November 2019 Existing Home Sales

Submitted by Atlas Indicators Investment Advisors on January 9th, 2020

According to the National Association of Realtors, existing home sales suffered a minor setback in November 2019. Completed transactions fell 1.7 percent. Suffering along with the monthly statistic, the year-over-year tally slowed to just 2.7 percent compared to 4.6 percent as recently as October.

Regional data were mixed but skewed lower for the two largest regions. Existing-home sales improved most in the Midwest with a 2.3 percent uptick and are 1.5 percent higher than in November 2018. Transactions in the Northeast were positive as well, rising 1.4 percent, but this portion of the nation is off 1.4 percent from a year ago. Unfortunately, sales declined 3.5 percent in the West but were 4.8 percent higher in the past twelve months. Finally, sales soured in the South, sinking 3.9 percent, and this region’s year-over-year tally slowed to 3.7 percent from 7.8 percent a month earlier.

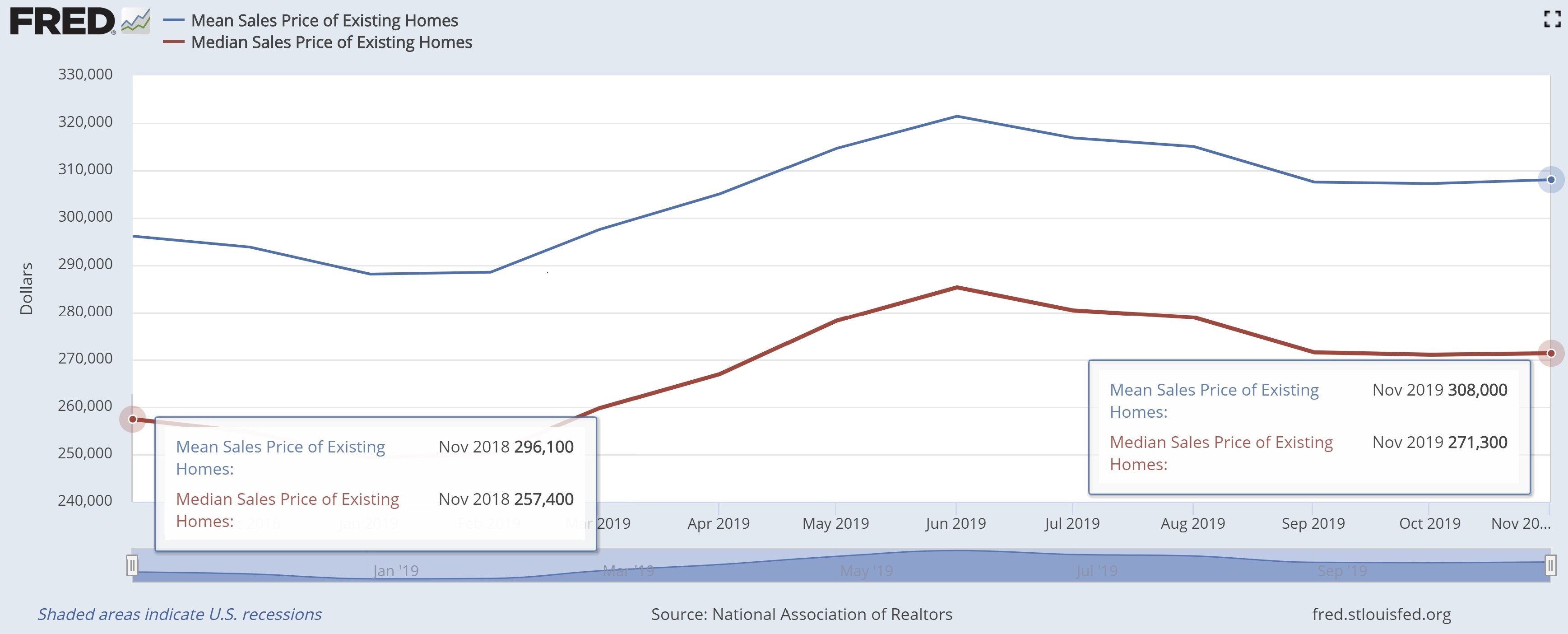

Price proxies were relatively steady. An average priced home set the buyers back $308,000 or $800.00 more than in October and $500 more than in September; it is $11,900 greater than a year earlier. The median price did about the same, rising marginally to $271,300, an uptick of $300.00; this statistic is up $13,900 compared to November 2018.

Notwithstanding the setback to monthly transactions, America’s economy remains poised to continue supporting the housing market. Labor conditions are healthy and improving (i.e., the employment rate is high, and wages are rising). Additionally, interest rates are low, allowing borrowers to afford higher priced homes.