Inflation

Price $pike Latte

Submitted by Atlas Indicators Investment Advisors on September 5th, 2025

The calendar has turned, and we find ourselves on the backside of Labor Day. Halloween, however, is nearly two months away. America finds itself in a sort of doldrums. Summer is unofficially over, yet the holiday season has not arrived. Many Americans resort to Pumpkin Spice Lattes (PSL) as a way of taking the edge off of this uneventful period. If that’s you

Balancing Act

Submitted by Atlas Indicators Investment Advisors on August 31st, 2025

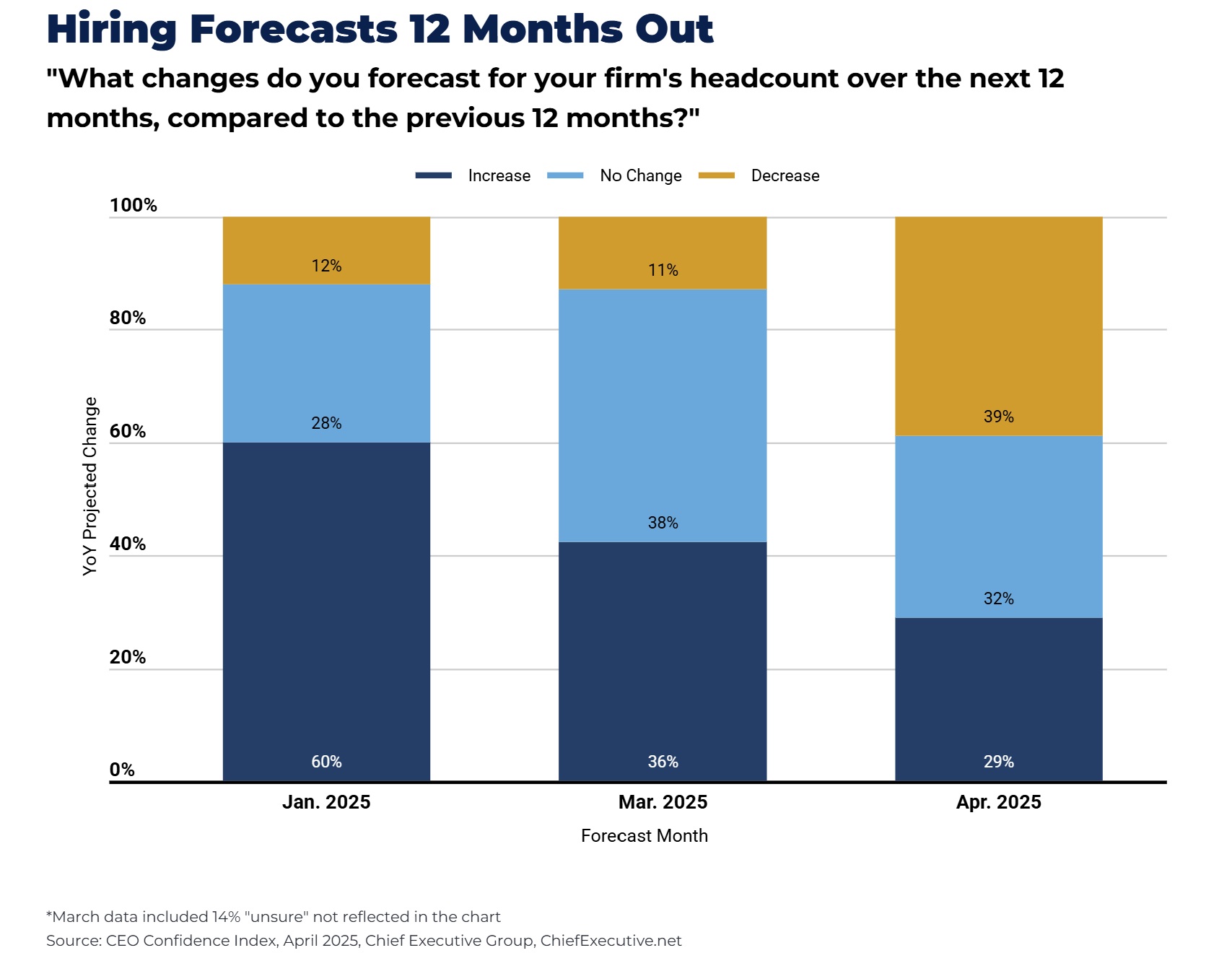

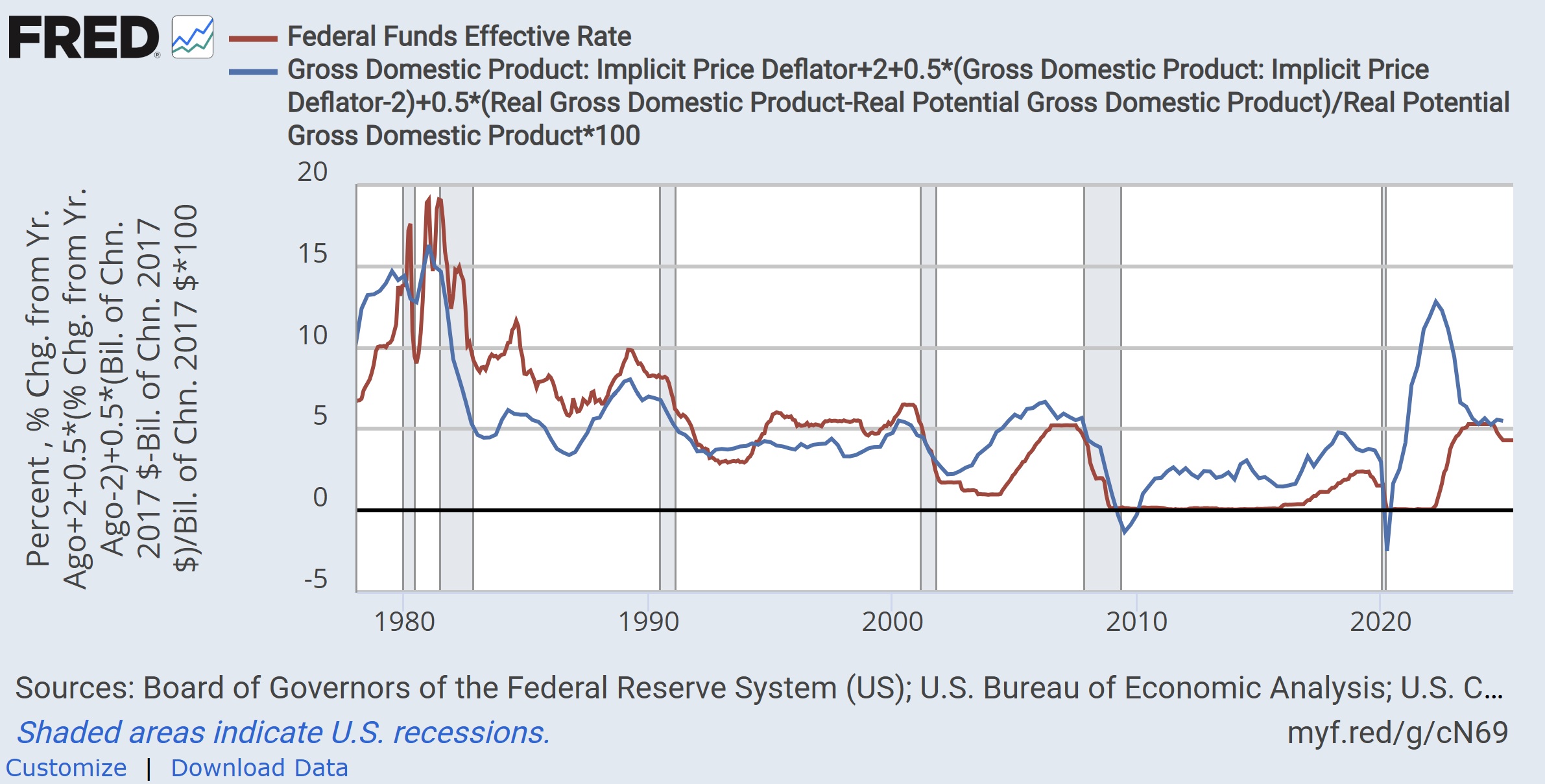

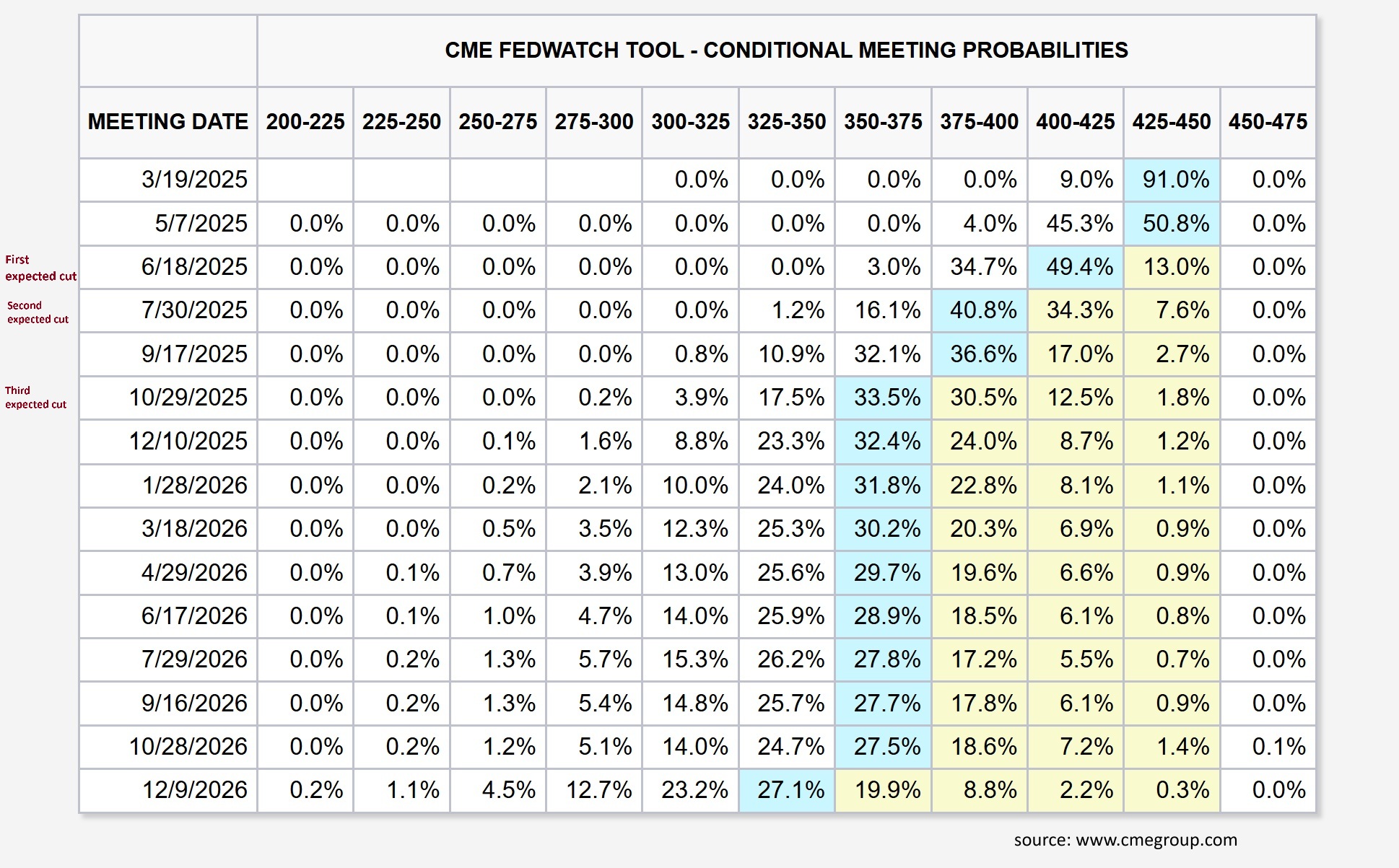

The Federal Reserve heavily influences the American economy. Every six weeks the Federal Open Market Committee (FOMC) gathers to determine the correct course for monetary policy; they do this by setting the Fed Funds Rate (the amount charged for overnight loans between banks). In short, they are trying to strike a balance between controlling inflation and supporting the labor market

Bitter Suite

Submitted by Atlas Indicators Investment Advisors on April 29th, 2025Inflated Dissonance

