Misleading Indicators

Submitted by Atlas Indicators Investment Advisors on February 23rd, 2023

Economic indicators come is three varieties, differentiated by their timing. Some offer an insight into the future. We call these leading indicators; for instance, new orders data help us see a bit over the horizon. Others tell us more about the here and now; these are coincident indicators like industrial production or personal income. Finally, there are lagging indicators which do a better job of telling us where we’ve been; employment-related figures fit here. None of these offer perfect timing, but they help to better understand the business cycle.

It is important to know the sequencing of various indicators because they can cause confusion otherwise. Many lagging indicators are signaling the economy was fine. For instance, our labor market remains strong. This is particularly interesting now since the Federal Reserve is leaning against the growth rate of the economy because it needs to push inflation lower. In the latest labor reports, firms continued hiring and very few were firing. If its lagging nature holds true this business cycle, it will be no surprise to see aggregate job cuts later this year in America’s labor market as employment follows the slowing trajectory of the economy.

Coincident indicators are starting to deteriorate, following the trajectory of their forward-looking counterparts. Take the latest Gross Domestic Product release from the Bureau of Economic Analysis for instance; they revised their 4th quarter 2022 tally lower (look for Atlas’ full note on this indicator in the coming days). Spoiler alert: it was a weakening consumption statistic which brought it down. Consumers are the largest contributors to output in America, so this downgrade is of particular interest.

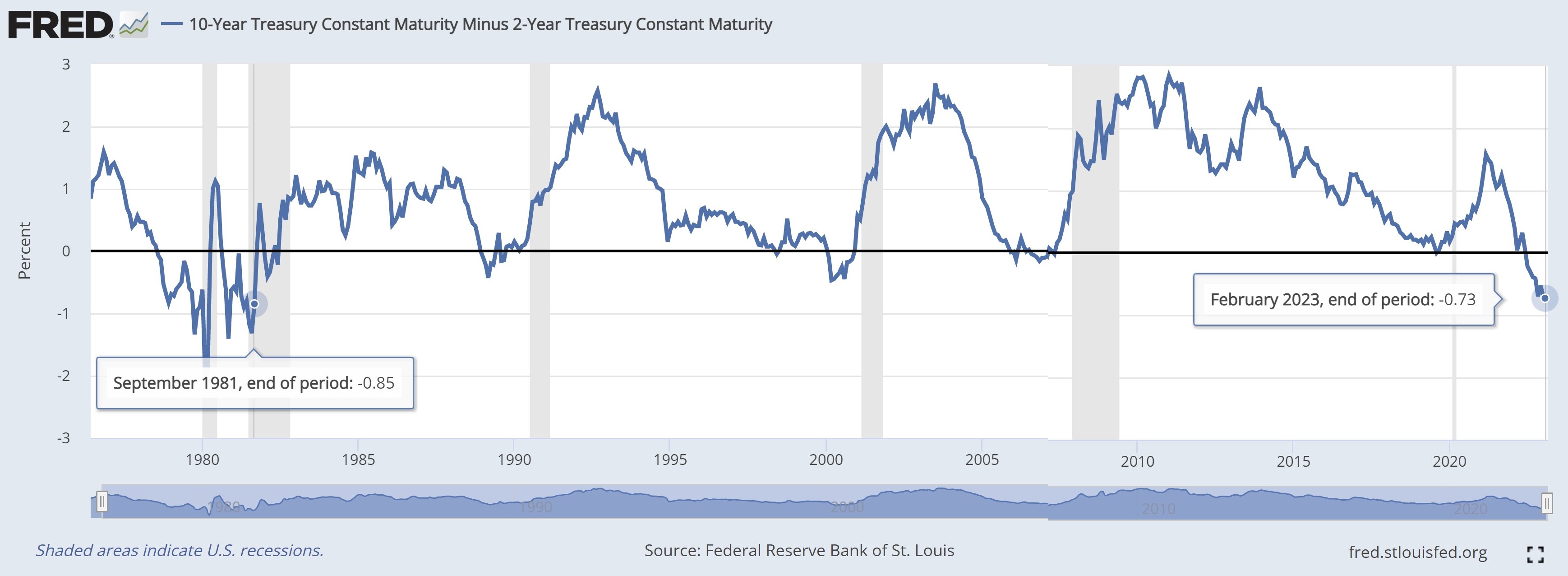

Leading indicators have been weakening for months and do not show much in the way of reversing. For example, the Conference Board’s Leading Economic Index is at levels seen in prior recessions. Additionally, the yield curve (the difference between a two-year treasury and 10-year treasury notes) remains inverted (i.e., yields are higher on the shorter note). In fact, as you can see above, the inversion is worse than any time since September 1981.

America’s economy is complex and dynamic. There’s never a steady correlation between leading indicators and its future trajectory (correlations by nature are always in flux), but the probabilities of a recession seem high to Atlas. Yes, there are indicators which look strong but consider where they line up in the sequence as they may prove to be misleading indicators.