Federal Reserve

Door Ajar

Submitted by Atlas Indicators Investment Advisors on December 31st, 2025Underlying Shifts

Submitted by Atlas Indicators Investment Advisors on November 29th, 2025Markets like stability whether its economic, geopolitical or otherwise. Stability helps buyers and sellers agree on the current and potential future values of a variety of financial and real estate assets, thus driving their prices. As stability wanes, the spectrum of expected outcomes stretches, inviting a broader range of opinions about potential future values.

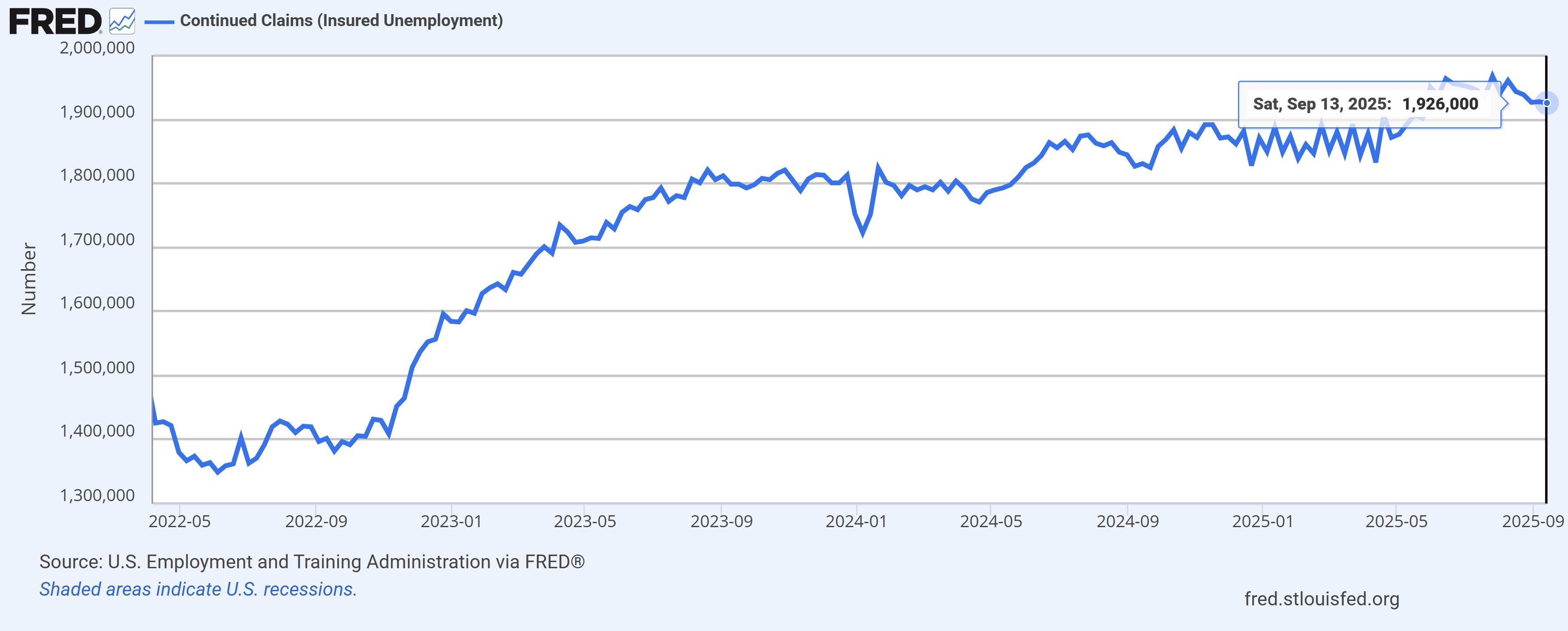

Laboring Through Data for You

Submitted by Atlas Indicators Investment Advisors on October 2nd, 2025

Welcome to Friday, jobs day. Your federal government may be shut down, but Atlas is not. A quick glance at the economic calendar will show you that the Bureau of Labor Statistics is supposed to release the September 2025 labor report later this morning. This would in turn cause Atlas to send you a note about the release’s details. That initial condition was not met

