Durable Goods Orders November 2019

Submitted by Atlas Indicators Investment Advisors on January 17th, 2020

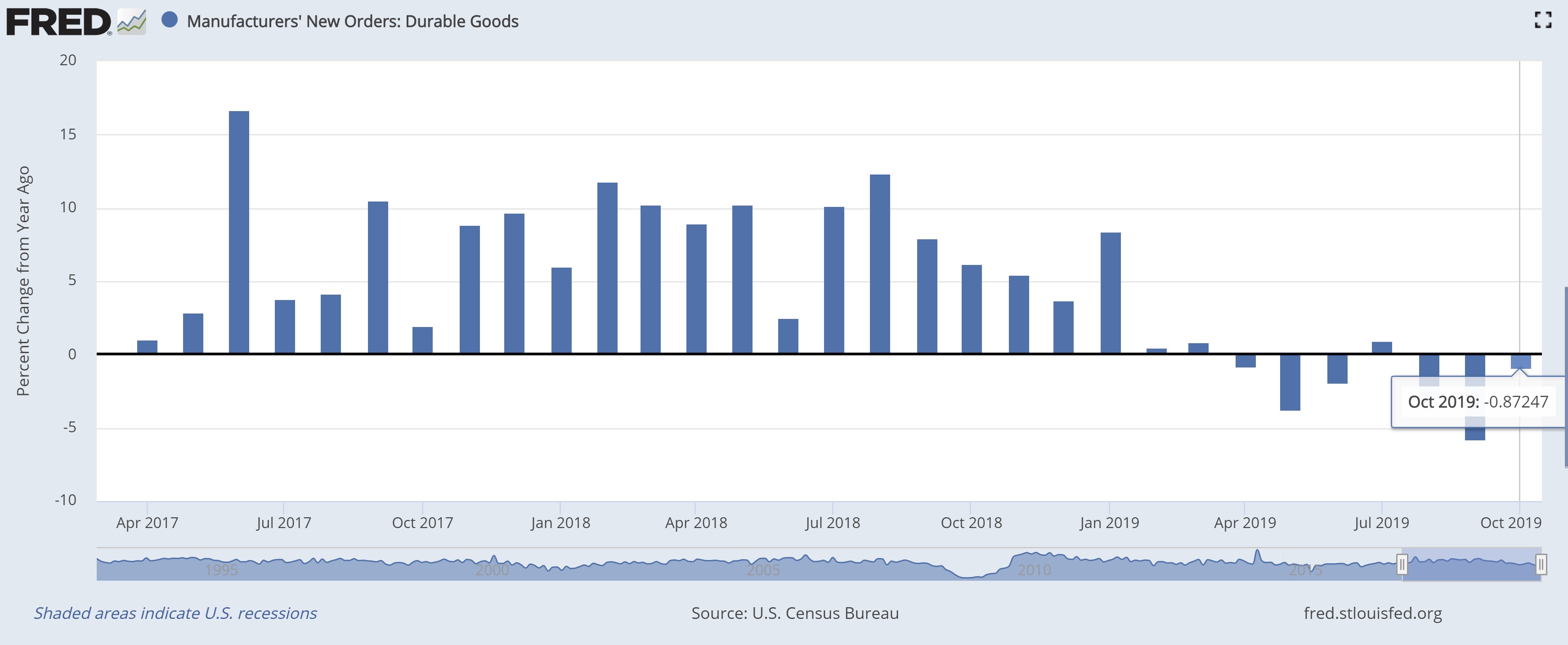

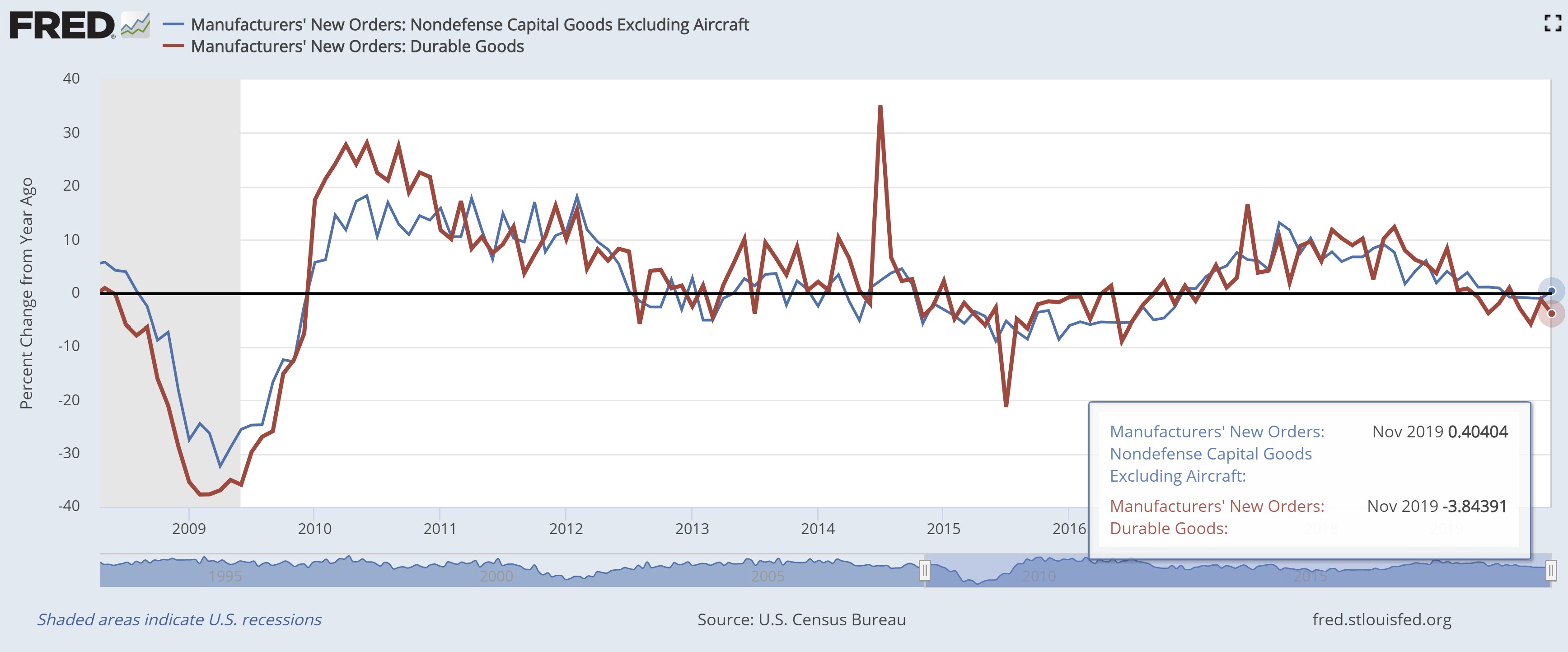

Durable Goods Orders declined in November 2019 according to the Census Bureau. This measure for orders of wares expected to last three years or longer fell 2.0 percent in the month alone. Year-over-year, the tally is even worse, down 3.8 percent. Ouch! However, it isn’t as bad as the headline suggests.