Federal Reserve

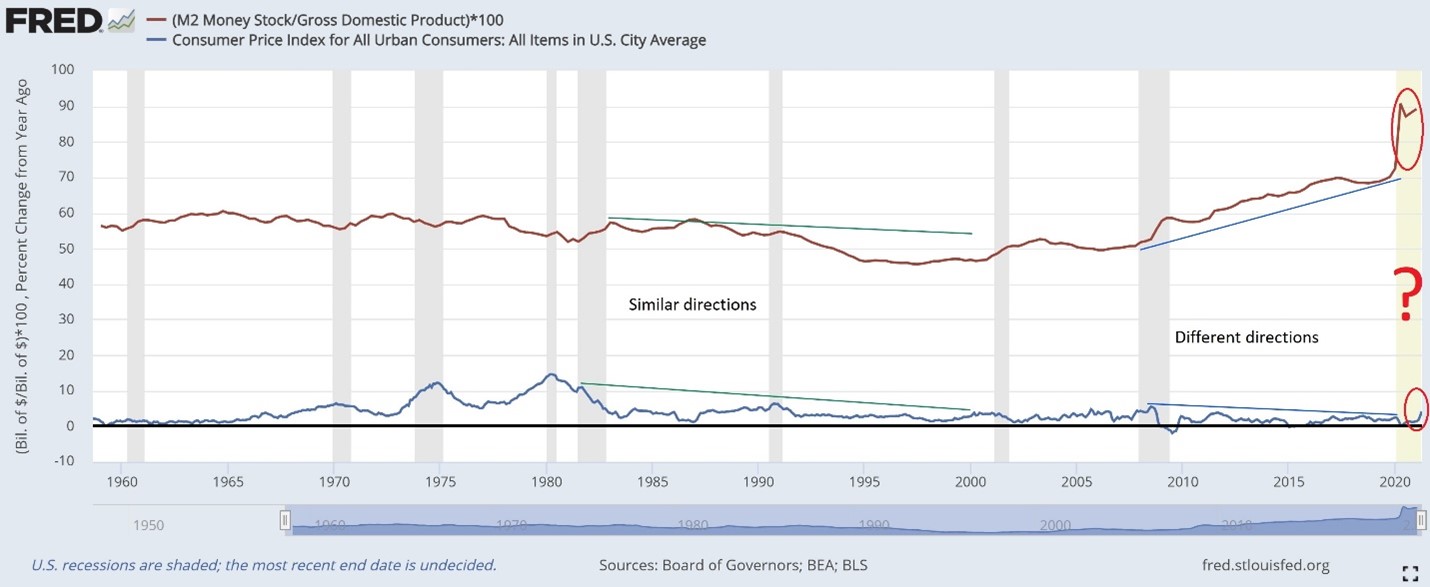

Classic Relationships

Submitted by Atlas Indicators Investment Advisors on May 28th, 2021

Classic relationships can be so romantic. They can even inform our own ideas about the successfulness of our pairings. Take Ethel and Fred Mertz. I know Lucy and Ricky are the main characters, but their neighbors really crack me up. Like Fred, I can’t tell you how many times I’ve looked for the price tag on some item my wife wants to get rid of because I thin

