January 2020

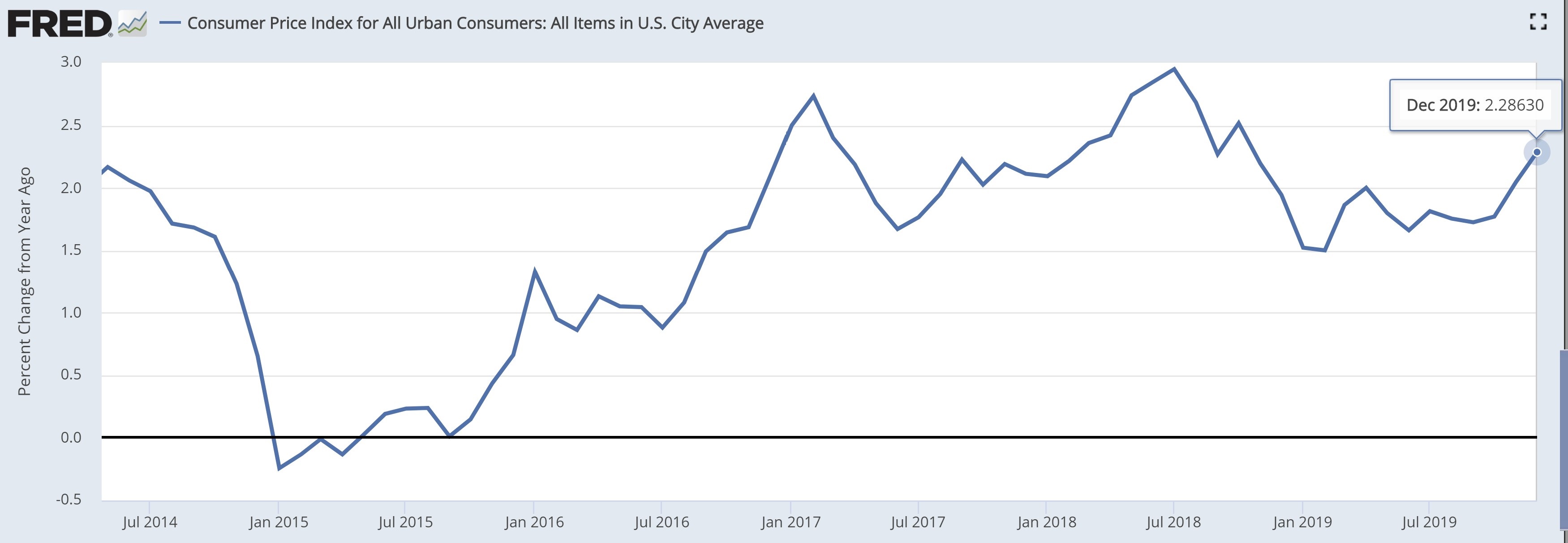

December 2019 Consumer Price Index

Submitted by Atlas Indicators Investment Advisors on January 23rd, 2020

Prices continued rising at a moderate pace in December 2019 according to the Bureau of Labor Statistics. Their Consumer Price Index rose 0.2 percent in the final 31 days of the decade. This final uptick helped push the year-over-year tally to 2.3 percent which is faster than the 1.9 percent rate of change in 2018.

