Soft

Submitted by Atlas Indicators Investment Advisors on June 9th, 2019

Soft is probably the best way to describe May’s employment report from the Bureau of Labor Statistics. As you may recall from yesterday’s note (click here if you missed it), America’s economy managed to increase the total number of jobs by just 75,000 in May. Adding to the angst of the release, the Bureau of Labor Statistics downwardly revised the prior two months’ gains by a combined 75,000. Not exactly the strongest release.

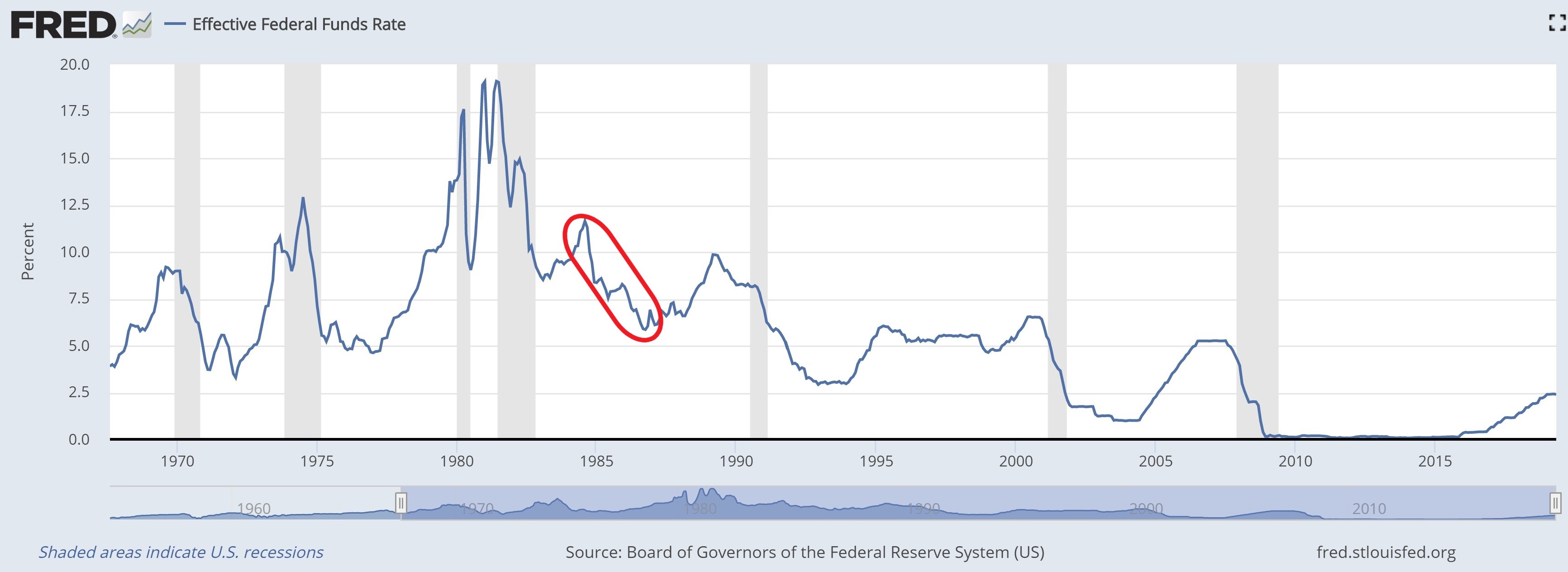

Despite the dour tone of the report, equity markets in the U.S. had a relatively good day on Friday. What gives? Perhaps more softness. As this year has worn on, market participants have been anticipating the Federal Reserve to jump into action. It seems global markets believe the soft labor report will give America’s central bank adequate cover to begin goosing the economy by lowering the overnight lending rate in the coming months. If this is done in a timely fashion, then the fine folks over at the Eccles Building in Washington D.C. could orchestrate the elusive “soft landing” which is a coveted goal of monetary policy makers around the globe anytime their respective economy begins deteriorating. In essence, they are attempting to prolong the virtuous period of the business cycle by stimulating output with less expensive borrowing.

Seems easy enough, right? If you look at the graph above, it has been tough for the Federal Reserve to time it correctly. In most instances, they begin lowering interest rates after the economy has started contracting. It appears they may have gotten it correct in early 1980s as they started lowering overnight lending rates from over 11 percent down to about six percent from September 1984 through September 1986 without a recession starting. But there haven’t been any other examples, so they have not mastered the technique if it exists. There’s no way of knowing how or when this cycle will end, but when it does, Atlas will use market indicators to help us navigate our managed portfolios through the period, removing risk when it appears necessary and waiting for the next upturn to begin.