Federal Reserve

February 2019 Producer Price Index

Submitted by Atlas Indicators Investment Advisors on March 20th, 2019Prices paid by producers and wholesalers rose marginally in February 2019 according to the Bureau of Labor Statistics. Their Producer Price Index rose 0.1 percent after declining a similar amount in both December and January. Year-over-year, this price proxy is up 1.9 percent, declining modestly from 2.0 percent in January.

February 2019 Consumer Price Index

Submitted by Atlas Indicators Investment Advisors on March 19th, 2019Where’s the Fulcrum?

Submitted by Atlas Indicators Investment Advisors on March 1st, 2019

Monetary policies executed by the Federal Open Market Committee (FOMC) are designed to fulfill our central bank’s dual mandate: full-employment and price stability. What the heck do those terms mean?

January 2019 Industrial Production

Submitted by Atlas Indicators Investment Advisors on February 25th, 2019

Industrial production took a hit to start 2019 according to the latest release from the Federal Reserve. Their indicator which covers everything physically made in America declined 0.6 percent in January. This set back followed a downwardly revised tally of +0.1 percent (originally +0.3 percent) in December. Not only was the monthly tally negative, but the trend decelerat

January 2019 Consumer Price Index

Submitted by Atlas Indicators Investment Advisors on February 18th, 2019Prices paid by Americans were unchanged in January 2019 according to the Bureau of Labor Statistics’ Consumer Price Index (CPI). This comprehensive look at inflation gained just 1.6 percent in the past twelve months. Stripping out food and energy, the “core” CPI tally gained 0.2 percent to start the year and 2.2 percent on a year-over-year basis.

Passing the Baton

Submitted by Atlas Indicators Investment Advisors on February 8th, 2019Relay races are exciting. You get the fastest runners from around the globe and wait for world records to be set. Of course, the most dangerous portion of the competition occurs during the handoff. If a smooth connection isn’t made, forget finishing the race, let alone contacting the folks from Guinness World Records.

December 2018 Industrial Production

Submitted by Atlas Indicators Investment Advisors on January 25th, 2019

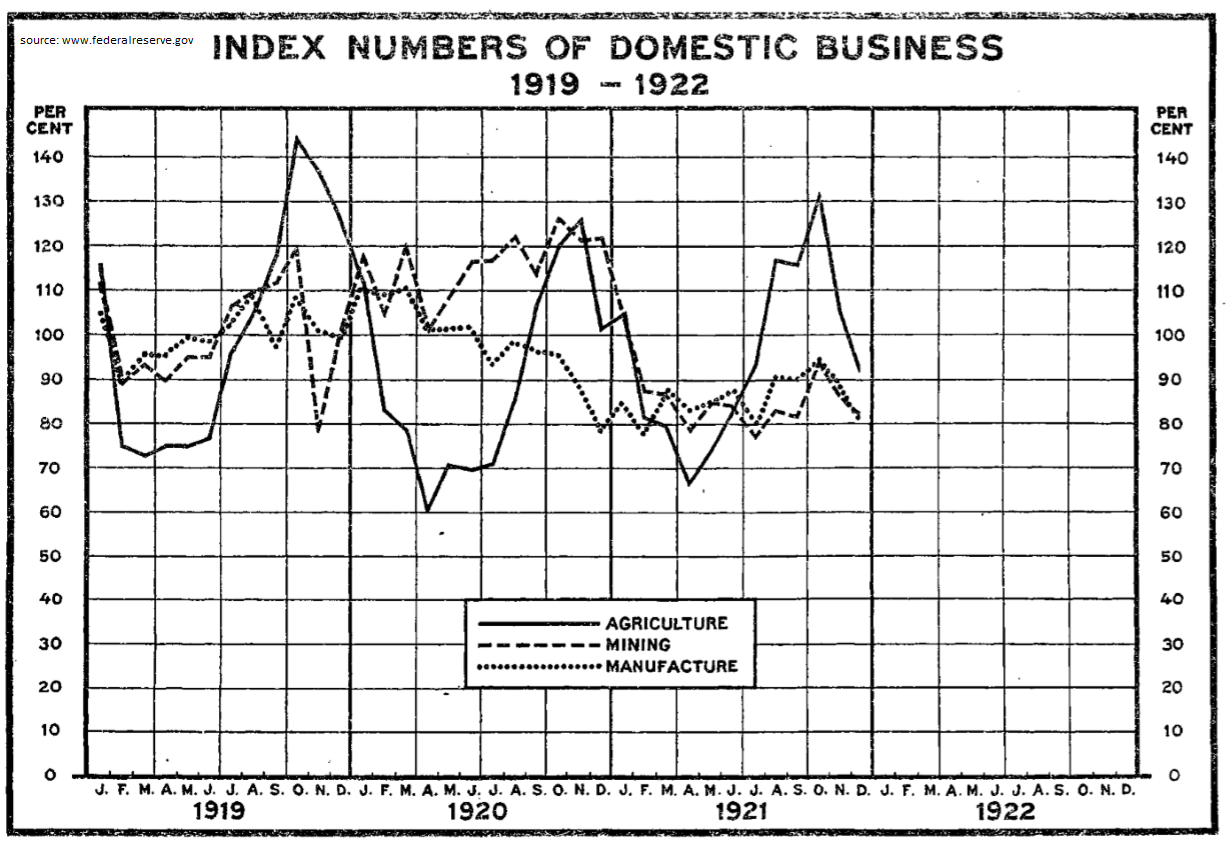

Before we get started on the details of December 2018 Industrial Production, I want to point out that the Federal Reserve’s latest release completes the first 100 years for this indicator. It’s first publication covered data for January 1919. The chart above is a copy of the first chart for industrial production.

December 2018 Consumer Price Index

Submitted by Atlas Indicators Investment Advisors on January 22nd, 2019Price changes were rather minor in December 2018 according to the Bureau of Labor Statistics. Their Consumer Price Index (CPI) fell 0.1 percent at the headline and increased 1.9 percent in the past year. Removing the two volatile components (food and energy) leaves the core-CPI figure which increased 0.2 percent and 2.2 percent during the month and year respectively.