Optimism

February 2019 Small Business Optimism

Submitted by Atlas Indicators Investment Advisors on March 18th, 2019July 2018 National Federation of Independent Businesses

Submitted by Atlas Indicators Investment Advisors on August 21st, 2018

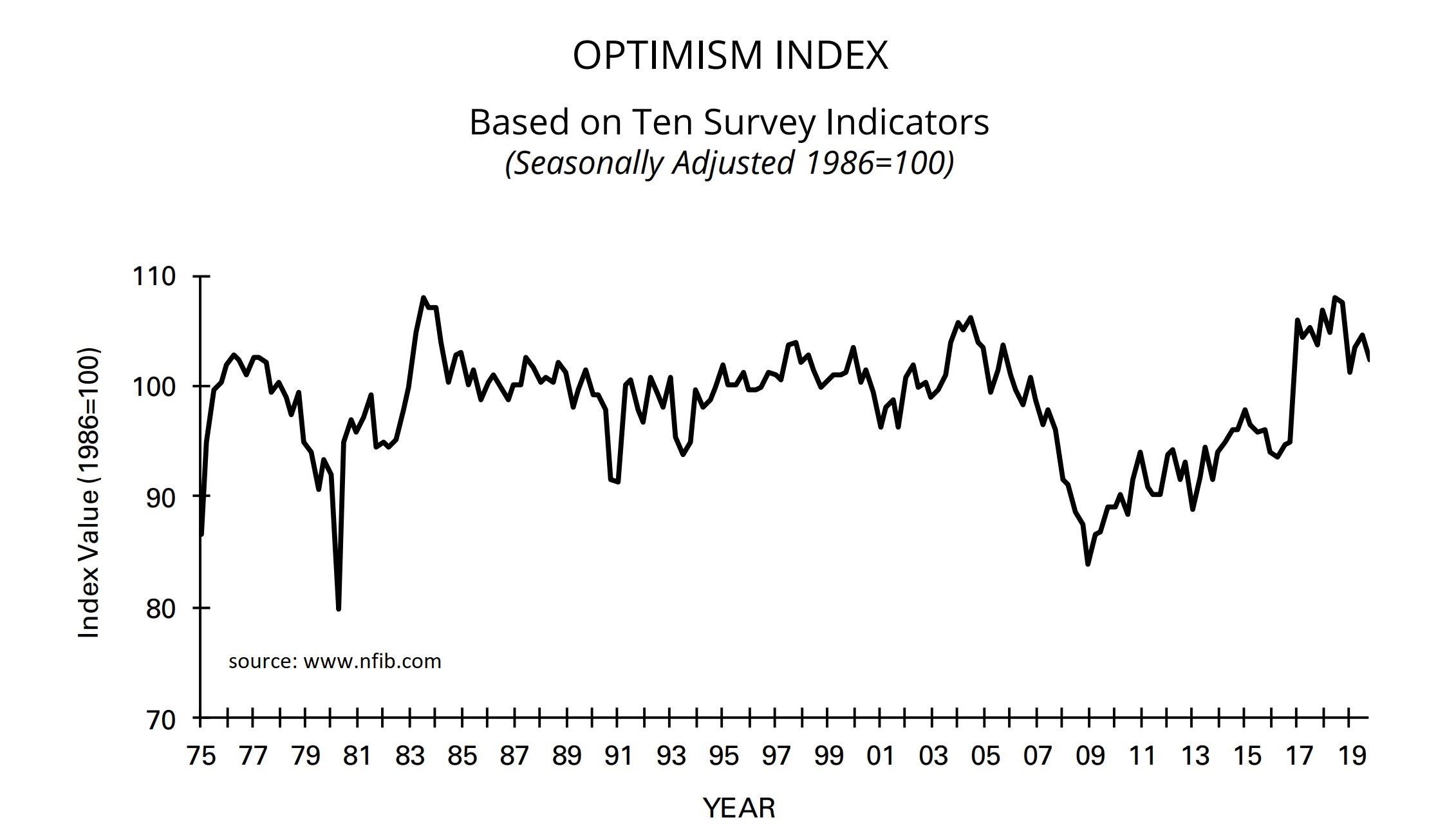

Small business optimism continued riding high as the summer of 2018 heated up. The optimism index from the National Federation of Independent Businesses reached its second highest level ever in July, rising to 107.9 from 107.2 in June; July 1983 (with a reading of 108.0) is the only period with a higher count in the survey’s 45-year history.