Inflation

Wheat’s Eating You!

Submitted by Atlas Indicators Investment Advisors on March 30th, 2022MOM and POP Inflation Cycle

Submitted by Atlas Indicators Investment Advisors on December 31st, 2021

Inflation is up. Since the beginning of this century, price appreciations have been relatively modest. That isn’t to say America hasn’t experienced inflation, we have. But under the watch of Federal Reserve Chairs Alan Greenspan, Ben Bernanke, Janet Yellen, and most of Jerome Powell’s first term, price gains were measured. In fact, some argue that the F

Sweet Cola 2022

Submitted by Atlas Indicators Investment Advisors on August 20th, 2021

Some of the best laid plans develop crimps. Take the Kinks and their song Lola for instance. They recorded the song in 1970 (it became one of their most famous songs) but needed to re-record it in order to get airplay on the United Kingdom’s BBC. You see, broadcasting is different in the UK. The nat

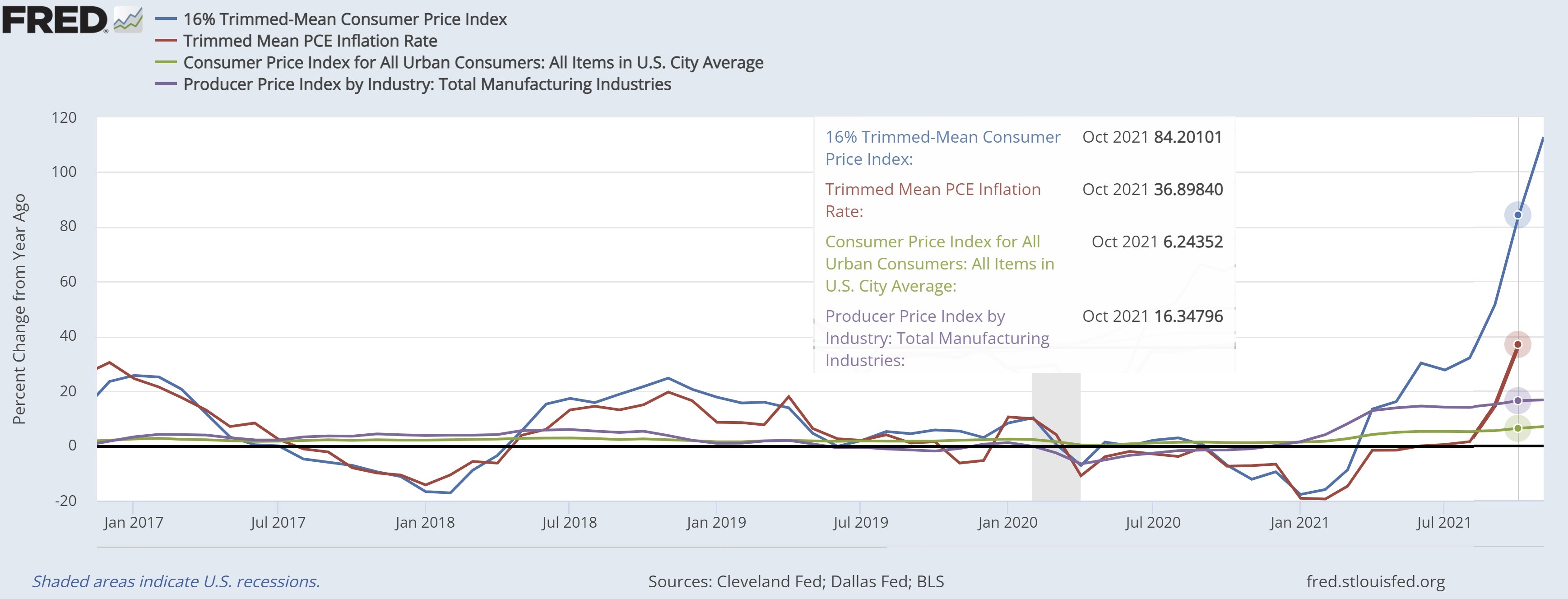

Percolating Price Pressures

Submitted by Atlas Indicators Investment Advisors on June 4th, 2021

We all know how important energy is to the modern world. We’ve recently had a couple of instances demonstrate how messed up things can get when its supply is interrupted. First was that freakish weather pattern which blanketed much of the nation in February as the Polar Vortex dipped lower than normal, pushing the power grid to the brink of failure in many areas. Simulta