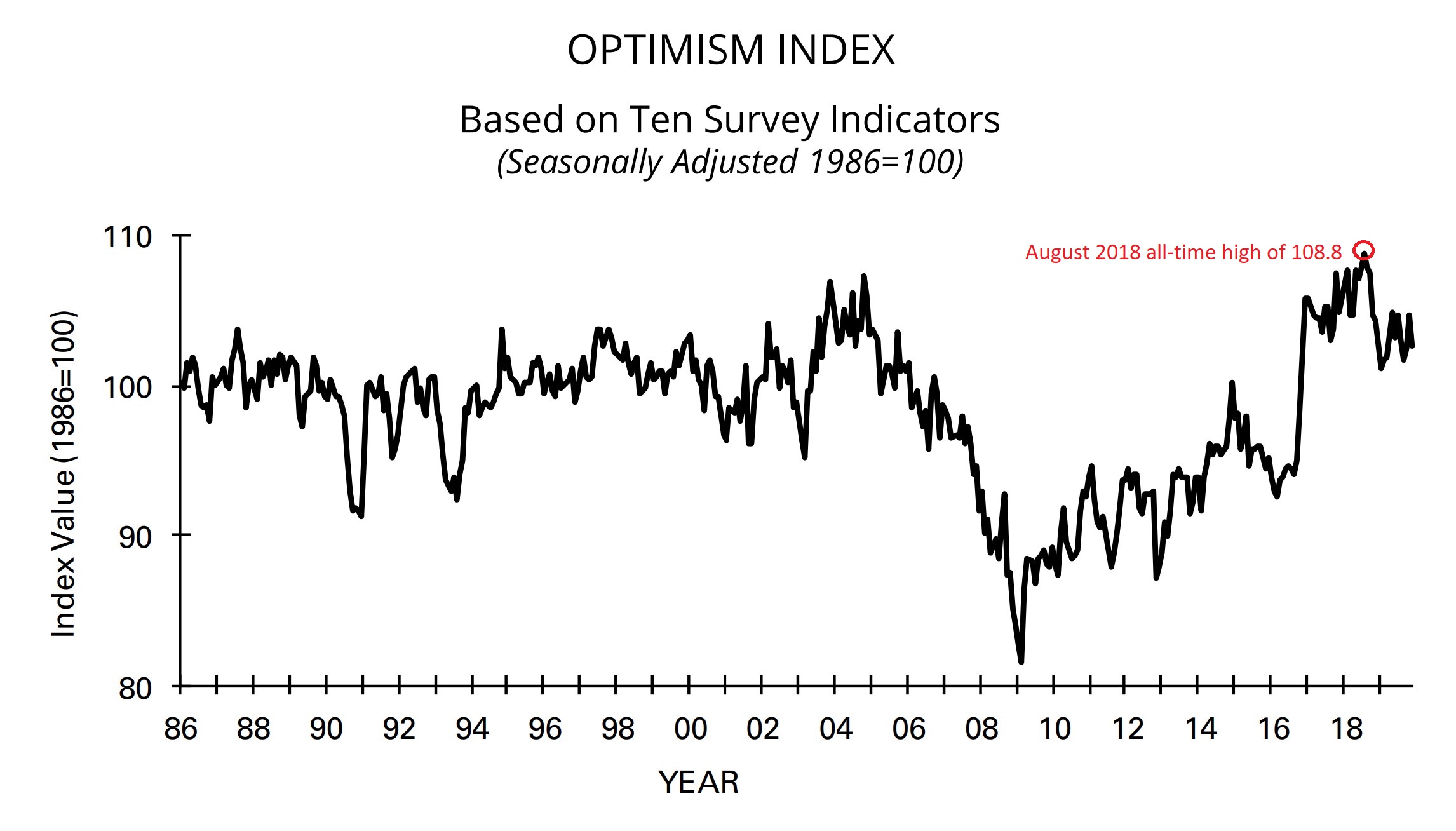

December 2019 National Federation of Independent Business

Submitted by Atlas Indicators Investment Advisors on January 23rd, 2020

Small business confidence remains high by longer-term standards but has been waning relative to its all-time high. The National Federation of Independent Business’ Optimism Index declined two points in December 2019 to 102.7 after rising 2.3 points in November. Despite all the recent gyrations, this index has moved very little over the past three years.

December 2019 Employment Situation

Submitted by Atlas Indicators Investment Advisors on January 23rd, 2020

America’s labor situation has been one of the economy’s highlights since it began recovering after the Great Recession. Last year (2019) ended the decade by adding 2.11 million net new jobs, including December’s uptick of 145,000 according the Bureau of Labor Statistics (BLS). The unemployment rate held steady at 3.5 percent.

McManipulator

Submitted by Atlas Indicators Investment Advisors on January 17th, 2020

America’s Treasury Department removed the designation of currency manipulator from China five months after the moniker was given. This seems reasonable since the two countries were in the process of negotiating the now-signed “phase one” portion of a larger trade agreement. Pejorative monikers probably don’t make deliberations easier.

