Federal Reserve

Antifeatures

Submitted by Atlas Indicators Investment Advisors on October 6th, 2022

Software runs our world. Whatever apparatus you’re reading this note on has programs and operating systems which allow you to receive and delete (hopefully not too quickly) this note. Some of the code runs in the background doing things I’ll never understand, but other parts of it create feature or functionality designed to be useful to us as users. Occasionally, a

Headed for the Frisco Bay

Submitted by Atlas Indicators Investment Advisors on September 30th, 2022Jackson Hole 2022

Submitted by Atlas Indicators Investment Advisors on September 12th, 2022

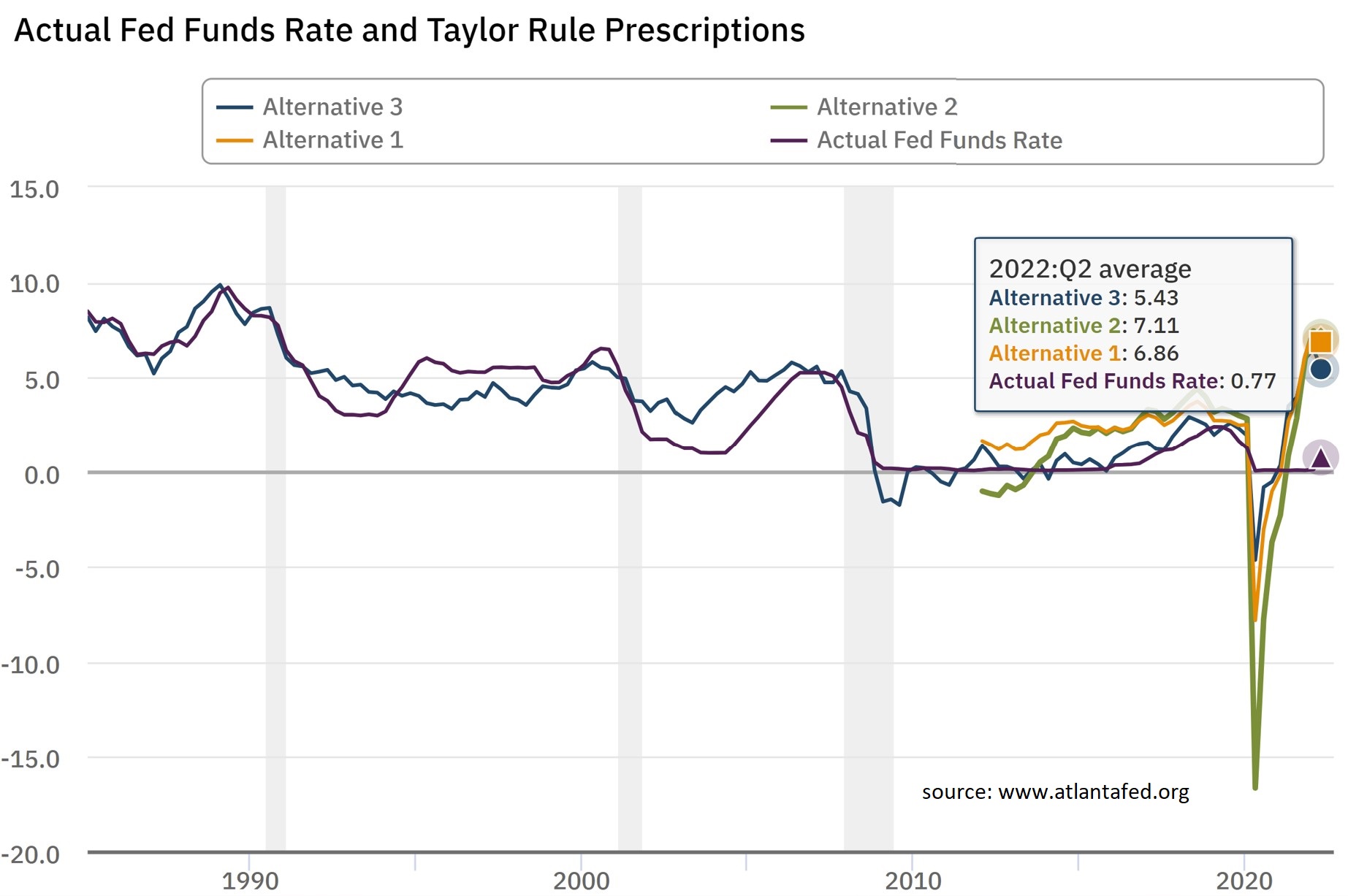

Each year the Kansas City branch of the Federal Reserve hosts a symposium in Jackson Hole, Wyoming. It’s a who’s who of economics, finance, and central banking. The world’s brain trust gathers to enjoy the bears, do some fishing, and see the natural beauty that accompanies any event with the Grand Tetons as a backdrop. In between sessions with the great outdo

Gyver or Gruber?

Submitted by Atlas Indicators Investment Advisors on July 28th, 2022The Trolley Rule

Submitted by Atlas Indicators Investment Advisors on July 28th, 2022

Technologist are busy creating machines capable of making human-like decisions in an instant. Self-driving cars are probably the most obvious example. In 2014 researchers at the MIT Media Lab introduced the Moral Machine, a website to crowdsource individuals’ decisions on how self-driving cars should prioritize lives in accident scenarios (e.g., how should it react when faced

All-Star Break

Submitted by Atlas Indicators Investment Advisors on July 28th, 2022Baseball season is about half way over with the All-Star Game taking place this coming Tuesday. Fans of the Los Angeles Dodgers have, thus far, been treated to a winning season. Of course, October is many months away, so it’s premature to call this year’s team champions. Contrarily, the calendar year is just beyond the half-way mark, and the Federal Reserve isn&rsq

Federal Reserve B.S.

Submitted by Atlas Indicators Investment Advisors on June 10th, 2022

When I learned to drive, I was taught two techniques help stop a car in a hurry: down shifting and pumping the brakes. It required an understanding of when to use the two together and also the finesse to pull it off efficiently. If I’m being honest, I don’t know if I could do it anymore. It’s been decades since I’ve owned a car with a manual transmissio

On the Q.T.

Submitted by Atlas Indicators Investment Advisors on May 6th, 2022

Shhhhhh…Did you hear that? Policy changes are afoot globally. Central banks around the world are quickly pivoting their positions on the global economy. It started Wednesday with America’s Federal Reserve. But then the Bank of England (BOE) got in on it yesterday. After years of supporting economic output by creating money, they are starting to reverse

Serving Two Masters

Submitted by Atlas Indicators Investment Advisors on April 22nd, 2022