Blog

Dark Friday

Submitted by Atlas Indicators Investment Advisors on December 22nd, 2022

Black Friday’s moniker is explained as the day when retailers go from being in the red for the year into positive earnings. Atlas won’t argue, but we cannot say for sure that this is still what happens. After your heart calms down from all the savings on Friday, you can hit Main Street America for Small Business Saturday. What a weekend. And then when you get bac

Bad to Better

Submitted by Atlas Indicators Investment Advisors on December 22nd, 2022Trends never move in straight lines. This is certainly observable in markets. Styles experience the same phenomenon. Perhaps the kernel of a trend is revealed at a fashion show, but it takes the greater population a little time to embrace the new look. A similar pattern is emerging for the globe as it tries trending back to something more normal from the depths of the pandem

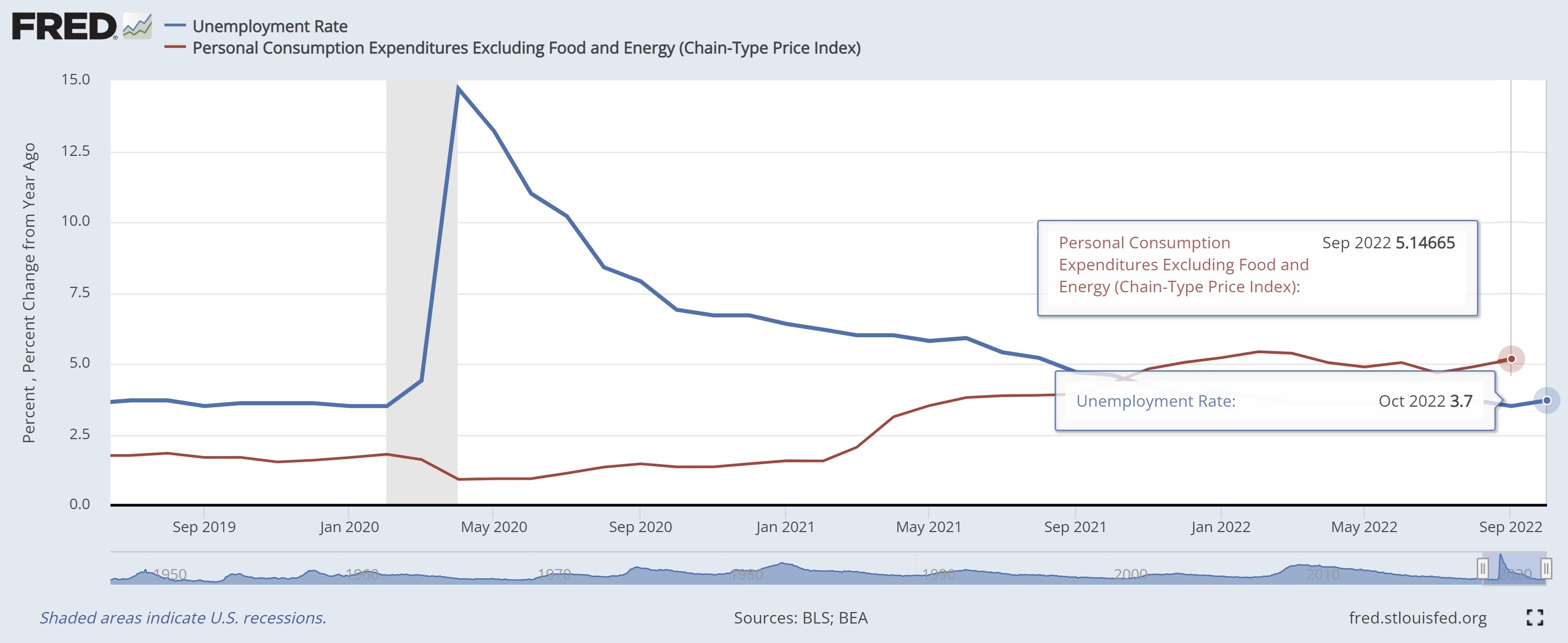

Holding Down Expectations

Submitted by Atlas Indicators Investment Advisors on November 6th, 2022

Every six weeks the Federal Reserve Open Market Committee meets to discuss monetary policies and to make any changes to it which they deem necessary. Their latest two-day meeting ended last Wednesday with the 12-person committee unanimously voting to raise the overnight lending rate banks charge each other by 0.75 percentage points; the range for this type of loan now stands at 3.75 - 4.0

Savings Gripe

Submitted by Atlas Indicators Investment Advisors on November 6th, 2022Savings are going away. A few days ago, regular readers were sent a note on income and outlays from the Bureau of Economic Analysis which includes data on the savings rate. In the note, Atlas highlighted the dismal rate of savings (currently 3.1 percent). It is understandable that households are less able to stash cash when inflation is rising while markets crash. But ou

The Sssssssurvey Sssssssaysssss

Submitted by Atlas Indicators Investment Advisors on October 31st, 2022

Family Feud is a gameshow which started in 1976 and aired through 1985. After a few years hiatus, it returned in 1988, only to end again in 1995. Then as the last century came to a close, it managed to make another comeback, one which has lasted through today. It pits two families against each other, competing to determine answers to survey questions previously asked to a grou

Stuck

Submitted by Atlas Indicators Investment Advisors on October 20th, 2022Playing Catch Up

Submitted by Atlas Indicators Investment Advisors on October 14th, 2022Antifeatures