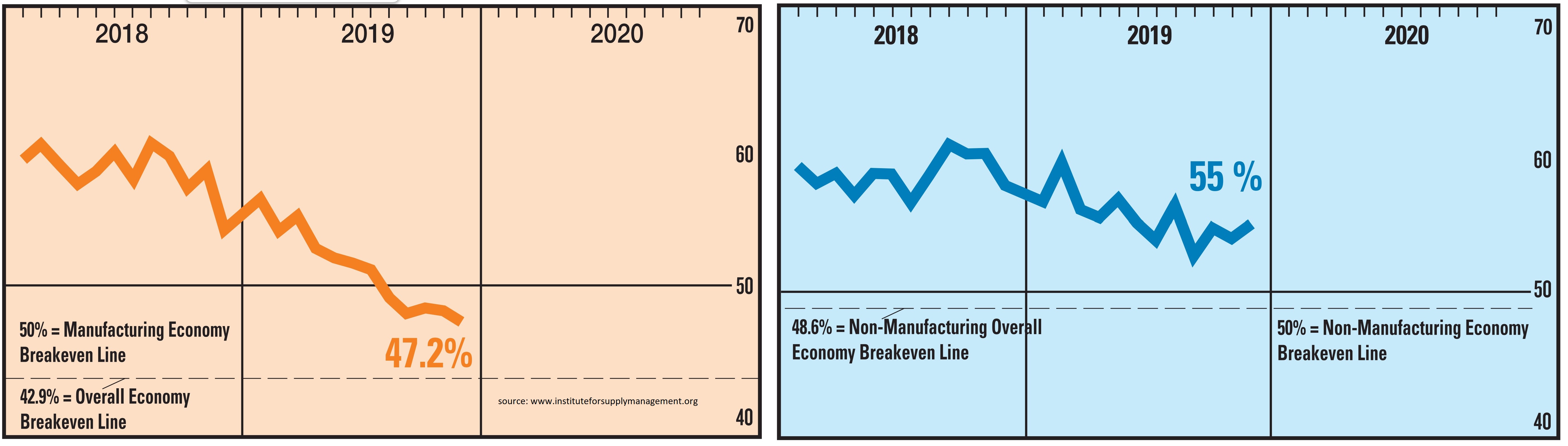

December 2019 Institute for Supply Management

Submitted by Atlas Indicators Investment Advisors on January 17th, 2020November 2019 Balance of Trade

