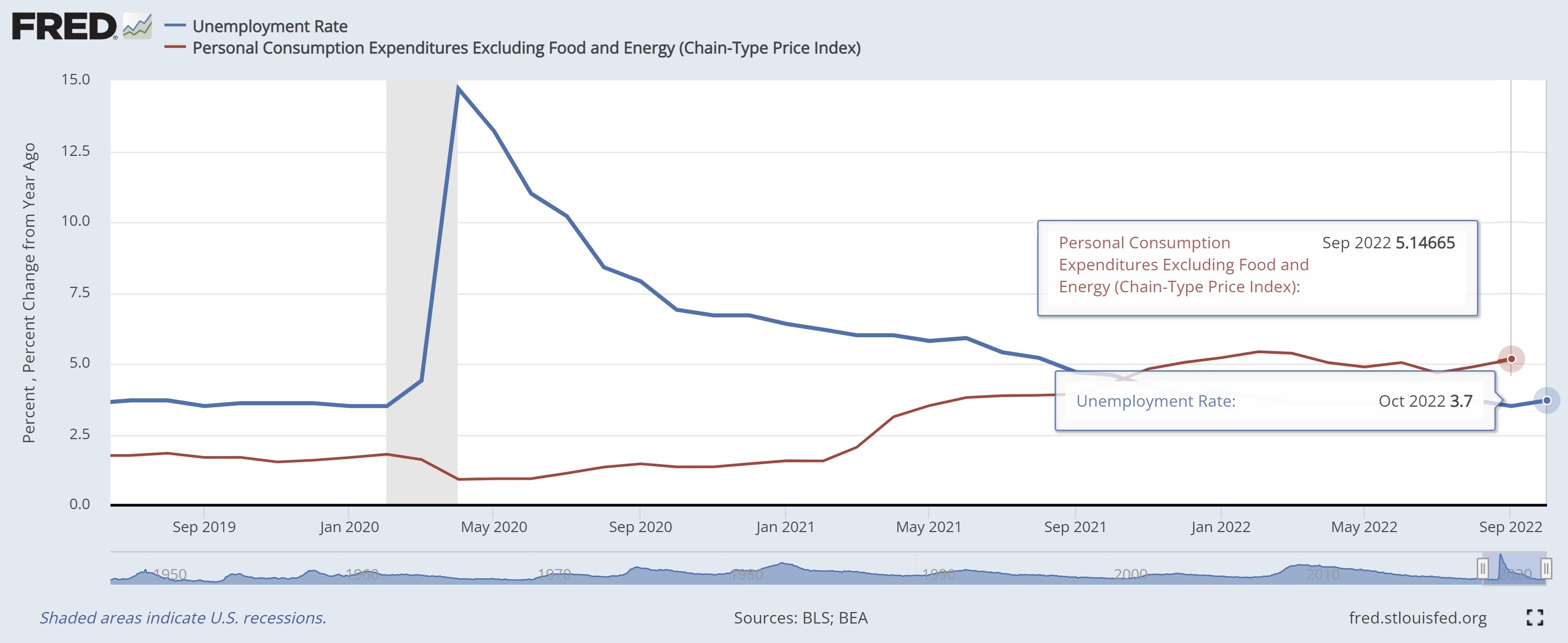

Every six weeks the Federal Reserve Open Market Committee meets to discuss monetary policies and to make any changes to it which they deem necessary. Their latest two-day meeting ended last Wednesday with the 12-person committee unanimously voting to raise the overnight lending rate banks charge each other by 0.75 percentage points; the range for this type of loan now stands at 3.75 - 4.0