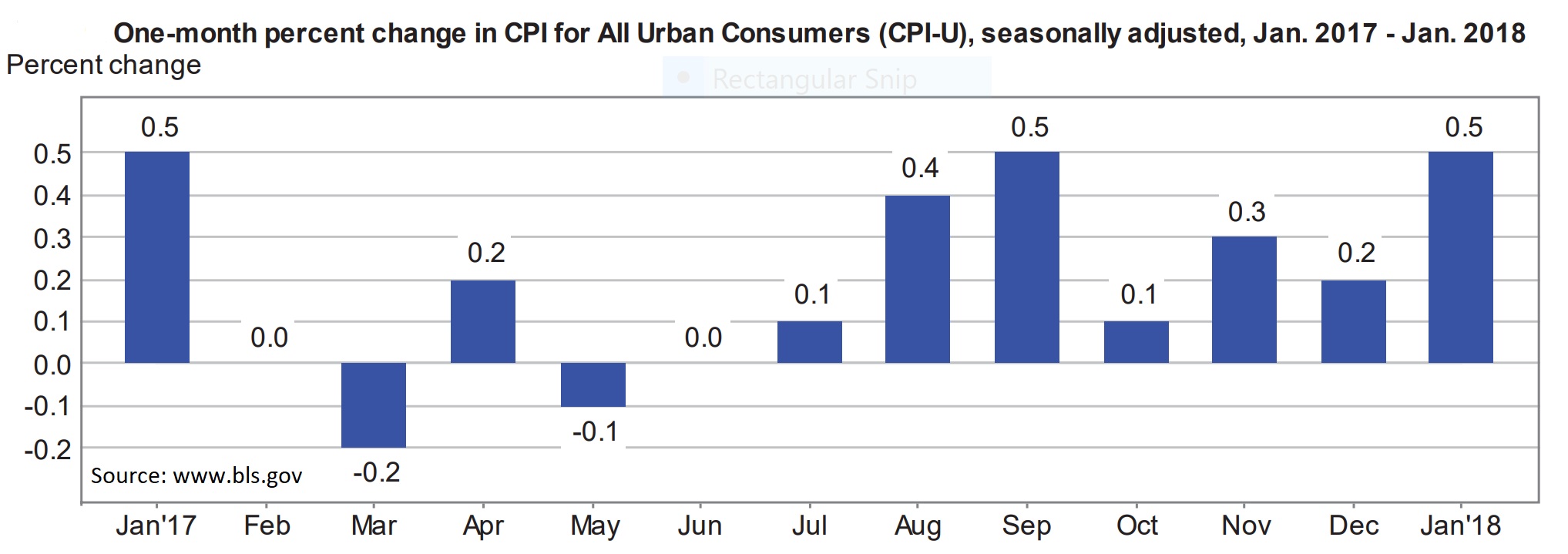

April 2018 Personal Consumption Expenditures

Submitted by Atlas Indicators Investment Advisors on June 14th, 2018

Incomes and outlays improved to start the second quarter of this year according to the Bureau of Economic Analysis. Personal income rose 0.3 percent in April 2018, and spending jumped 0.6 percent. Disposable personal income (DPI), aka after-tax pay, rose 0.4 percent or $60.9 billion, leading to some decay in the nation’s savings rate.