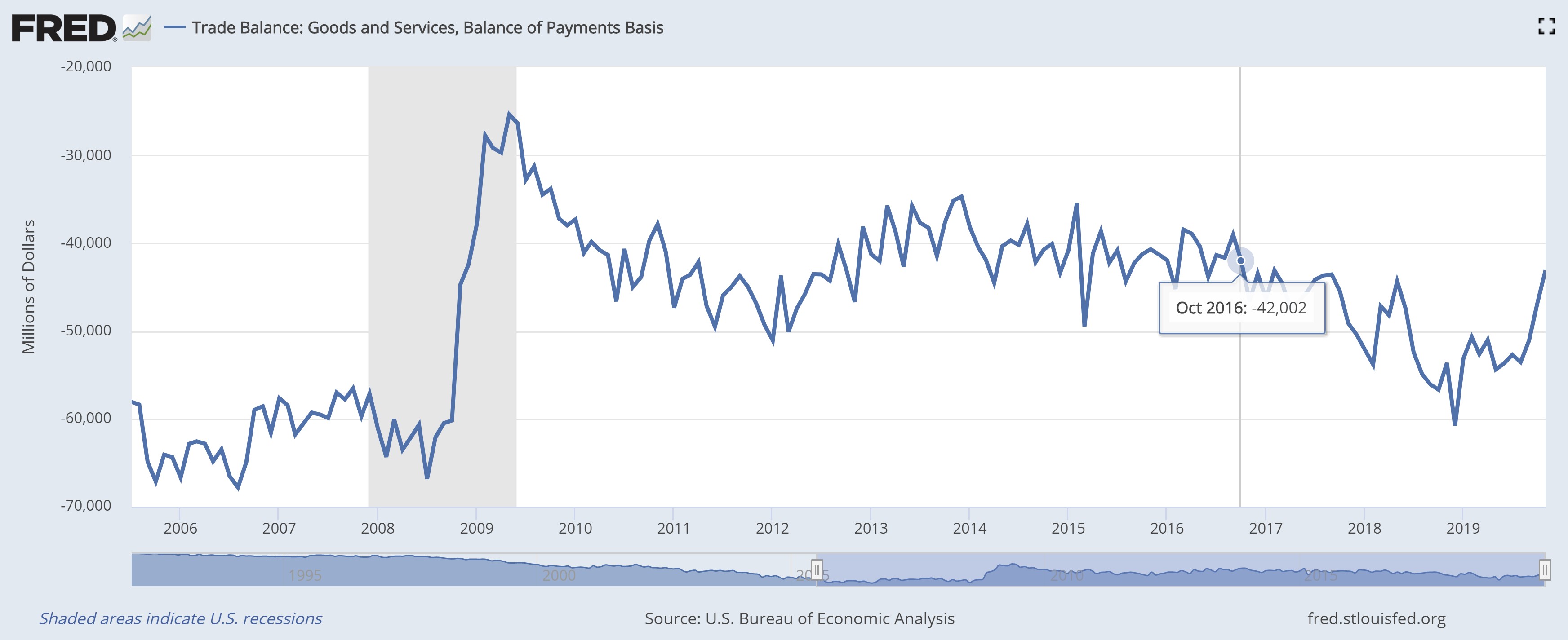

Submitted by Atlas Indicators Investment Advisors on January 17th, 2020

America’s trade balance improved in November 2019 according to data from the Bureau of Economic Analysis. The nation’s deficit improved to $43.1 billion from the upwardly revised count of $46.9 billion (originally $47.2 billion). In short, both sides of the ledger improved for America as imports fell while exports increased.

