Addition and Subtraction, Not Recession

Submitted by Atlas Indicators Investment Advisors on June 30th, 2025

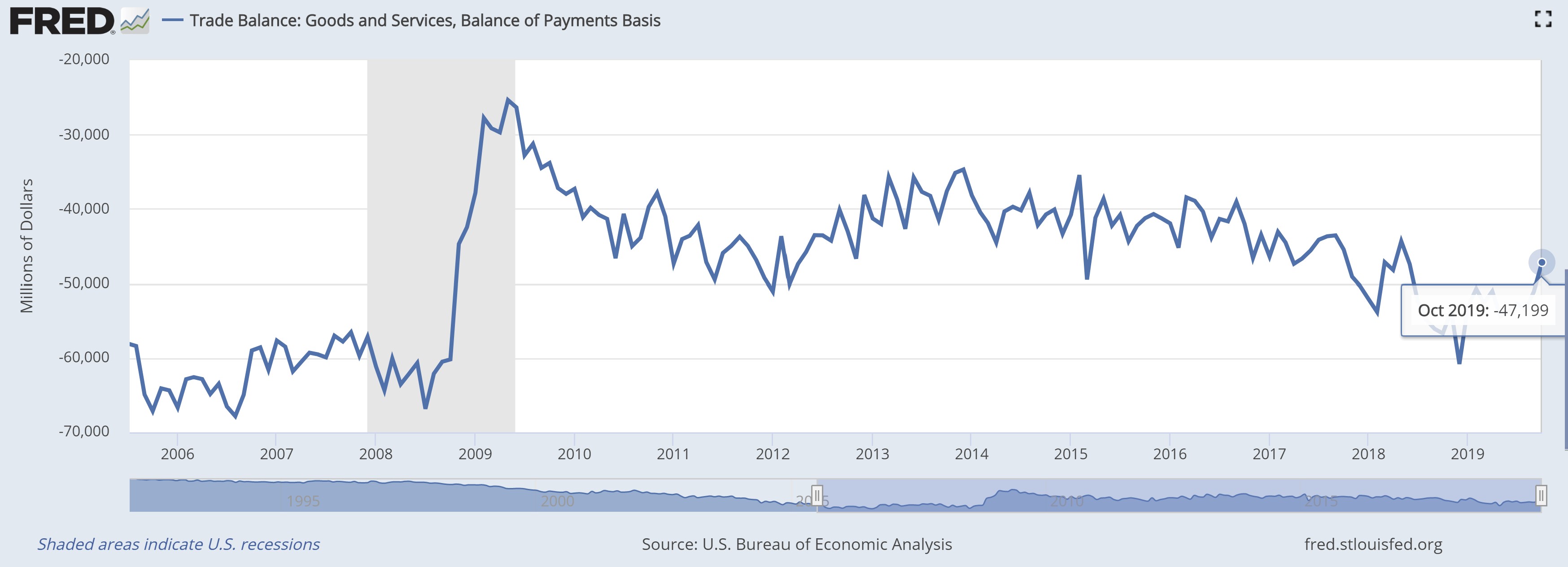

Gross Domestic Product (GDP) is one way to measure the output of our economy. It considers how money is spent in America by consumers, businesses, and the government. Recently, the Bureau of Economic Analysis released the advance report on first quarter 2025 GDP, and it was negative for the first time since declining for two consecutive quarters in 2022.