Wonderful Wizard of Wall Street

Submitted by Atlas Indicators Investment Advisors on December 5th, 2019

The Land of Oz was ruled by The Wizard of Oz in the children’s novel from 1900, The Wizard of Oz by L. Frank Baum. His subjects held the mysterious man in high regard. Dorothy and her friends even traveled to Emerald City, the capital of Oz, because they were certain he was the only person capable of solving their issues.

America’s very own Empire City has a venerable wizard of sorts, a person upon which the financial markets rely to solve many of their issues. This person oversees the Federal Reserve from the Eccles Building in Washington D.C. During the Great Recession, Ben Bernanke was the great wizard, then Janet Yellen spent some time at the helm, and now Jerome Powell has the honor. Liquidity is often the magic concoction they use to cure what ails the market.

Recently, in September 2019, liquidity started to disappear from the marketplace. This phenomenon was a major talking point at our September Pie Party, and Chuck from PA recently wrote me an email asking for some follow-up on the topic. The lack of liquidity was demonstrated by surging interest rates (e.g. from around 2 percent to roughly 10 percent) in the repo market.

So what is the repo market and how does it work? Financial institutions participate in this particular market; you and I do not. In short, financial firm “A” temporarily buys an asset from financial institution “B” because “B” needs cash right away. Firm “B” also promises to repurchase the asset for slightly more (the interest rate) on a predetermined date. When no institutions are willing to buy the asset from “B,” “B” must sweeten the pot by offering to pay higher and higher interest rates. But when the rate starts to pinch, the Federal Reserve can step in and buy the short-term assets from firm “B,” providing the necessary liquidity.

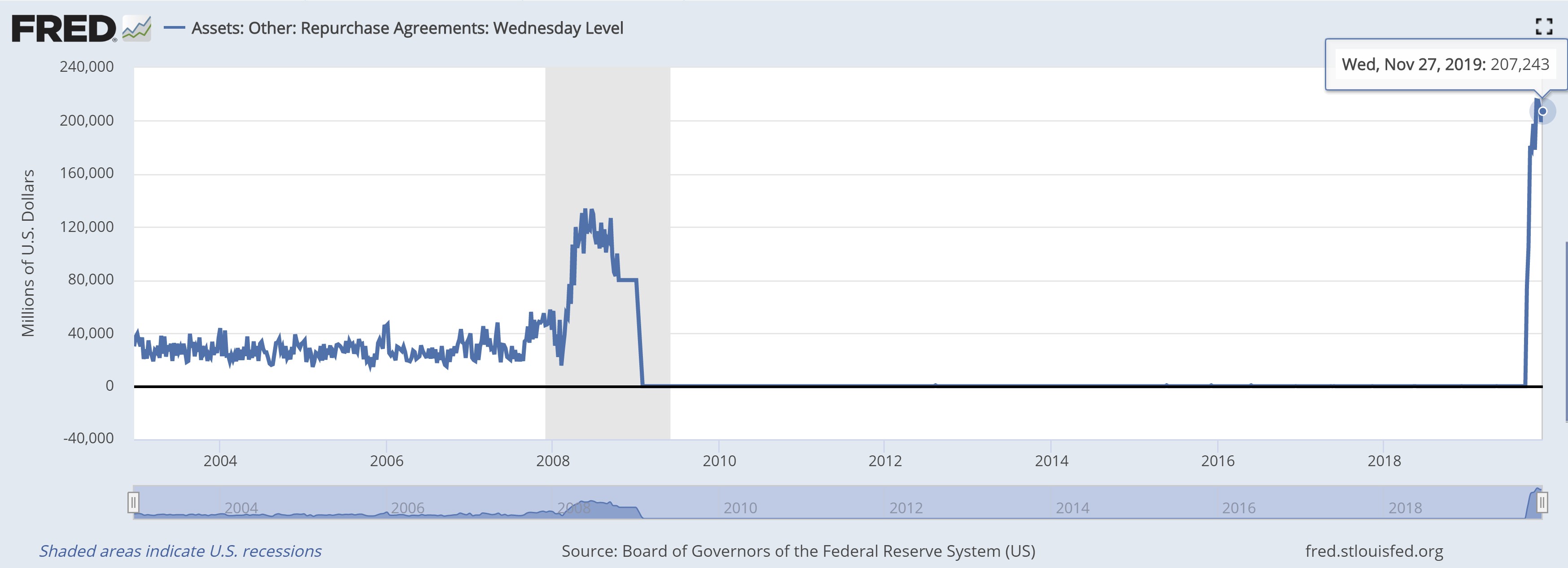

As you can see in the chart above, the Wall Street Wizards have been busy. After a very quiet period which started 10 years ago in the middle of the Great Recession, the Federal Reserve has begun to intervene big time. After the interest rate spike in September, according to the Federal Reserve, they have purchased $1.962 trillion from September 17th through November 27th. America’s central bank has been able to treat the symptom (soaring interest rates) but hasn’t been able to fix the cause: market illiquidity.

When the dust settled in Oz, we found out that the wizard was not as powerful as he’d have everyone believe. He used props and magic tricks, giving the illusion of sorcery. Pumping trillions of dollars of liquidity into this marketplace is far from a parlor trick, but it might not be a powerful enough solution to deal with whatever is taking away normal liquidity in this short-term segment of lending. More on that in a future blog.