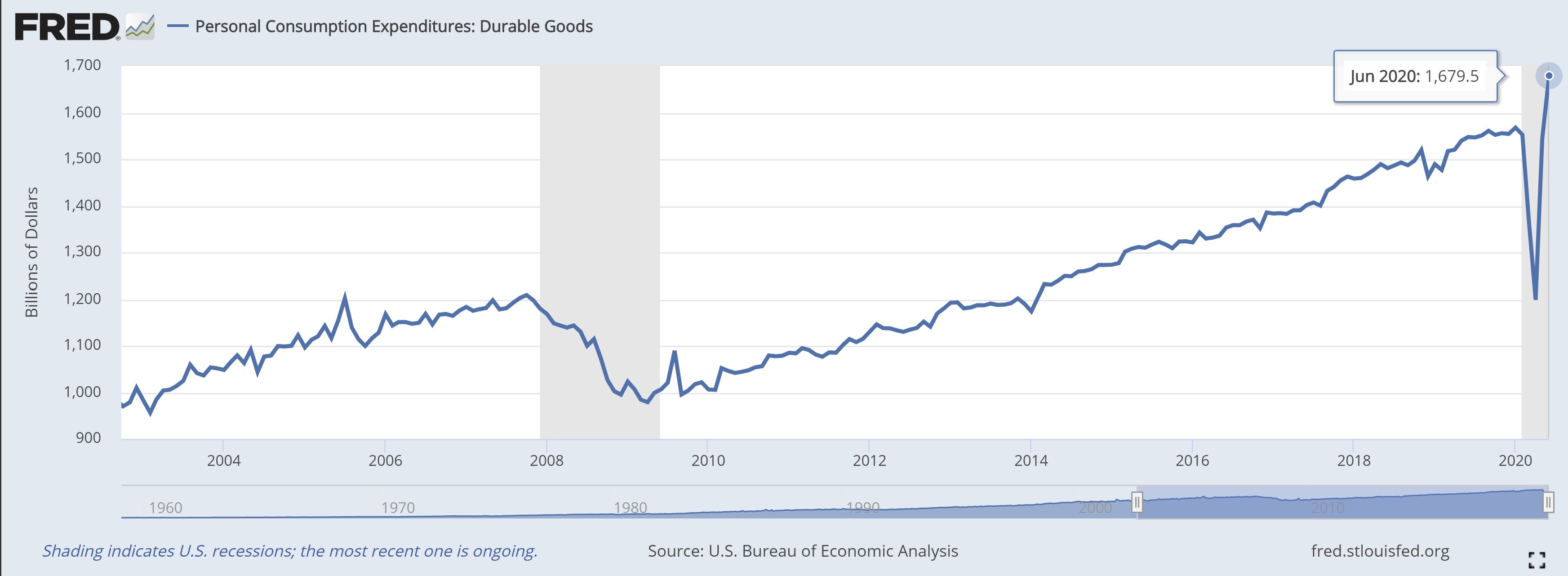

October 2020 Income and Outlays

Submitted by Atlas Indicators Investment Advisors on December 7th, 2020Income and outlays data provide an important and frequent look into the state of our economy. Of course, income is, for the most part, a necessary condition for spending. Outlays, in the report on personal consumption expenditures (PCE) represents over two-thirds of our nation’s output. Both were mixed in October 2020 according to the Bureau of Economic Analy

Zombie Inc.

Submitted by Atlas Indicators Investment Advisors on November 19th, 2020

Zombies are occasionally the subjects of fictional works. These undead, horror-related characters are found in books, music videos, movies, and video games. Often pathogens infect them, turning a once lively person into no more than an animated corporeal without other human essences. Once an individual transitions, they may become a vector of the disease for which there is no

pôrtˈmantō

Submitted by Atlas Indicators Investment Advisors on October 16th, 2020A portmanteau is one for my favorite tools of the English language. It sounds awfully French to be English, but I digress. They result from blending two or more words. Spork is probably the most utilitarian one I can think of. You can eat a salad or bowl of cereal with that portmanteau. Those of us in Southern California are familiar with smog (smoke + fog).&

Lucy van Pelt Economics

Submitted by Atlas Indicators Investment Advisors on August 27th, 2020Far From Cashless

Submitted by Atlas Indicators Investment Advisors on August 20th, 2020

Cash use has been on the decline. Technology has made it easier to spend money without it ever being held in your hands. Consumption is nearly frictionless as mobile technologies allow a person to go from an advertisement on social media to payment in seconds. So, are we headed to a cashless society? The jury is still out but a trend has emerged.