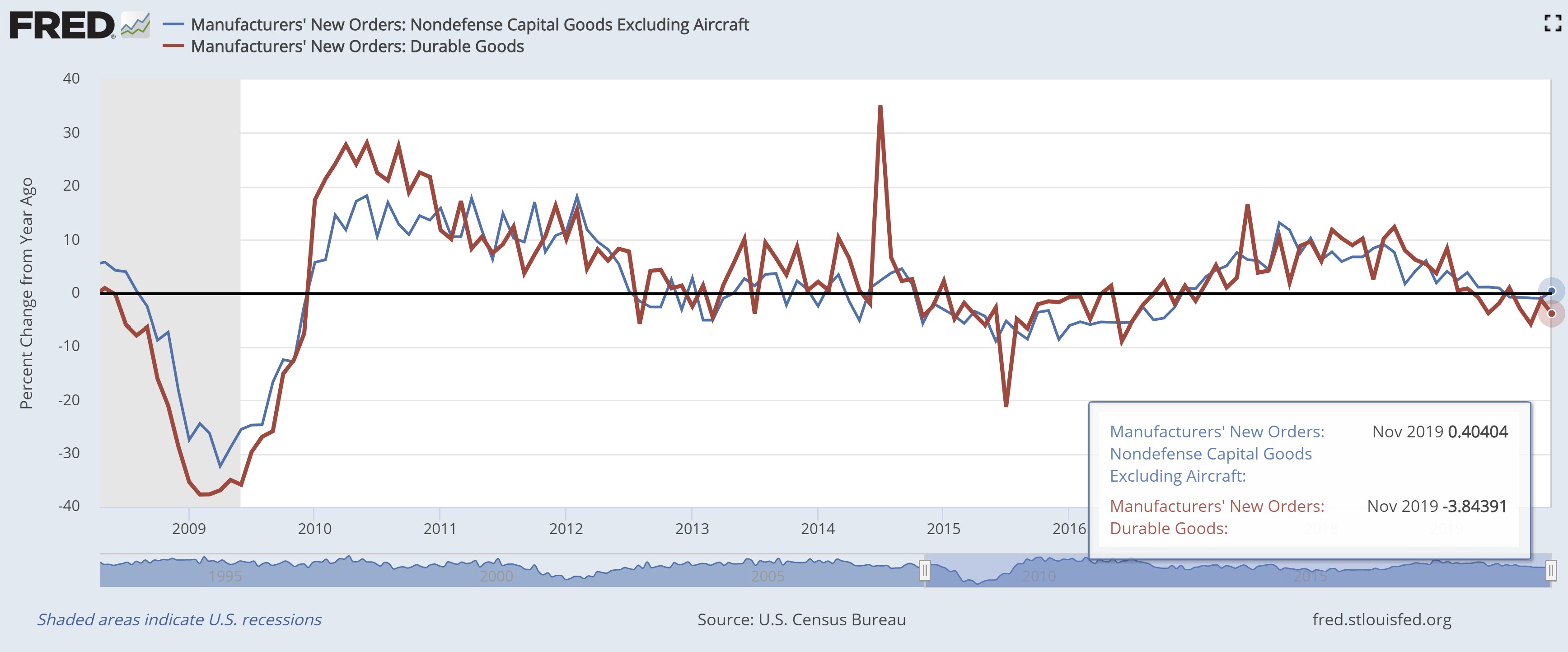

Durable Goods Orders November 2019

Submitted by Atlas Indicators Investment Advisors on January 17th, 2020

Durable Goods Orders declined in November 2019 according to the Census Bureau. This measure for orders of wares expected to last three years or longer fell 2.0 percent in the month alone. Year-over-year, the tally is even worse, down 3.8 percent. Ouch! However, it isn’t as bad as the headline suggests.

November 2019 New Home Sales

Submitted by Atlas Indicators Investment Advisors on January 17th, 2020

Sales of new homes improved 1.3 percent to 719,000 units on a seasonally adjusted annualized basis in November 2019 according to the Census Bureau. However, the uptick did require one caveat, a 23,000 unit downward revision to October’s tally to 710,000. Year-over-year, transactions are up 16.9 percent.