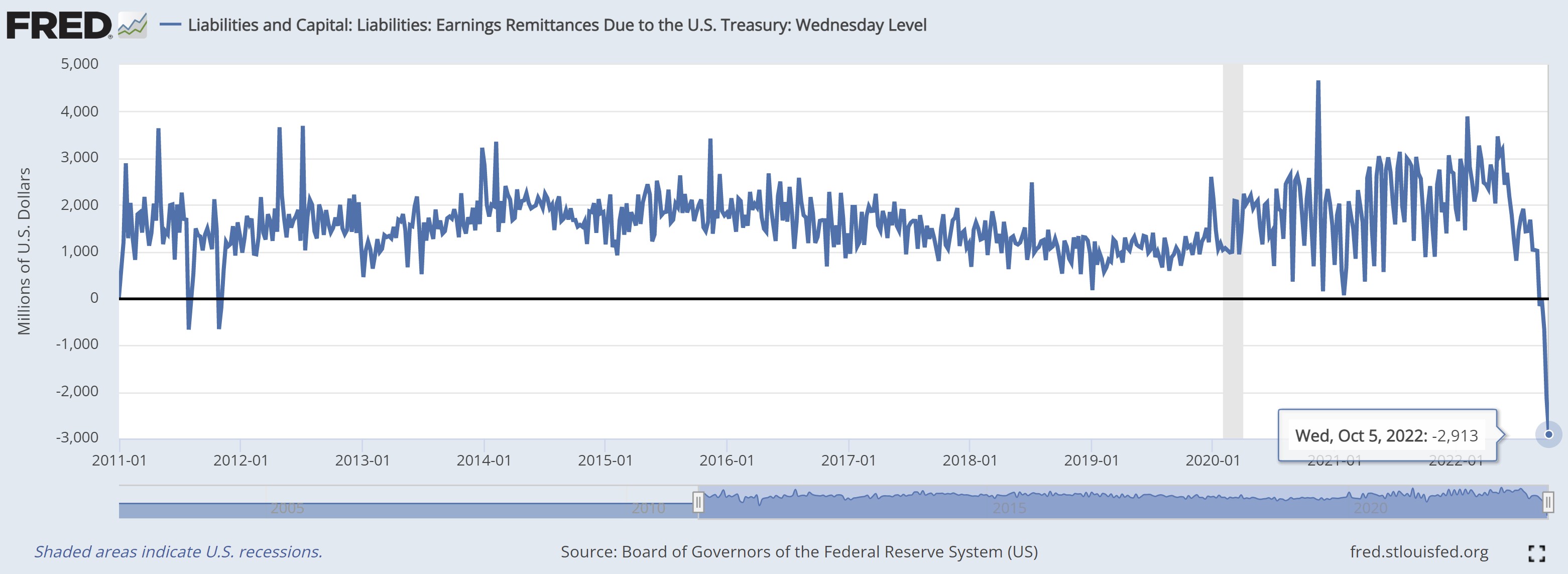

Submitted by Atlas Indicators Investment Advisors on October 6th, 2022

Software runs our world. Whatever apparatus you’re reading this note on has programs and operating systems which allow you to receive and delete (hopefully not too quickly) this note. Some of the code runs in the background doing things I’ll never understand, but other parts of it create feature or functionality designed to be useful to us as users. Occasionally, a

What, BOE Worry?

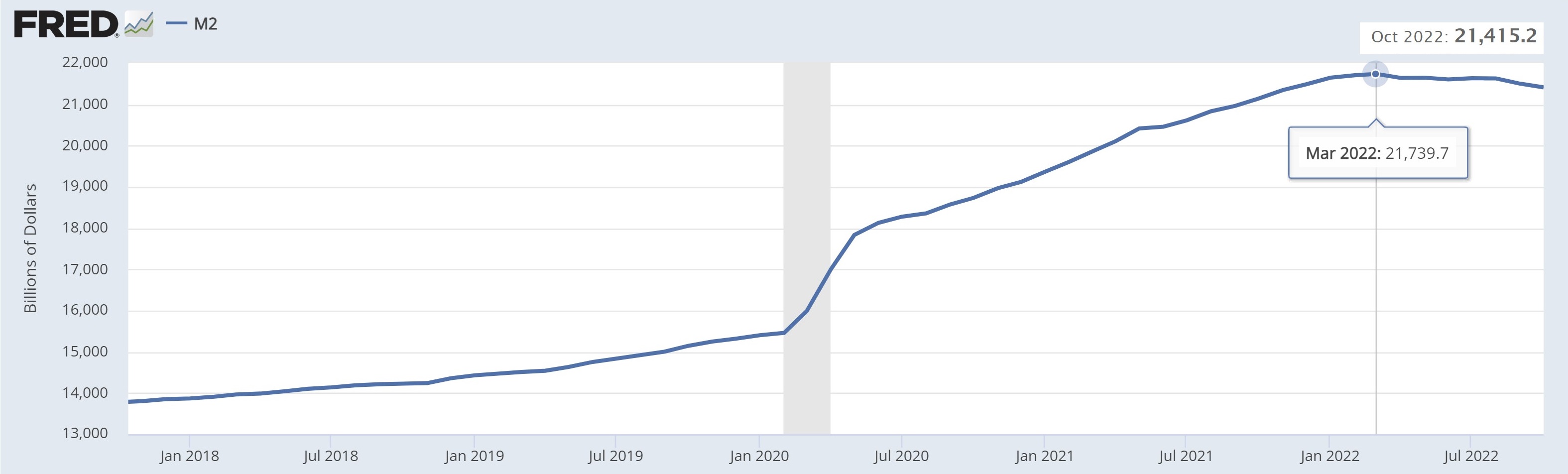

Submitted by Atlas Indicators Investment Advisors on September 30th, 2022

Our global economy is struggling. It started with the global pandemic. This led to uncertainty which forced leaders across the world to shut down economies. Then fiscal and monetary policies ensued as households needed support. Eventually things started to normalize but cash created out of thin air to support output remained in the system. This eventually led to in