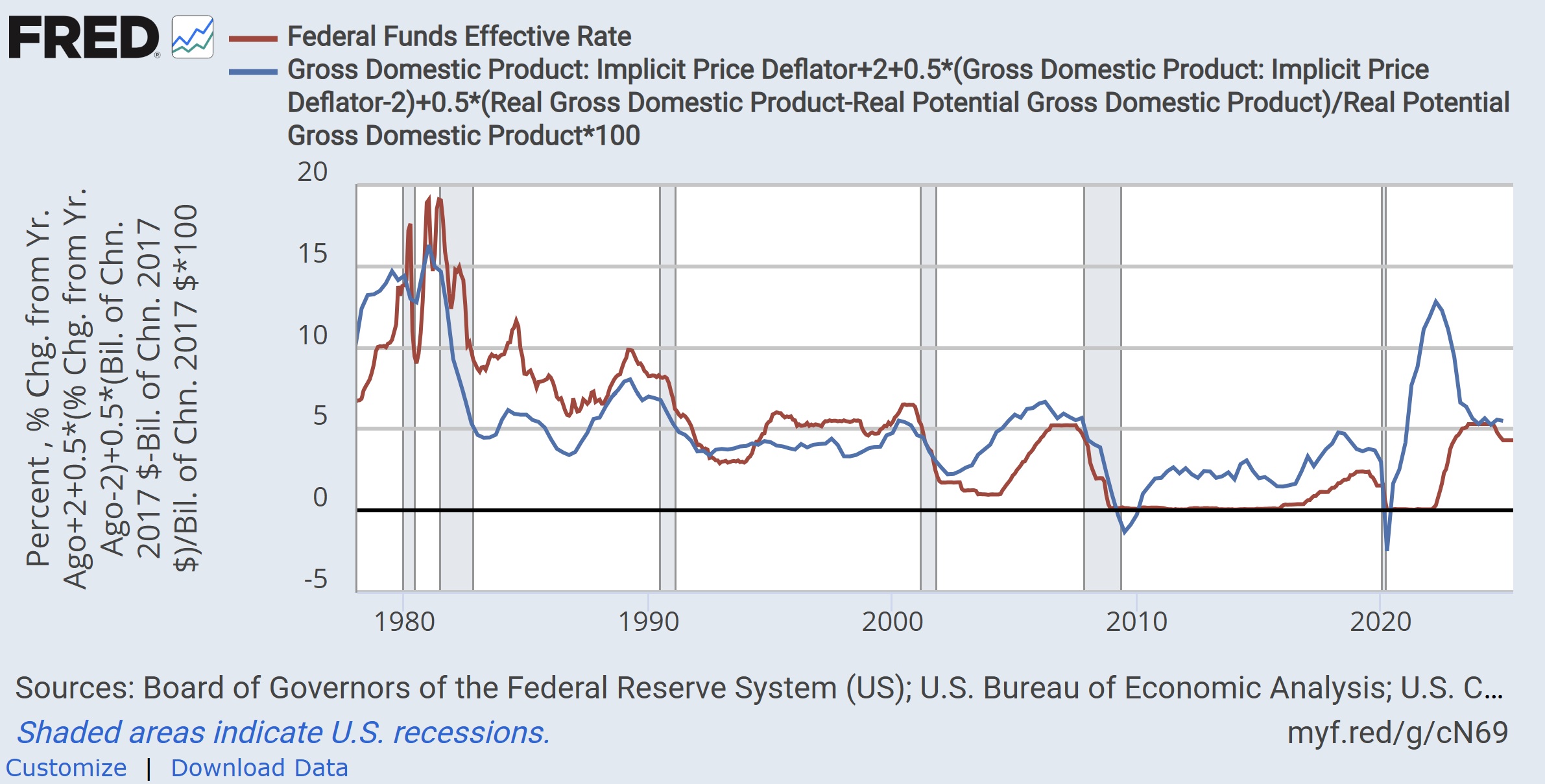

Balancing Act

Submitted by Atlas Indicators Investment Advisors on August 31st, 2025

The Federal Reserve heavily influences the American economy. Every six weeks the Federal Open Market Committee (FOMC) gathers to determine the correct course for monetary policy; they do this by setting the Fed Funds Rate (the amount charged for overnight loans between banks). In short, they are trying to strike a balance between controlling inflation and supporting the labor market

Far from Camelot

Submitted by Atlas Indicators Investment Advisors on July 24th, 2025Certainly Uncertain

Submitted by Atlas Indicators Investment Advisors on June 30th, 2025

Federal Reserve Chair Jerome Powell addressed the press Wednesday following the Federal Open Market Committee’s decision to keep the overnight interest rate unchanged. During the Q&A, he offered an assessment of the economic outlook in light of recent tariff increases. Powell emphasized that while the U.S.

Economic Jury

Submitted by Atlas Indicators Investment Advisors on June 30th, 2025

Jury duty is a civic responsibility where citizens are randomly selected to serve as jurors in legal trials. Having served as a jury foreman about a decade ago, I can attest to the deliberative process Americans are fortunate to have when considering the facts of important moments in the lives of the parties involved in a case. As of this writing, I just finished my day of jury duty

Inflation Beyond Money Supply

Submitted by Atlas Indicators Investment Advisors on February 13th, 2025The Illusion of Control

Submitted by Atlas Indicators Investment Advisors on January 31st, 2025

Tour guides are useful when exploring unfamiliar territories. They can help make sure a trip accomplishes desired outcomes while making sure travelers avoid places where calamitous outcomes are more likely. While they cannot directly prevent spoiled vacations, they help improve the odds that one will be enjoyed.