MOM and POP Inflation Cycle

Submitted by Atlas Indicators Investment Advisors on December 31st, 2021

Inflation is up. Since the beginning of this century, price appreciations have been relatively modest. That isn’t to say America hasn’t experienced inflation, we have. But under the watch of Federal Reserve Chairs Alan Greenspan, Ben Bernanke, Janet Yellen, and most of Jerome Powell’s first term, price gains were measured. In fact, some argue that the Fed was unable to produce the amount of inflation for which it was hoping. At least for now, that has changed. Welcome to the MoM and pop era.

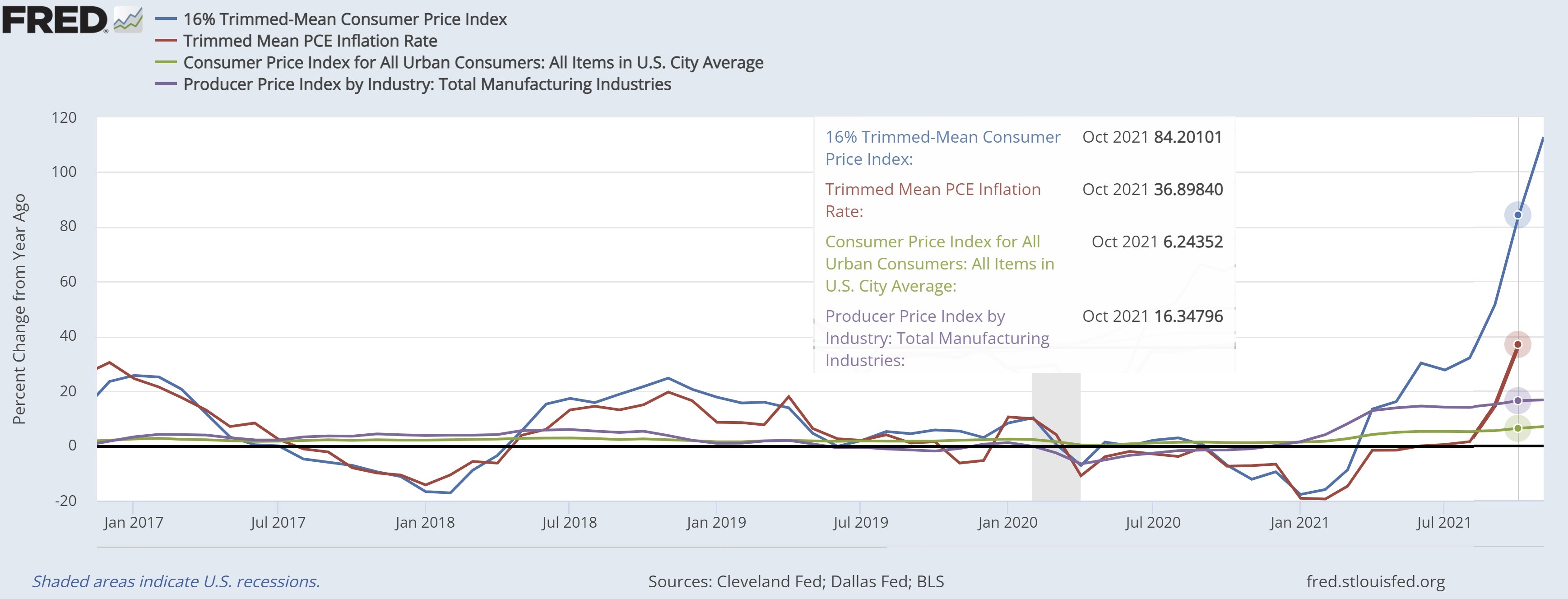

Inflation gets measured a variety of ways. Take a look at the Consumer Price Index (CPI) which we wrote about yesterday; it measures a fixed basket of goods each month. And then there is the Producer Price Index (our note on it will be in your inbox next week) which measures price inputs for producers and wholesalers at various stages of output. Separate Federal Reserve branches offer inflation measures, each with their unique approach to quantifying costs. And, oh yeah, there’s the Personal Consumption Expenditure Price Index from the BLS, a subset of which is thought to be the central bank’s favorite price proxy.

No matter how you slice it, they are all mom and popping. Month-over-month (mom) statistics have caused a lot of pop, like a bright flower against a dark background. CPI reached levels not seen since June 1982. Remember which movie came out that month? E.T. It became the first movie to have four weekends with gross revenue over $10 million. Of course, times were different then. The federal government was paying double digit coupons to borrow money, demographics were favorable, and the global supply chain wasn’t nearly as interconnected yet.

It’s tough to know exactly how this mom-and-pop era will play out. Atlas looks to the yields on government bonds and finds some comfort that this marketplace isn’t demanding higher coupons. It suggests that participants haven’t yet concluded that accelerating inflation is here to stay. An aging population in many developed countries could be exerting downward price pressure as their consumption profile changes. Of course, this influence is likely at least partially offset by new money created during the past couple of years in response to the economic fallout of the pandemic. This growing money supply along with some onshoring of our nation’s supply chain should theoretically push inflation higher, all else constant. More time and space is being dedicated to inflation in the news cycle, something Atlas views as a contrarian point. How it all shakes out is to be determined but don’t be surprised if month-over-month figures start weakening and pop now that all this attention has been paid.