January 2020 Durable Goods Orders

Submitted by Atlas Indicators Investment Advisors on March 12th, 2020

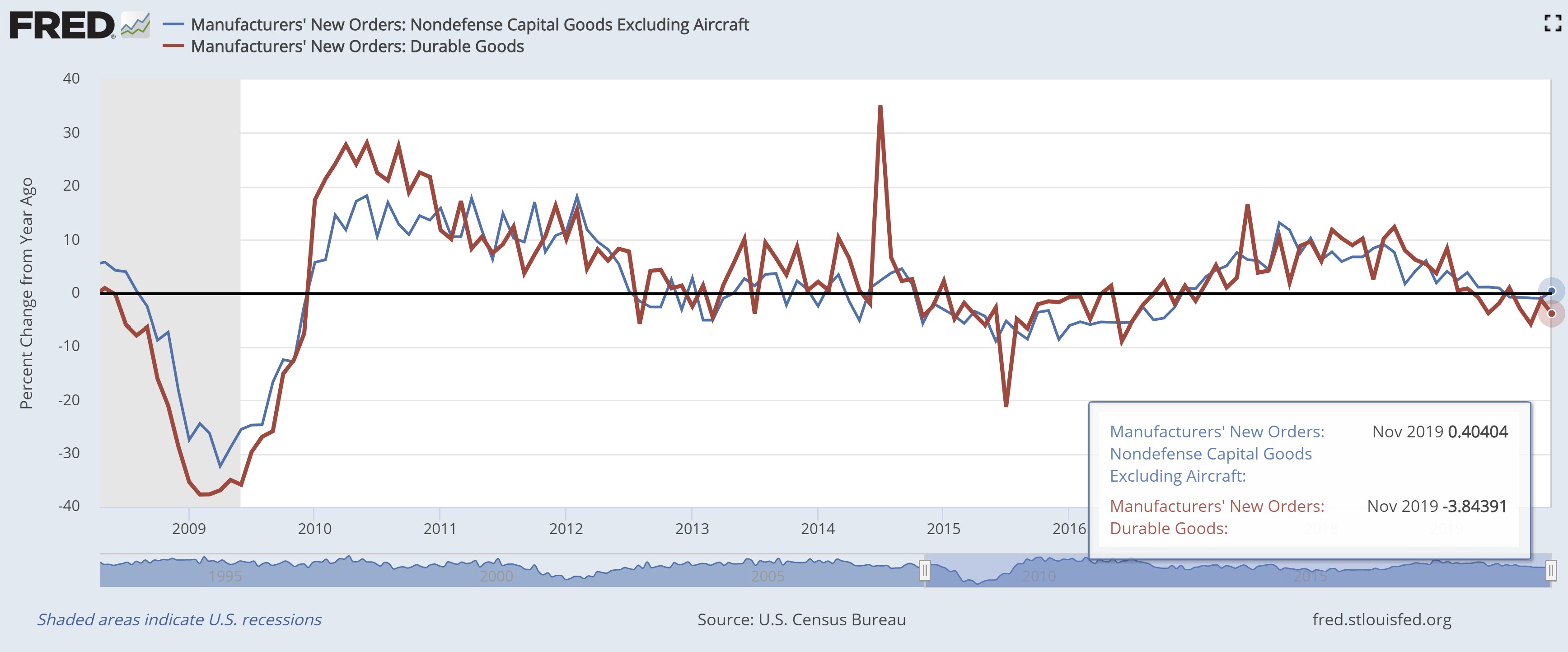

Durable Goods Orders declined in November 2019 according to the Census Bureau. This measure for orders of wares expected to last three years or longer fell 2.0 percent in the month alone. Year-over-year, the tally is even worse, down 3.8 percent. Ouch! However, it isn’t as bad as the headline suggests.

Orders for wares expected to last longer than three years improved for a third consecutive month in January according to the Census Bureau. Their measure of Durable Goods Orders rose $900 million or 0.4 percent. However, even after three months of increases, this indicator is not yet back to the September 2018 level because the 4.3 percent drop in October’s reading has yet to

Here is another indicator delayed by the lapse in federal funding a couple of months ago. However, the Census Bureau is confident the information collected was adequate to produce the report. They went so far as to disclose at the top of the report that “…coverage rates were at or above normal levels for this release.” So here we go!

Durable goods orders were strong in June 2018 according to data from the Census Bureau. This indicator measuring wares expected to last three years or longer rose 1.0 percent to end the first half of the year. This monthly uptick was a welcome reversal from the prior two periods which encountered shrinking orders.

Orders for durable goods declined in January 2018 according to the Census Bureau. Falling 3.7 percent to $239.7 billion, this indicator gave back all of December’s downwardly revised gain of 2.6 percent (originally 2.9 percent) and then some. This most recent setback took the year-over-year number down from 11.3 percent to 6.8 percent, signaling some deceleration from the nati

Durable Goods Orders jumped in December 2017 according to the Census Bureau. Rising 2.9 percent to $249.4 billion, the most recent uptick followed November’s upwardly revised tally of 1.7 percent (originally 1.3 percent). From the vantage point of this indicator’s headline, the outlook for the economy is positive as orders for wares expected to last at least three years

Durable Goods Orders soared in November according to data from the Census Bureau. Aircraft orders (up 31 percent in the period) provided much of the lift in the period’s 1.3 percent improvement. This most recent uptick followed an upwardly revised, albeit still disappointing, October tally of -0.4 percent (originally -1.2 percent).