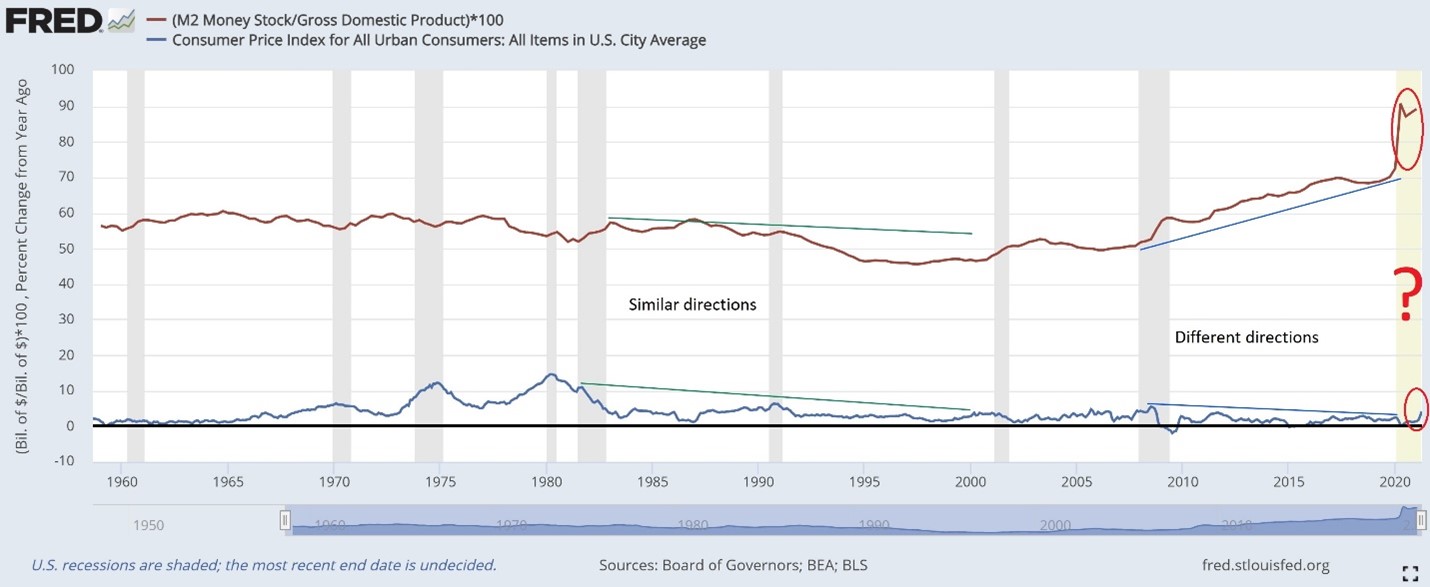

Classic Relationships

Submitted by Atlas Indicators Investment Advisors on May 28th, 2021

Classic relationships can be so romantic. They can even inform our own ideas about the successfulness of our pairings. Take Ethel and Fred Mertz. I know Lucy and Ricky are the main characters, but their neighbors really crack me up. Like Fred, I can’t tell you how many times I’ve looked for the price tag on some item my wife wants to get rid of because I thin

