July 2018 Treasury Budget

Submitted by Atlas Indicators Investment Advisors on August 21st, 2018

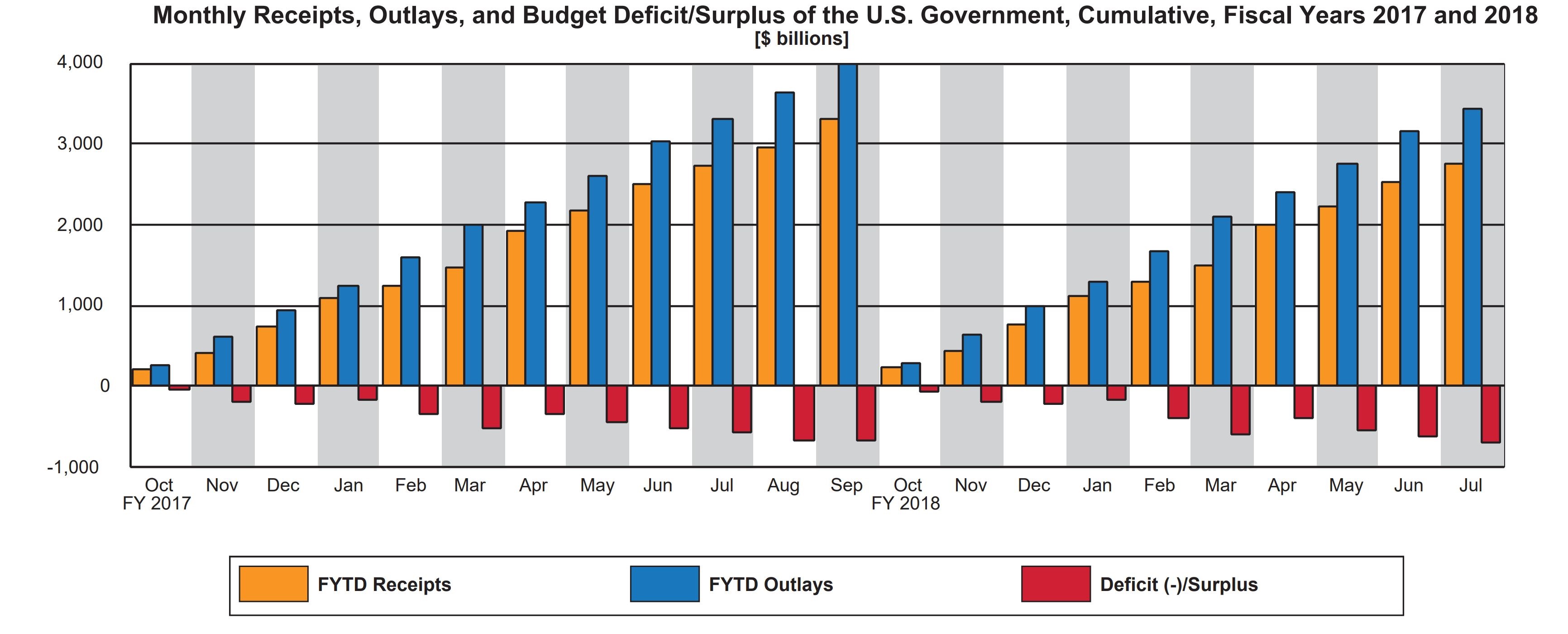

Your federal government went deeper into the hole in July 2018 according to the Treasury Department’s budget release. Spending outpaced revenues by $76.9 billion, increasing the monthly shortfall by $2.0 billion compared to June. Year-to-date, the fiscal deficit is $684.0 billion, 20.8 percent deeper than a year ago.