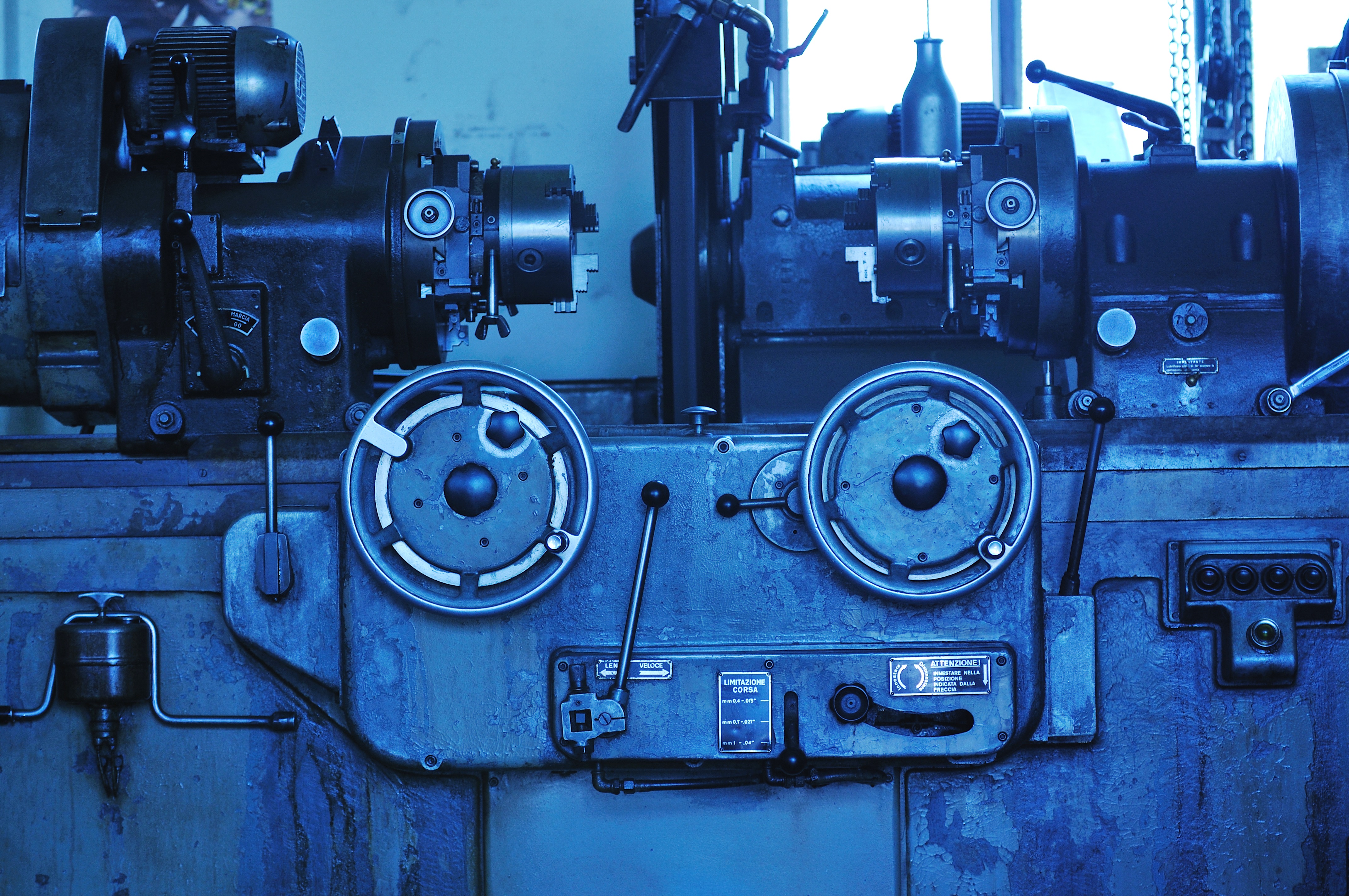

December 2017 Industrial Production

Submitted by Atlas Indicators Investment Advisors on January 24th, 2018America’s output of physically made goods improved 0.9 percent in December 2017 according to the Industrial Production figures from the Federal Reserve. This strong uptick followed the downwardly revised count of 0.1 percent in November (originally up 0.2 percent). Versus twelve months earlier, this indicator is 3.6 percent higher.