BLS

Juuuust a Bit Outside

Submitted by Atlas Indicators Investment Advisors on May 24th, 2021

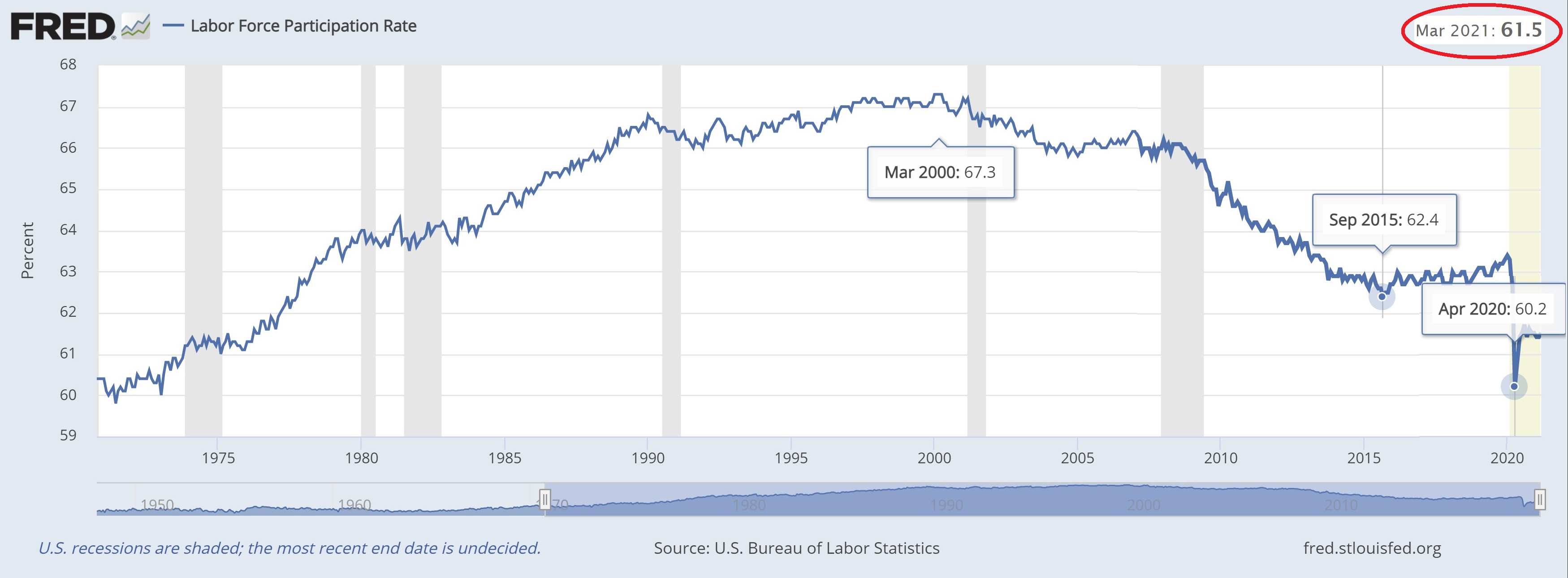

People of notoriety are often given the opportunity to throw out a ceremonial first pitch at a baseball game. As you can see in this video which highlights some of the worst throws, the sixty-foot toss is harder than the professionals make it look. Similarly, economists throw out projections each month, anticipating the outco

Where Are They?

