CB…Oh No!

Submitted by Atlas Indicators Investment Advisors on May 31st, 2023

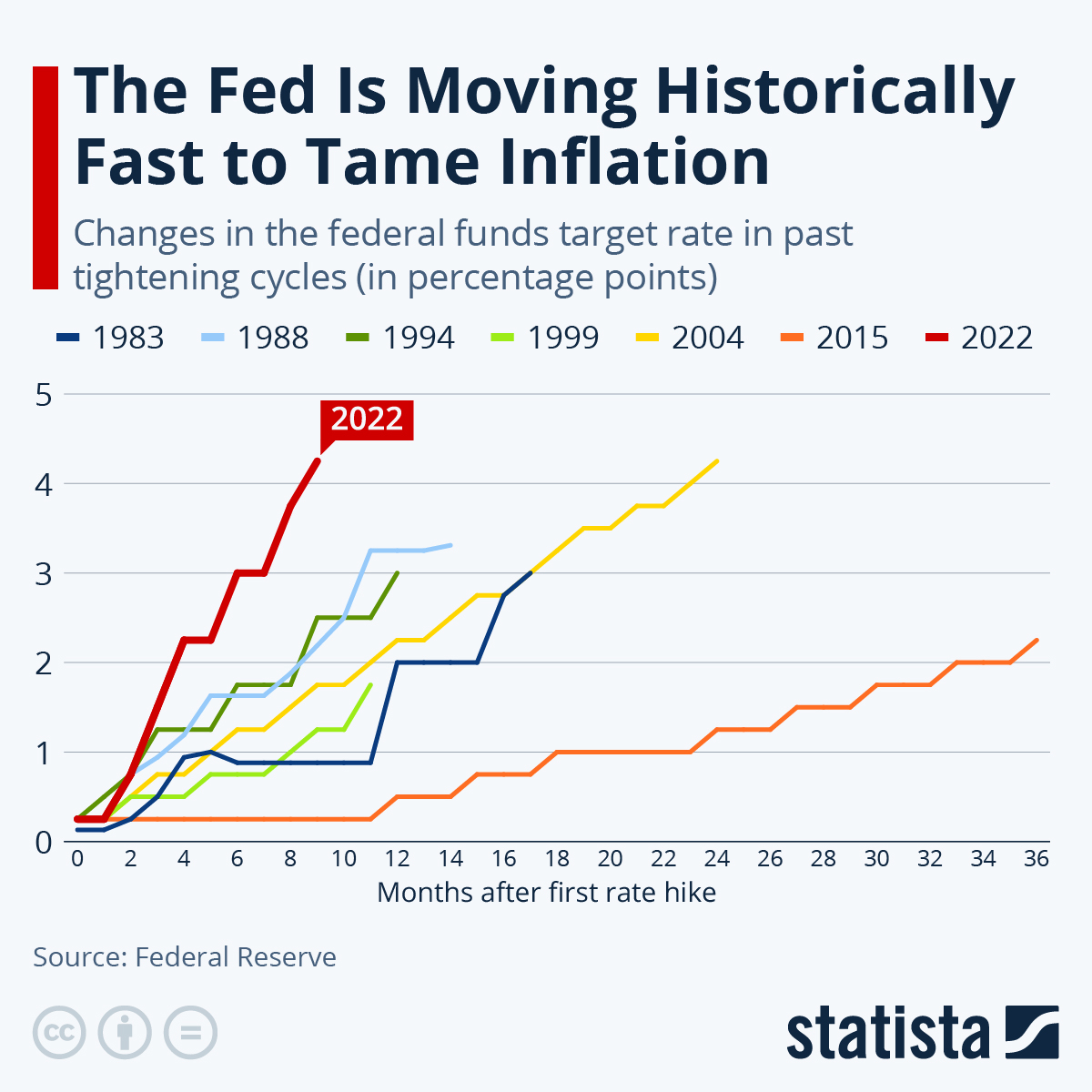

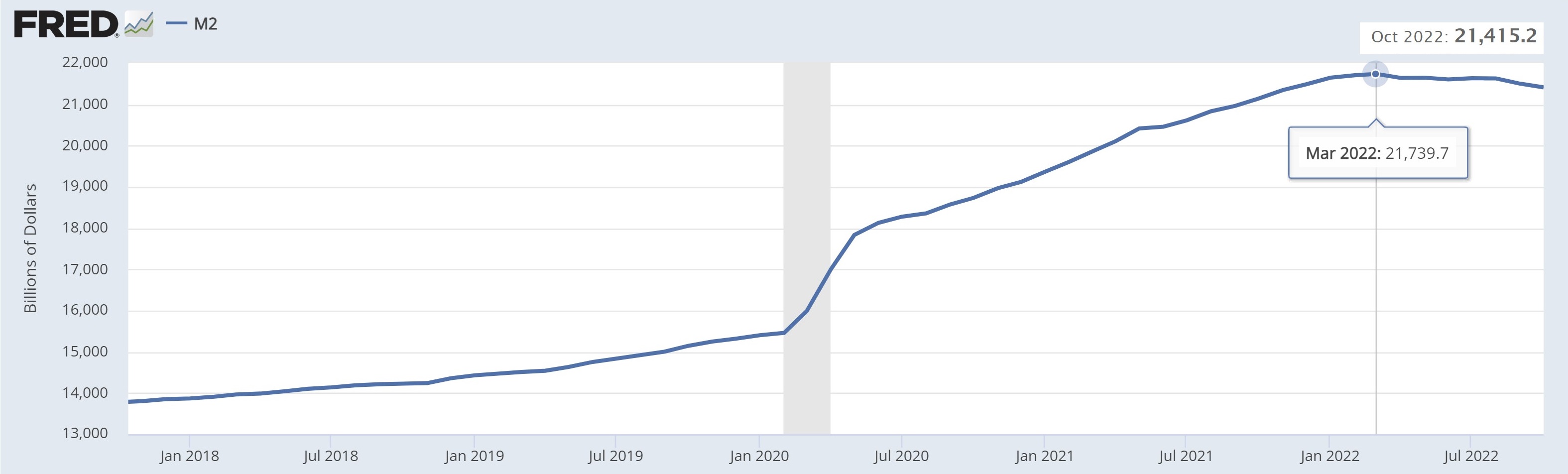

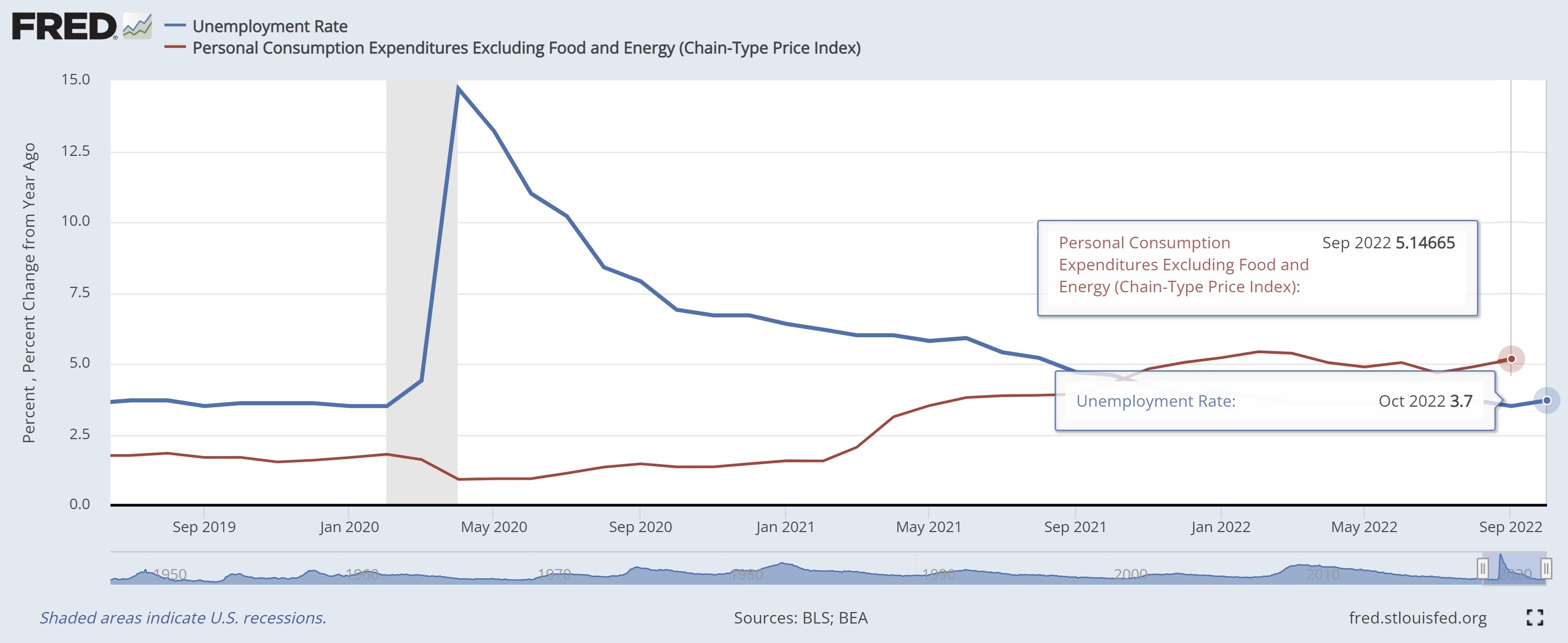

With the Federal Reserve’s latest meeting behind us, growing focus is directed to America’s budget. Expect more of this type of discussion in the news as May wears on because our nation is near its debt limit. Leadership is expected to meet next week to discuss the matter which could come to a head in early June. Unfortunately, busy calendars and trips out of the c