Monetary Policy

How Did We Get Here?

Submitted by Atlas Indicators Investment Advisors on January 31st, 2025Monetary Trolicy

Submitted by Atlas Indicators Investment Advisors on May 31st, 2024

The Federal Reserve (Fed) is currently grappling with a significant dilemma reminiscent of the classic Trolley Problem, where any decision carries considerable consequences. This predicament stems from the Fed's dual mandate: to achieve maximum employment and maintain stable prices, specifically targeting low inflation which they have determined is 2.0 percent on a trending basis.&nbs

Marshalling a Big Bang

Submitted by Atlas Indicators Investment Advisors on May 31st, 2024

For not fully understood reasons, conditions for the Big Bang were met about 13.8 billion years ago. This unfathomable event set off a series of reactions. Evidence of the reaction’s aftermath is observable even today. For instance, according to NASA, we can still see the heat that was there roughly 380,000 years after the expansion of the universe (13.42 billion years a

Eclipsing the Fed’s Control

Submitted by Atlas Indicators Investment Advisors on May 31st, 2024

The world is just a few days removed from the 2024 solar eclipse, and some have already booked their flights and places to stay for the next one. It will happen on August 12, 2026 and will be visible in Greenland, western Iceland, and northern Spain. Happening in August, the event is more than two years away, yet we know when it will occur because of math.

The Weight and Watching

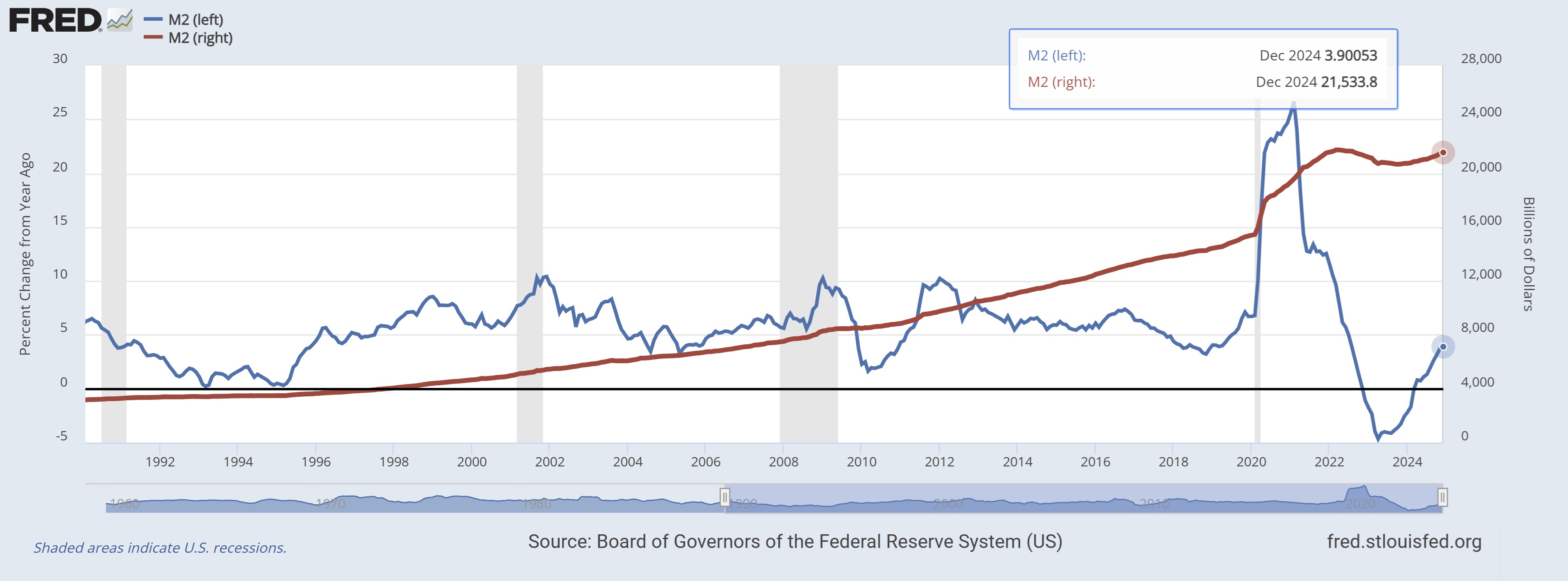

Submitted by Atlas Indicators Investment Advisors on May 31st, 2024The Weight from the Canadian-American rock group The Band is probably their best-known song. Its lyrics evoke feelings of burdens, responsibility, and interconnectedness of community obligations. In times of need, the Federal Reserve can counteract negative conditions in the economy as it did in the Great Financial Crisis and the economic challenges America faced during the Covid-19

What Decade is This?

Submitted by Atlas Indicators Investment Advisors on February 5th, 2024A Dot in the Road

Submitted by Atlas Indicators Investment Advisors on August 22nd, 2023

Those in the economics profession are often charged with making forecasts. For some periods, there is a lot of agreement regarding the path of the economy. But then the road gets bumpier, and opinions begin to differentiate more and more. Th

Monetary Hopscotch

Submitted by Atlas Indicators Investment Advisors on June 28th, 2023Six Heads and a Whirlpool

Submitted by Atlas Indicators Investment Advisors on March 22nd, 2023

The Odyssey is an epic poem written by Homer, telling the story of Odysseus, a Greek warrior embarking on a long journey home to Ithaca after the Trojan War. Along the way, Odysseus faces many adventures and must battle monsters, gods, and the sea itself. He eventually makes it home, but not before enduring a series of obstacles and tasks set by the gods.