Where Are They?

Submitted by Atlas Indicators Investment Advisors on April 15th, 2021

Economic indicators are heating up. Earlier this week we got data on inflation and retail sales (Atlas will have more on those later) which were strong. Weeks ago, we warned readers of this phenomenon in this note. In short, comparing today’s economy to one which has been forced into shutdown in response to a global pandemic makes it easy for indicators to appear strong.

Labor market indicators aren’t immune from this experience either. Firms are bringing on new employees quickly as the economy continues reopening. Hospitality and leisure firms are working rapidly to serve as many customers as possible to stave off their own demise. This takes employees, so there was a hiring surge in March which was reflected in the latest employment report from the Bureau of Labor Statistics. As you may recall, the unemployment rate reached 14.8 percent a year ago and now stands at 6.0 percent, demonstrating the marked improvement since the depths of the recession.

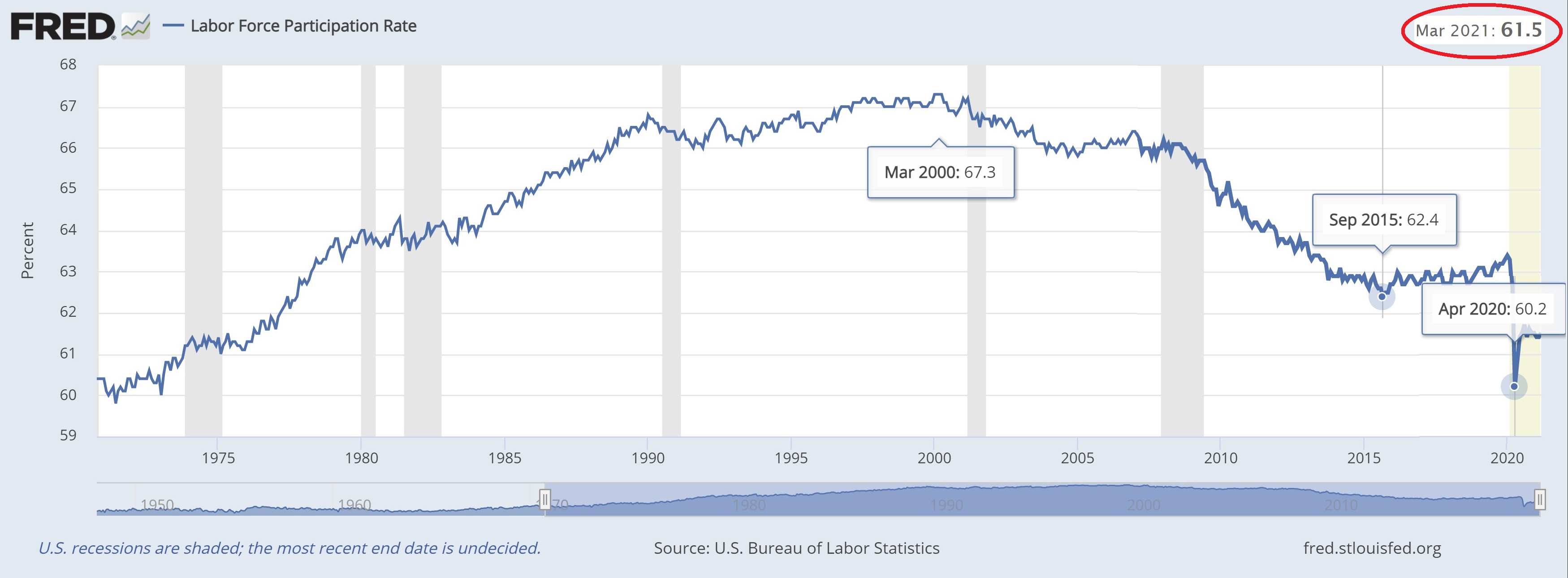

There is, however, one statistic we didn’t touch on in our note to you on the employment report: the participation rate. It tells us what proportion of the entire “working age” population is actually employed or looking for work. Because this statistic includes folks who have given up looking for a job, it might give us a better insight into the health of the labor economy. As you can see in the chart above, this statistic peaked for three months in 2000 at 67.3 percent, it bottomed in September 2015, and rose gradually until the pandemic hit. Since the April 2020 low of 60.2, it has made back some ground but has a way to go before meeting back up with the previously rising trend.

Atlas brings this to your attention today because it might answer why the Federal Reserve has been so relaxed about inflation even though some of the fiscal and monetary supports have been heroic relative to previous recessions. First, inflation data are starting to suffer from the base effects in their year-ago comparisons, so they could begin overstating the trend in prices. Secondly, until more people actually participate in the labor force again, those not working will offset some of the inflationary pressures caused by stimulus packages. For now, inflation worries by monetary officials are difficult to find. These concerns might be hiding with working age adults who aren’t participating in the labor market.