Dark Friday

Submitted by Atlas Indicators Investment Advisors on December 22nd, 2022

Black Friday’s moniker is explained as the day when retailers go from being in the red for the year into positive earnings. Atlas won’t argue, but we cannot say for sure that this is still what happens. After your heart calms down from all the savings on Friday, you can hit Main Street America for Small Business Saturday. What a weekend. And then when you get back to the office, you can squander your workday with Cyber Monday. Finally, if you have anything left over, you can send it to your favorite nonprofit on Giving Tuesday. What a world.

And now it’s Friday again folks. The first one of December 2022 and just one removed from the post-Thanksgiving shopping bonanza. And while counting one’s blessings is something most do this time of year (Atlas certainly does), it’s also important that we take inventory of our current economic reality.

Early data suggest some growth on a year-over-year basis for both Black Friday and Cyber Monday spending (it’s tough to know how Saturday and Tuesday fared, but if you’ve seen any data on it, send it over). Black Friday sales gained 2.3 percent on a year-over-year basis. Similarly, Cyber Monday revenue grew 5.1 percent. That’s the good news. The bad news is that core inflation (it excludes food and energy) is up 6.3 percent according to the latest Consumer Price Index from the Bureau of Labor Statistics. If you subtract that out from those two sales-growth figures, you get a negative year-over-year tally.

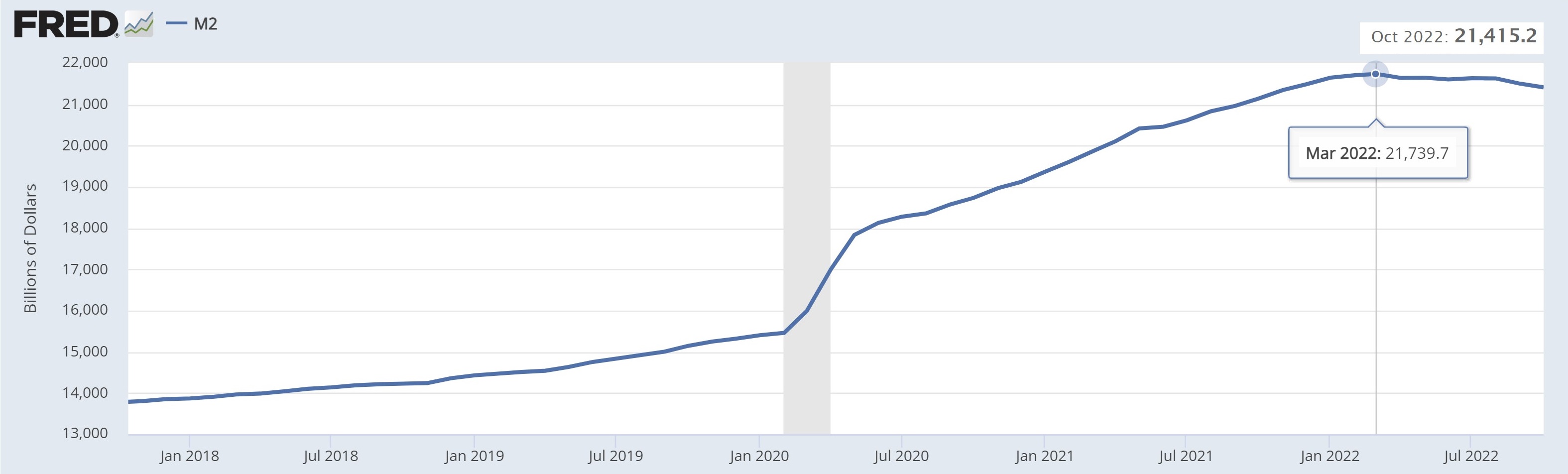

Looking forward, there isn’t a lot of positive news on the horizon just yet. Don’t worry, it will come as the economy is cyclical. But the Federal Reserve is trying to extinguish the flame of inflation and will likely do so at the expense of the economy. Take a look at the graph above. It is a measure of America’s money supply known as M2, a measure of the U.S. money stock that includes M1 (currency and coins held by the non-bank public, checkable deposits, and travelers' checks) plus savings deposits (including money market deposit accounts), small time deposits under $100,000, and shares in retail money market mutual funds. It peaked in March of this year. While the rounded pattern may not look very ominous, it matters to an economy which runs on consumption because it is means less money is sloshing around in the system, making it marginally harder for people to access cash to spend. Additionally, America’s consumer base has already slowed its savings rate to the lowest level since right before the Great Recession (November 2007), so their ability to buttress spending without using credit could be compromised.

America will bounce back from this. Our nation has gone through 12 recessions since the end of WWII. And technically, we don’t even know if we will reach one in the coming quarters, but the probability seems rather high. If we do enter a period of contraction, know that the other side has tended to bring years of prosperity after a relatively short period of darkness.