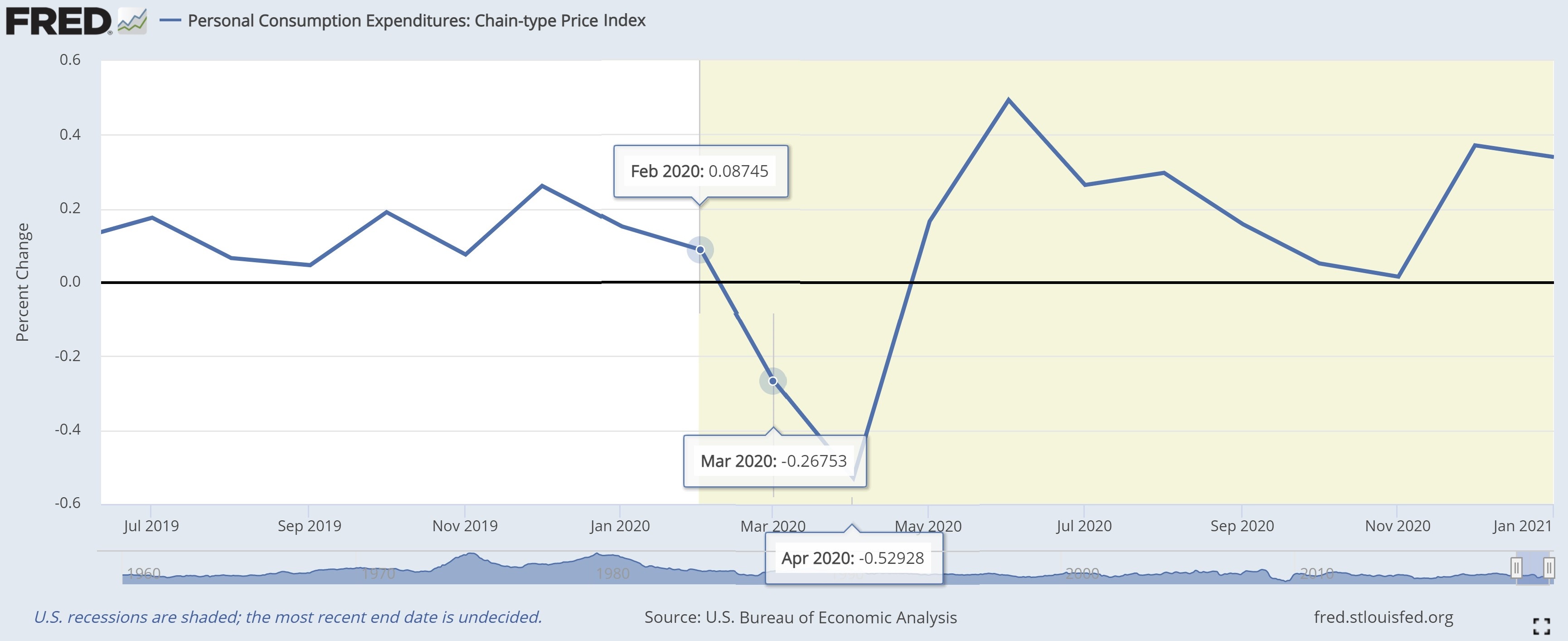

Submitted by Atlas Indicators Investment Advisors on April 15th, 2021All About That “Base”