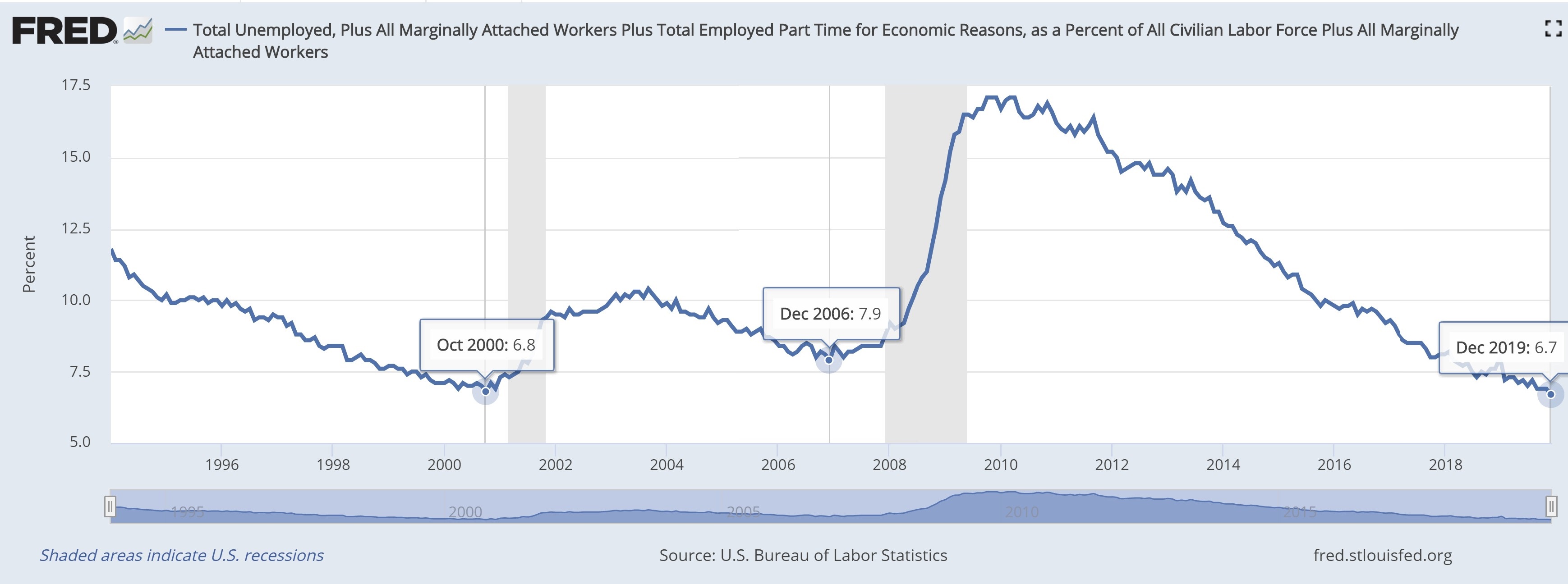

Alternative Employment Stats

Submitted by Atlas Indicators Investment Advisors on January 9th, 2020Before we get the final job report from the Bureau of Labor Statistics (BLS) for last decade (it’ll be out at 5:30 AM in California), let’s look at a survey the New York Federal Reserve does every four months which also sheds light on employment. Their Survey of Consumer Expectations (SCE) includes questions about job searches, annual income, labor force longevity, and what it