Submitted by Atlas Indicators Investment Advisors on March 9th, 2025

From time to time, Atlas will look at consumer attitude data. Recently, the University of Michigan’s Consumer Sentiment release caught our attention. In particular, inflation expectations made a dramatic move higher. Those surveyed in February 2025 believe inflation will climb 3.5 percent per year over the next five years. This is up from 3.2 percent in January and

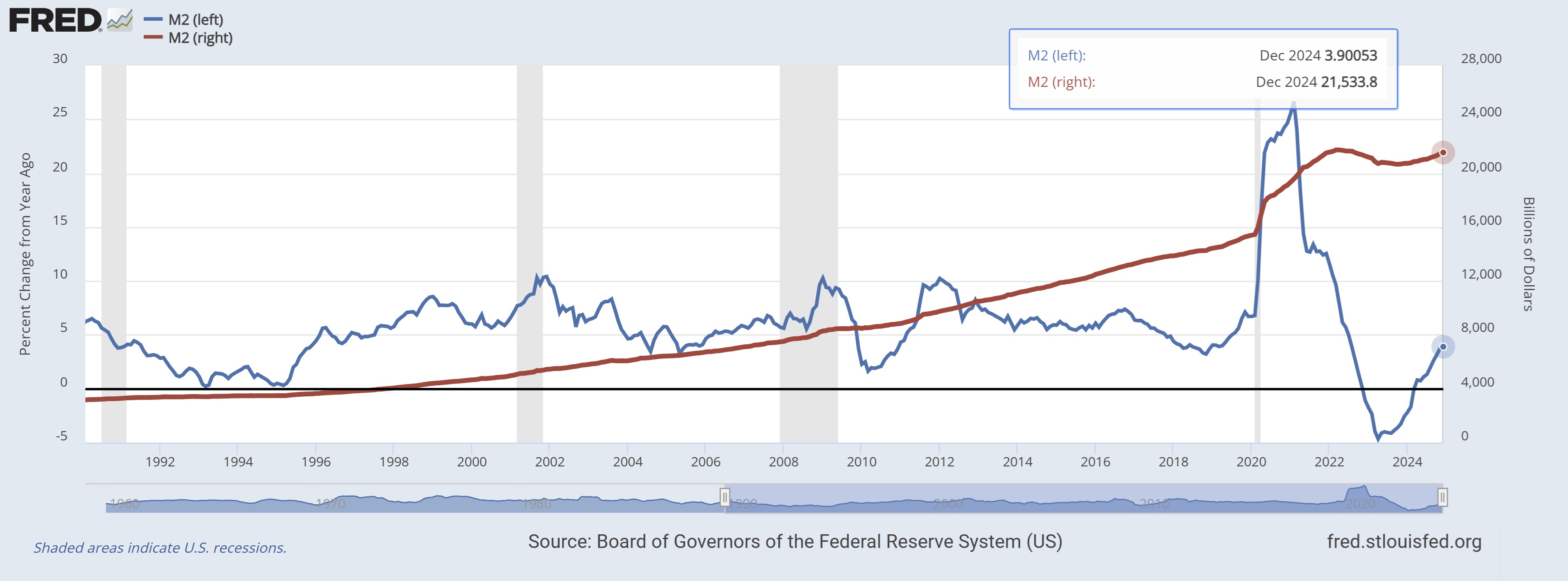

Inflation Beyond Money Supply

Submitted by Atlas Indicators Investment Advisors on February 13th, 2025How Did We Get Here?

Submitted by Atlas Indicators Investment Advisors on January 31st, 2025Not Mission Accomplished. But…

Submitted by Atlas Indicators Investment Advisors on September 30th, 2024

On Wednesday, America’s central bank made its first downward adjustment to its Federal Funds Rate since the pandemic was just getting started back in March 2020. This interest rate is what banks charge each other for overnight loans when their cash reserves aren’t adequate to meet weekly regulatory requirements. While it does not impact other rates directly, the Fed Fund

Fireworks Friday

Submitted by Atlas Indicators Investment Advisors on July 14th, 2024

As the Fourth of July approached, America’s sky prepared to display vividly colored fireworks in rhythmic fashion, a spectacle that reminds one of the ebbs and flows of our economy. Just as fireworks launch into the night, so too does our economic activity, bursting with energy and brightness during periods of prosperity.