Unexpected And Pernicious

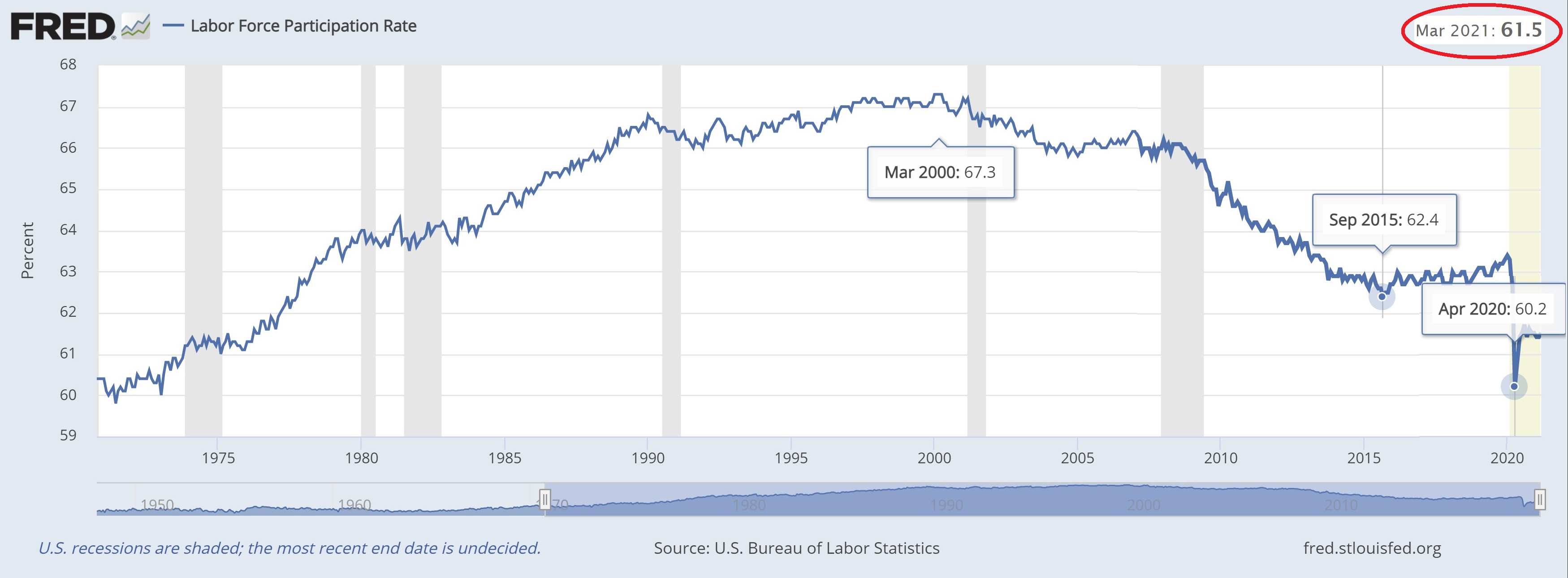

Submitted by Atlas Indicators Investment Advisors on May 24th, 2021Where Are They?

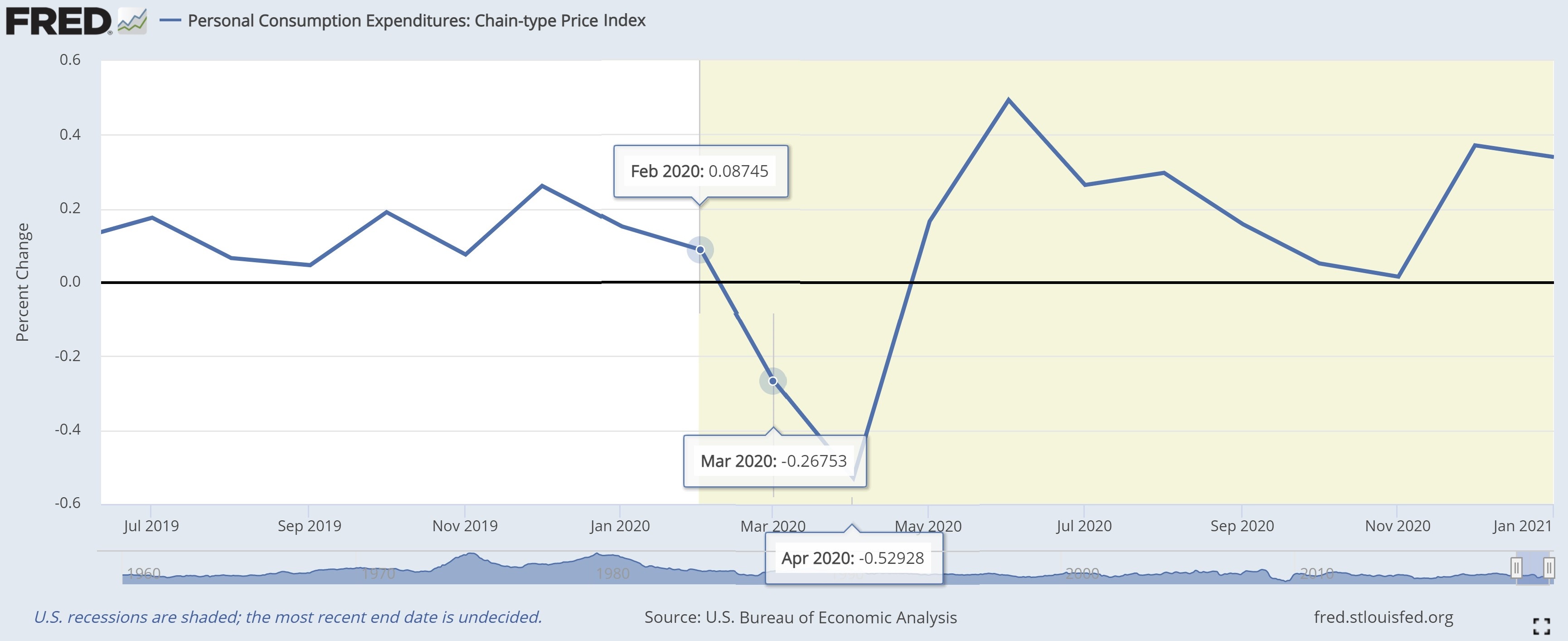

Submitted by Atlas Indicators Investment Advisors on April 15th, 2021All About That “Base”

Submitted by Atlas Indicators Investment Advisors on March 5th, 2021- « first

- ‹ previous

- 1

- 2

- 3

- 4