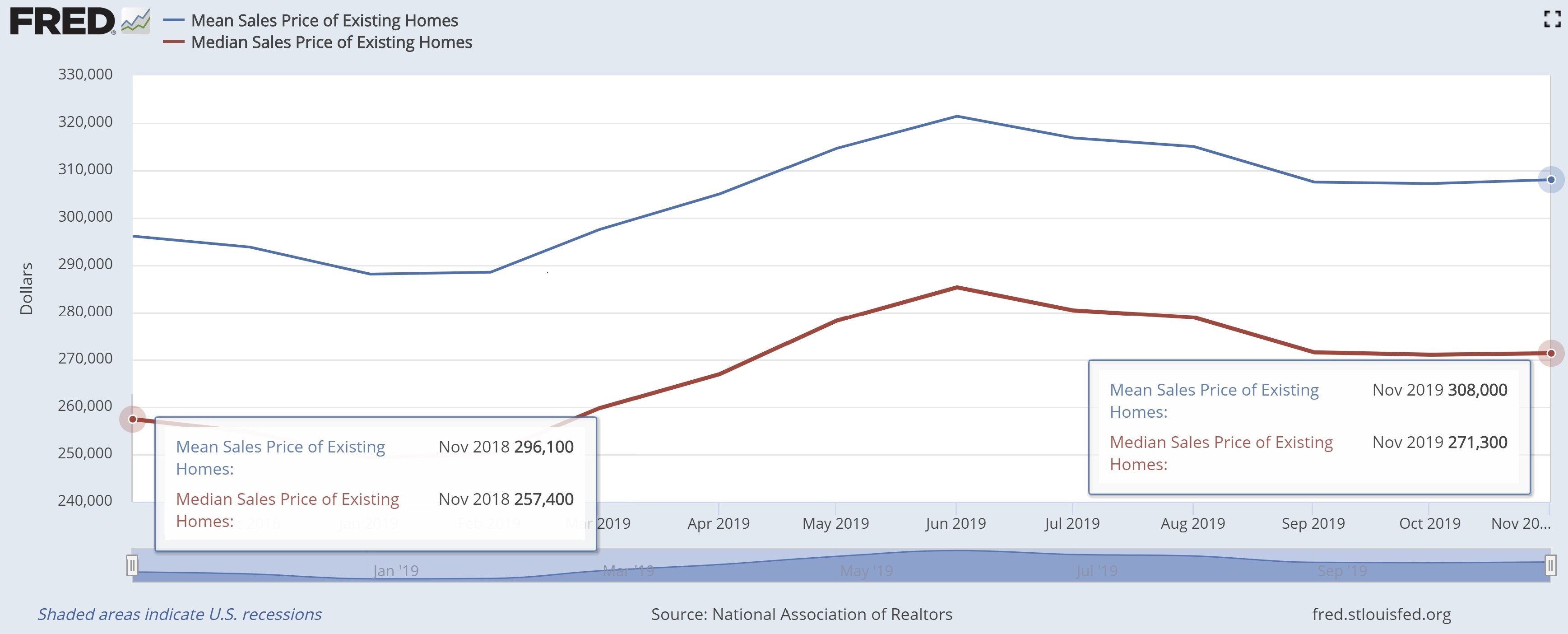

November 2019 Existing Home Sales

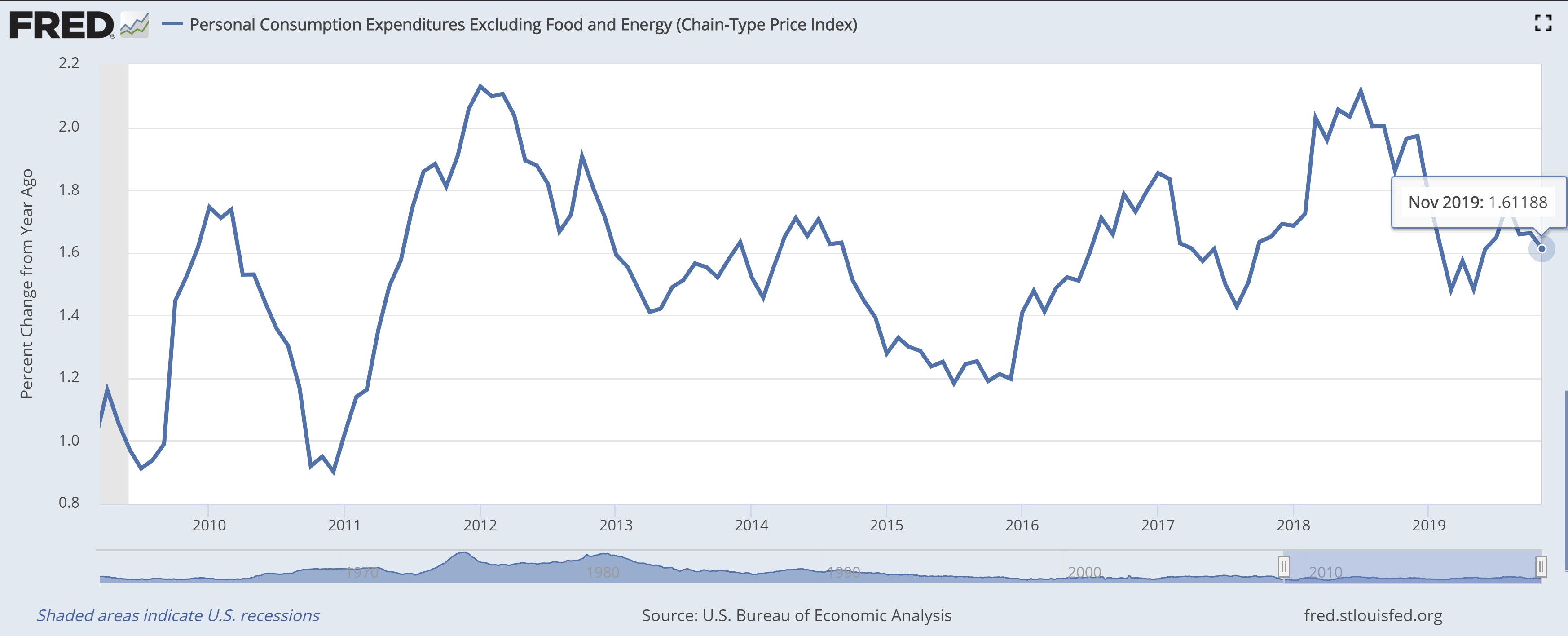

Submitted by Atlas Indicators Investment Advisors on January 9th, 2020November 2019 Income and Outlays

Submitted by Atlas Indicators Investment Advisors on January 9th, 2020

Income and outlays improved in November 2019 according to the Bureau of Economic Analysis. The headline count for income gained 0.5 percent. Similarly, disposable income (after-tax income) was also up 0.5 percent. Further, inflation adjusted income gained 0.4 percent. No matter how you dice it, Americans had more money to spend. And their spending increased.

- 1 of 2

- ››