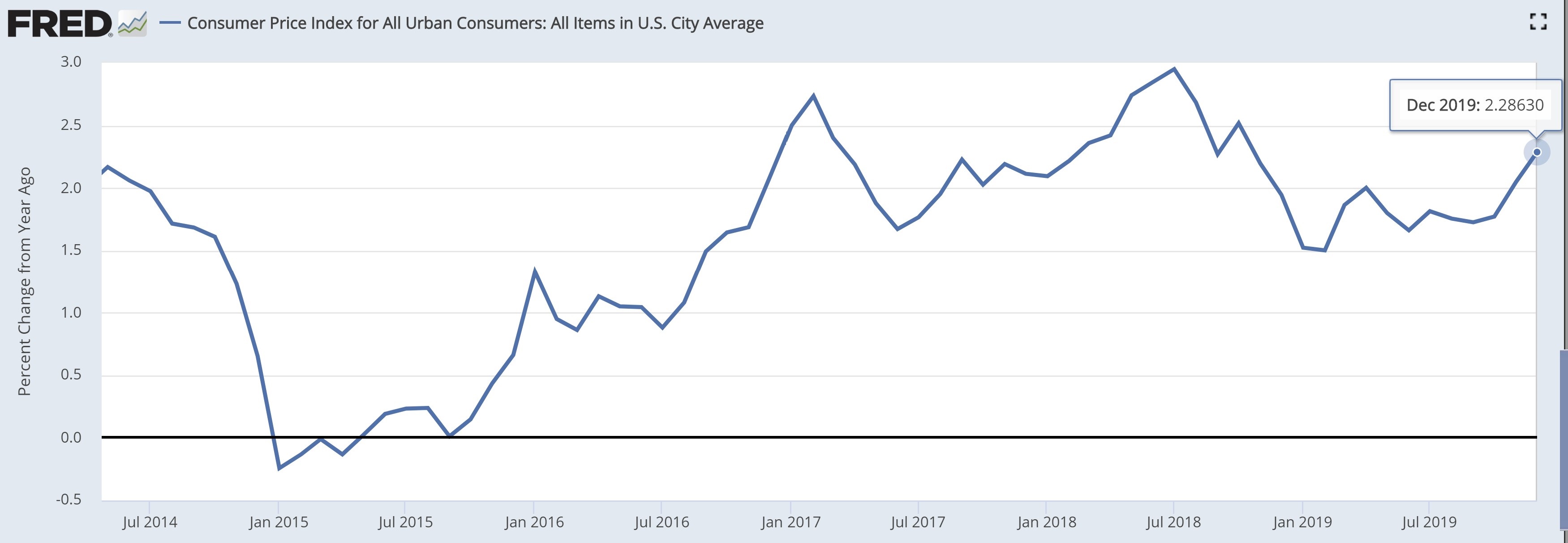

Submitted by Atlas Indicators Investment Advisors on March 5th, 2021December 2019 Consumer Price Index

