December 2019 Institute for Supply Management

Submitted by Atlas Indicators Investment Advisors on January 17th, 2020

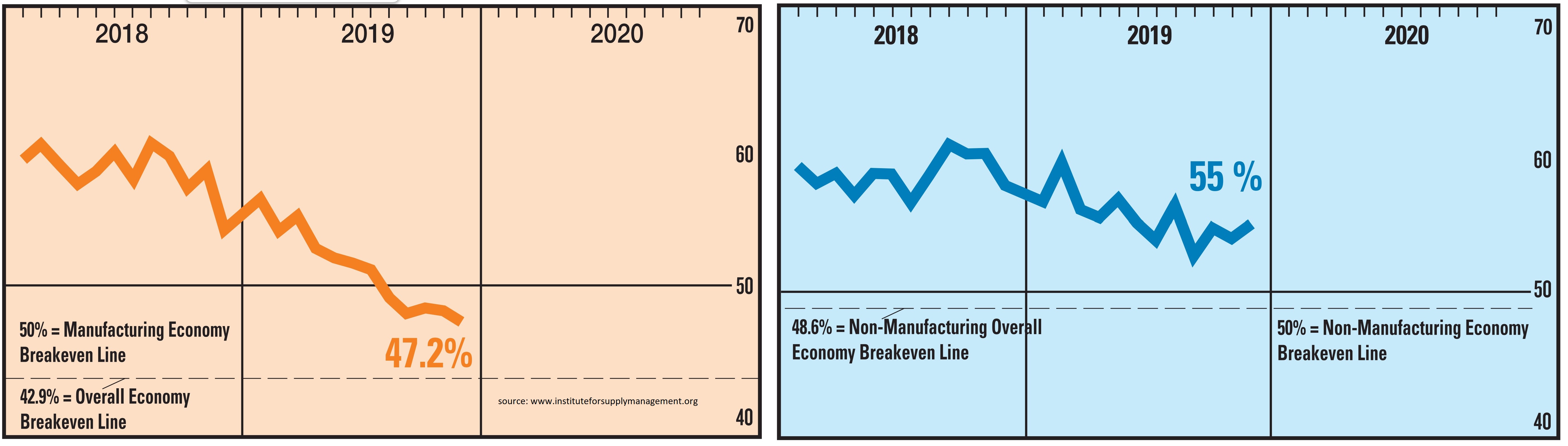

America’s economy continued its recent bifurcation in December 2019 according to data from the Institute for Supply Management. Their two readings on output continue to suggest a split. Manufacturing data suggest further contraction in this cyclically sensitive portion of the economy. Meanwhile, nonmanufacturing data, which represents a larger portion of America’s output, points to further expansion.

These are diffusion indices which, in short, means any reading below 50.0 means contraction. Manufacturing’s reading of 47.2 is 0.9 percentage point worse than November, suggesting an accelerating decline. It also happens to be the fifth consecutive reading of decreasing output. Production took a real hit, falling 5.9 percentage points to just 43.2 which does not bode well for fourth quarter gross domestic product. Additionally, the forward-looking segment, new orders, also slipped further (46.8 versus 47.2), which could bleed into production numbers in the months ahead. While it cooled on this side of the economy, things were far from dour on the services portion of output.

Growth for the headline figure looked good for the services/nonmanufacturing part of the economy. This tally gained 1.1 percentage points to 55.0, suggesting economic acceleration. Production gained a whopping 5.6 percentage points to 57.2 and kept its winning streak alive, now at 125 consecutive months. However, new orders slowed some, dipping to 54.9 from 57.1. This development only points to decelerating order growth, not contraction, so output growth should continue for the foreseeable future.

America’s economy appears to be fine. Output is growing in the larger of the two segments. Admittedly, the contracting manufacturing data is concerning, but other indicators are not confirming this decline, so no alarms are being set off just yet. Atlas will continue to monitor this and other manufacturing-related datapoints, but for now it looks as if the overall economy’s trajectory remains positive.