Federal Reserve

Economic Coo

Submitted by Atlas Indicators Investment Advisors on June 12th, 2020

Mourning doves are found throughout America and have large populations in most places they reside. They are a hearty animal, capable of surviving in a variety of conditions, including summers in desert climates. As you know, deserts are challenging environments. Relative to other parts of earth, little grows here and that which does is highly adapted. For these birds to

Quantitative Pleasing

Submitted by Atlas Indicators Investment Advisors on December 12th, 2019

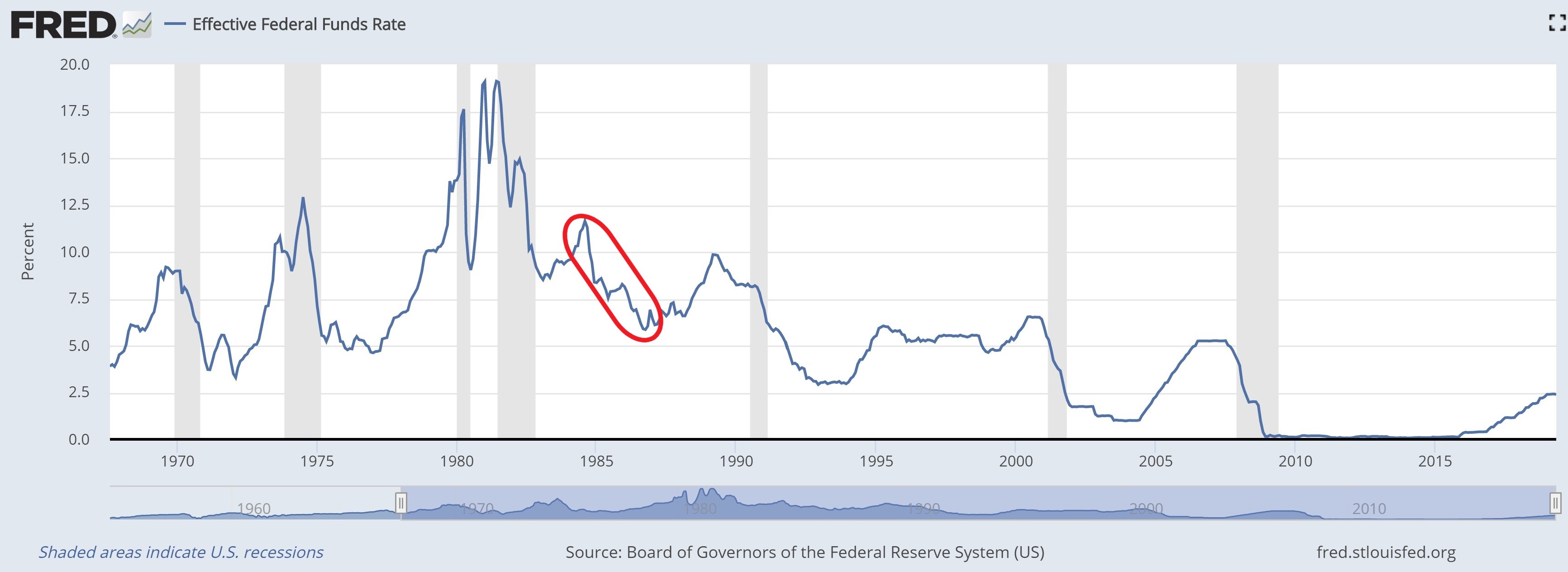

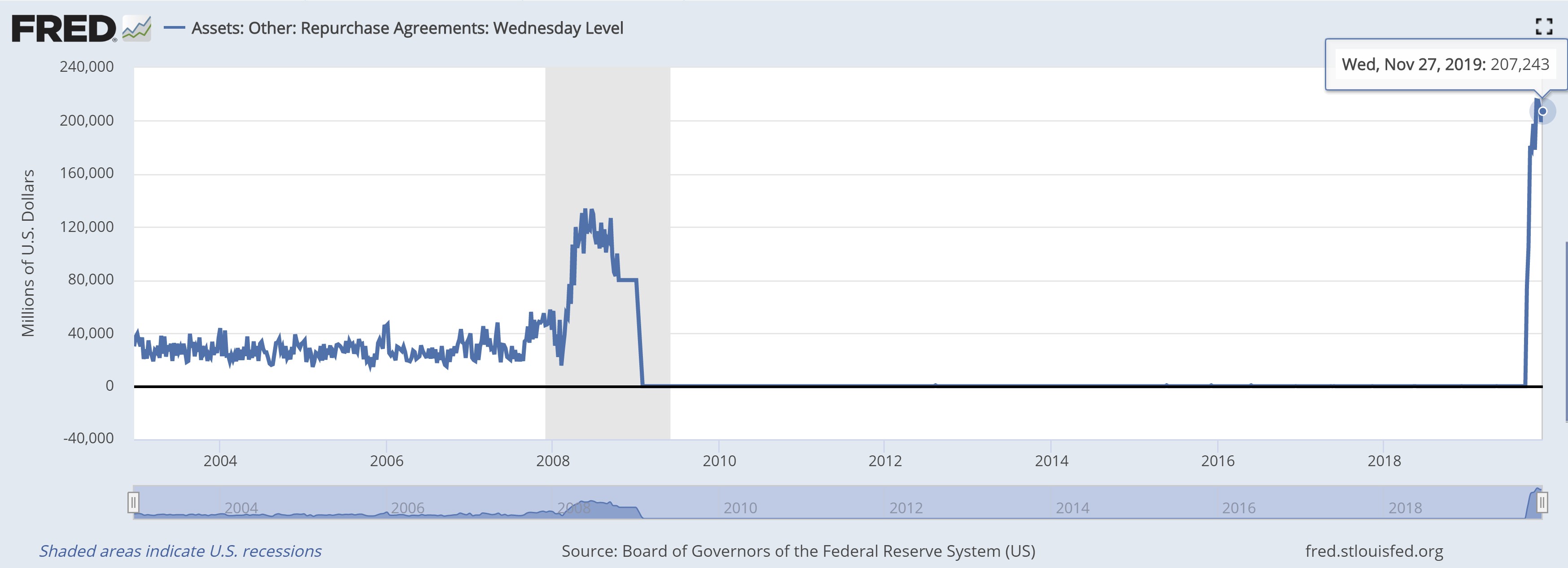

Last Friday we published this note about the recent disruption in the repurchase agreement (repo) market. This is a short-term lending resource for various financial institution (banks and non-banks alike) to borrow cash by temporarily selling high-quality assets and promising to buy them back

Wonderful Wizard of Wall Street

Submitted by Atlas Indicators Investment Advisors on December 5th, 2019

The Land of Oz was ruled by The Wizard of Oz in the children’s novel from 1900, The Wizard of Oz by L. Frank Baum. His subjects held the mysterious man in high regard. Dorothy and her friends even traveled to Emerald City, the capital of Oz, because they were certain he was the only person capable of solving their issues.

Automatic Sharing

Submitted by Atlas Indicators Investment Advisors on October 3rd, 2019

Our economy is currently in the middle of its longest economic expansion ever. Sometimes it’s tough to imagine the Great Recession ended over a decade ago or that the first recession of this century started over 18 years ago. During both downturns, output was in steep decline and firms were hemorrhaging jobs by the hundreds of thousands each week (e.g., in March 2009, the net

Repo Follow-up

Submitted by Atlas Indicators Investment Advisors on September 26th, 2019Just Say Negative

Submitted by Atlas Indicators Investment Advisors on August 22nd, 2019Slowbalized Output

Submitted by Atlas Indicators Investment Advisors on June 20th, 2019

Soft

Submitted by Atlas Indicators Investment Advisors on June 9th, 2019April 2019 Chicago Fed National Activity Index

Submitted by Atlas Indicators Investment Advisors on June 9th, 2019April 2019 Chicago Fed National Activity Index