Submitted by Atlas Indicators Investment Advisors on January 23rd, 2020

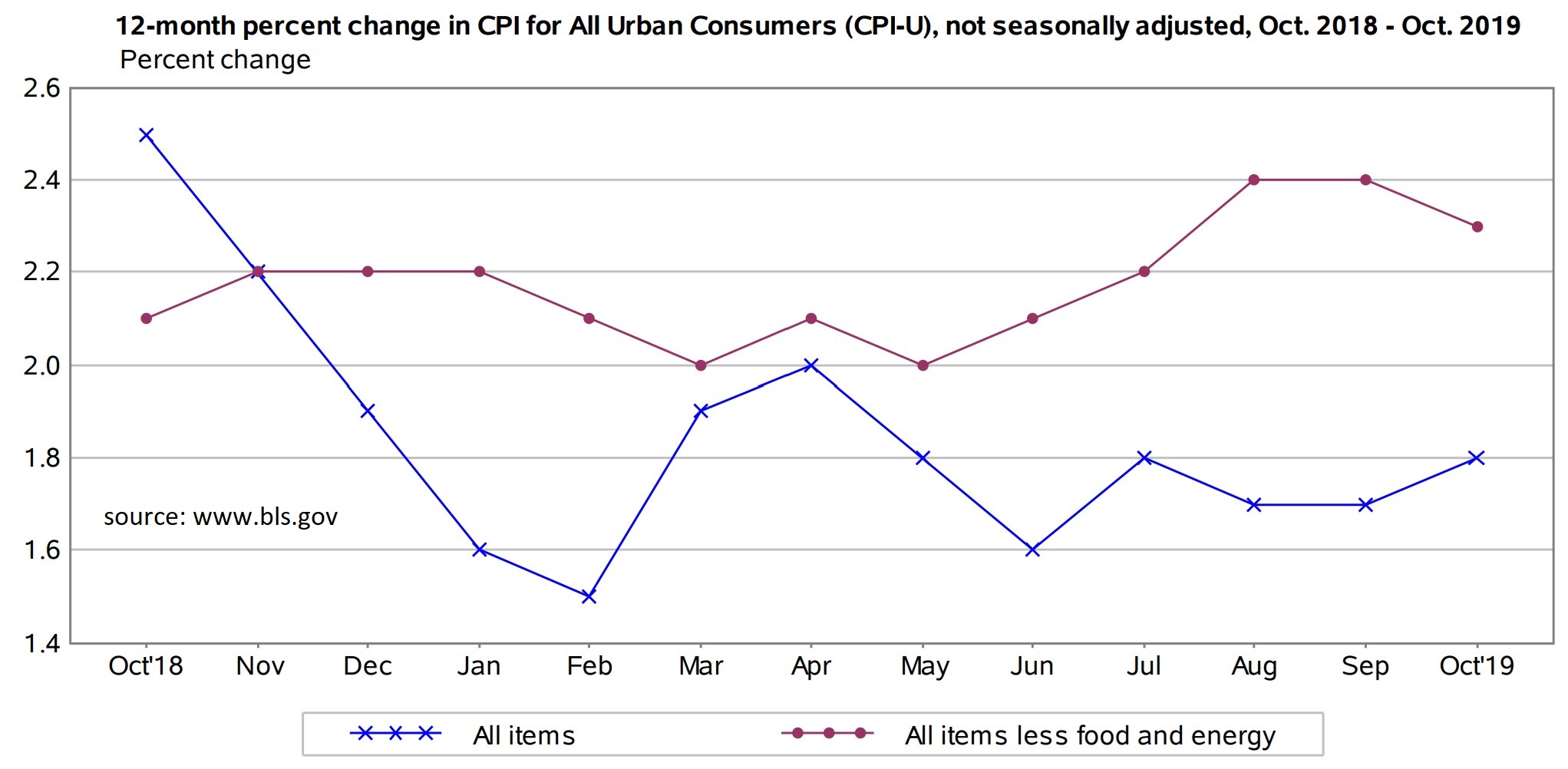

Prices continued rising at a moderate pace in December 2019 according to the Bureau of Labor Statistics. Their Consumer Price Index rose 0.2 percent in the final 31 days of the decade. This final uptick helped push the year-over-year tally to 2.3 percent which is faster than the 1.9 percent rate of change in 2018.

