June 2020 Income and Outlays

Submitted by Atlas Indicators Investment Advisors on August 4th, 2020

It intuitively makes sense that the directions of spending and income would generally move together. However, there are periods when they are out of sync; June 2020 was one of these times. Despite personal incomes declining for a second consecutive period, personal consumption expenditures (PCE) increased for a second time in a row according to the Income and Outlays report from the Bureau of Economic Analysis.

Personal income decreased $222.8 billion (1.1 percent) as the first half of the year came to a close. Disposable personal income (i.e., after-tax income) fell even further, down $255.3 billion (1.4 percent). Wages and salaries gained 2.2 percent after rising 2.6 percent but are still down 6.3 percent from their February level. Proprietors’ income gained 5.5 percent on the heels of a 2.1 percent uptick but remain 12.2 percent less than their pre-pandemic tally. Rental income was lower for a third consecutive period, and receipts on assets (i.e., dividends and interest) haven’t had an up month since January. Finally, after surging 100.1 percent in April, personal current transfer receipts fell for second month in a row, down 8.9 percent, mostly due to a decrease in social benefits to individuals from the federal economic recovery programs in response to the covid-19 pandemic.

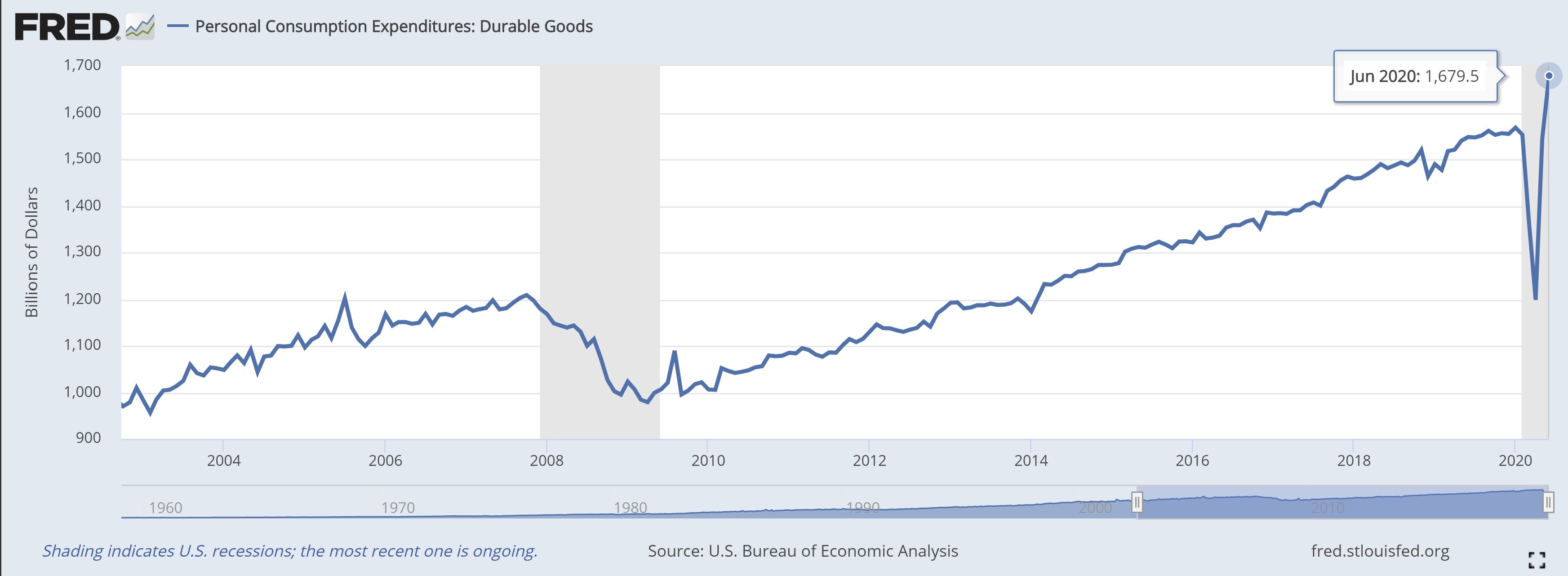

Outlays continued higher for a second month, rising 5.6 percent. Nevertheless, they remain 6.9 percent lower than February. Outlays for durable goods led the way, rising 8.7 percent and are now at their highest level in history (see chart above). Nondurables weren’t far off as they gained 5.2 percent and are just 2.7 percent from their previous record. Services also gained for a second month but remain 11.5 percent from their peak in February.

Inflation data contained in the report remained tame. There was mild a uptick in the headline PCE price index trend, accelerating to 0.8 percent versus a year ago after sitting at 0.5 percent in the prior two periods. However, much of this was caused by rising energy prices. The core PCE price index (it excludes food and energy) decelerated to 0.9 percent from 1.0 percent in May. For perspective, the Federal Reserve has been trying to get the core PCE price index to reach consistently 2.0 percent since the last recession, something it has not been able to achieve.

America’s business cycle can be broken down to four basic components: output, jobs, income, and spending. An uptick/downtick in any of these (exogenous or happening more organically) generally leads to a rise/decline in the others. This is why Atlas pays such close attention to the Bureau of Economic Analysis’ release on income and outlays; it contains two of the four basic components. Adding to the indicator’s utility, it also gets released monthly, providing looks at the direction of the economy long before the official gross domestic product figures which are released nearly a month after a quarter ends. After a devastating start to the second quarter, the income and outlays report suggests the economy stopped contracting in May and continued recovering in June.