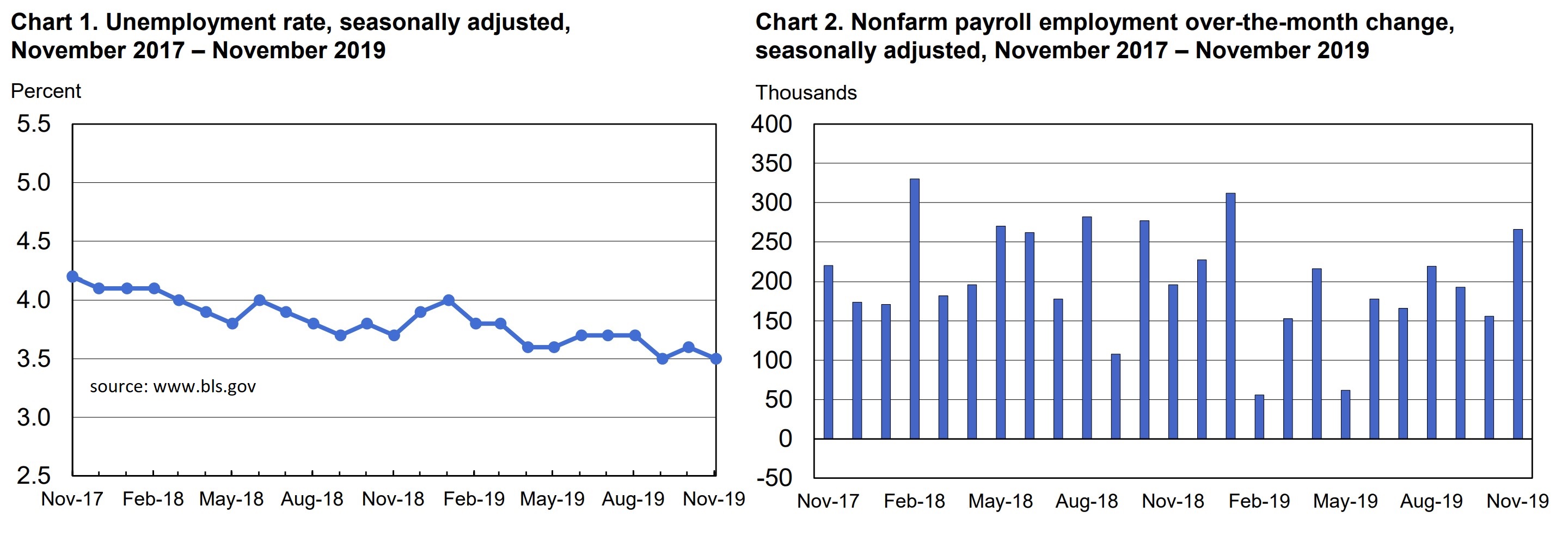

December 2019 Employment Situation

Submitted by Atlas Indicators Investment Advisors on January 23rd, 2020

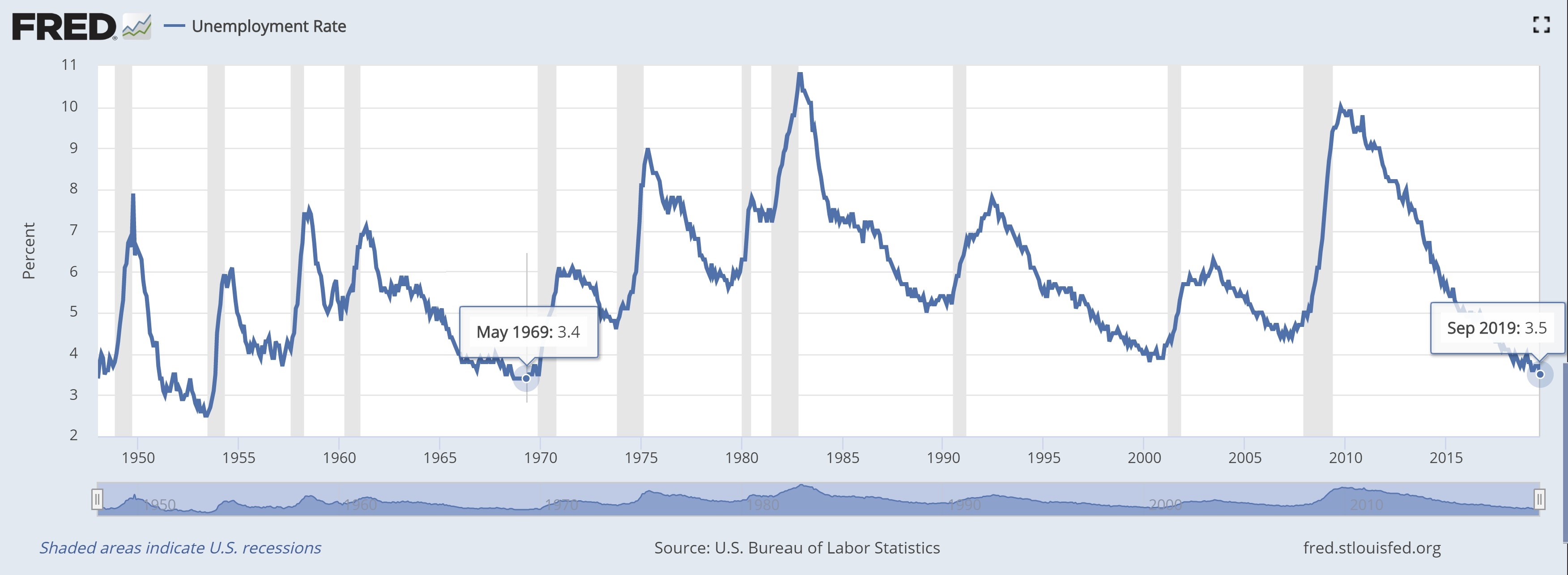

America’s labor situation has been one of the economy’s highlights since it began recovering after the Great Recession. Last year (2019) ended the decade by adding 2.11 million net new jobs, including December’s uptick of 145,000 according the Bureau of Labor Statistics (BLS). The unemployment rate held steady at 3.5 percent.

Revised Third Quarter 2019 Productivity and Unit Labor Costs

Submitted by Atlas Indicators Investment Advisors on December 19th, 2019Productivity contracted in the third quarter of this year according to revised data from Bureau of Labor Statistics (BLS). Their measure of output per labor hour fell 0.2 percent from July through September 2019 (originally down 0.3 percent).

November 2019 Employment Situation

Submitted by Atlas Indicators Investment Advisors on December 12th, 2019October 2019 Consumer Price Index

Submitted by Atlas Indicators Investment Advisors on November 20th, 2019

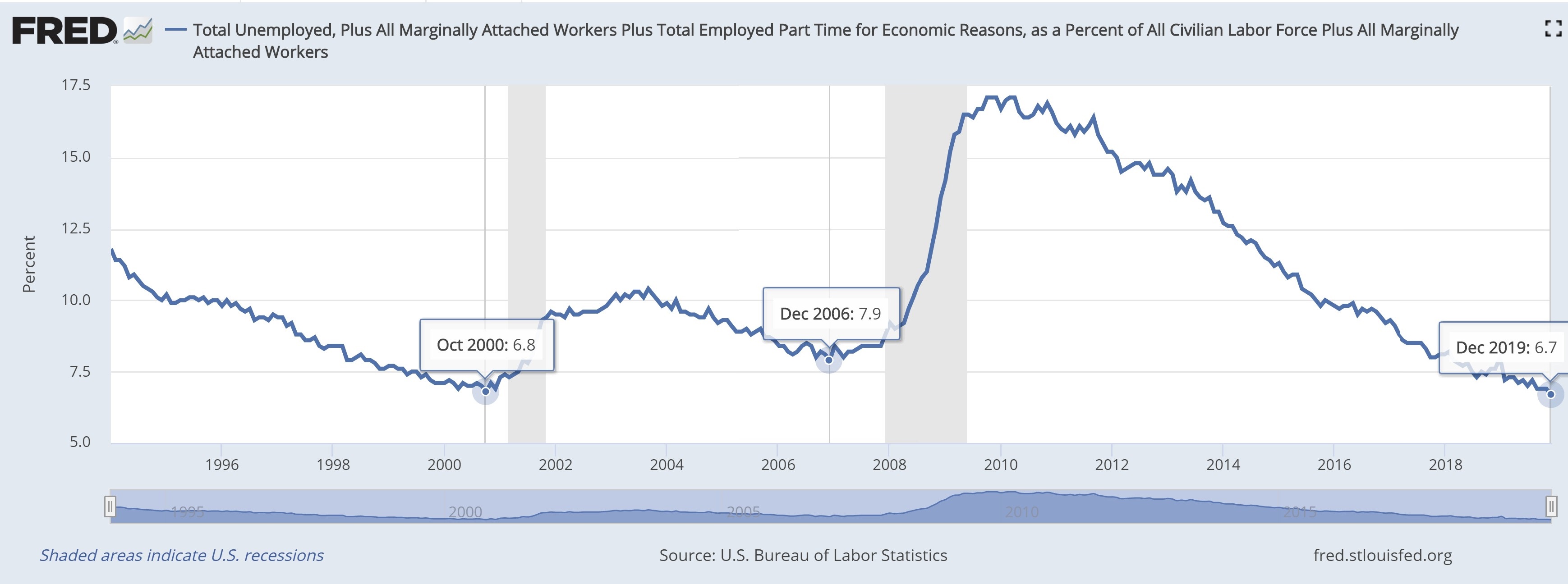

Prices continued rising in October 2019 according to the Consumer Price Index (CPI) from the Bureau of Labor Statistics. The month-over-month tally accelerated to 0.4 percent after going unchanged in September. However, this sudden uptick had only a marginal impact on the year-over-year statistic, rising to 1.8 percent from 1.7 percent. Removing food and energy, leaving

September 2019 Employment Situation

Submitted by Atlas Indicators Investment Advisors on October 16th, 2019

American firms continued adding jobs in September 2019 according to the Bureau of Labor Statistics. Their latest tally indicates 136,000 net new jobs were gained in the period. However, this improvement is slower than the upwardly revised tally of 168,000 (originally 130,000) in August. Despite the slowing rate of improvement, the unemployment rate fell to just 3.5 percent, th