December 2019 Consumer Price Index

Submitted by Atlas Indicators Investment Advisors on January 23rd, 2020

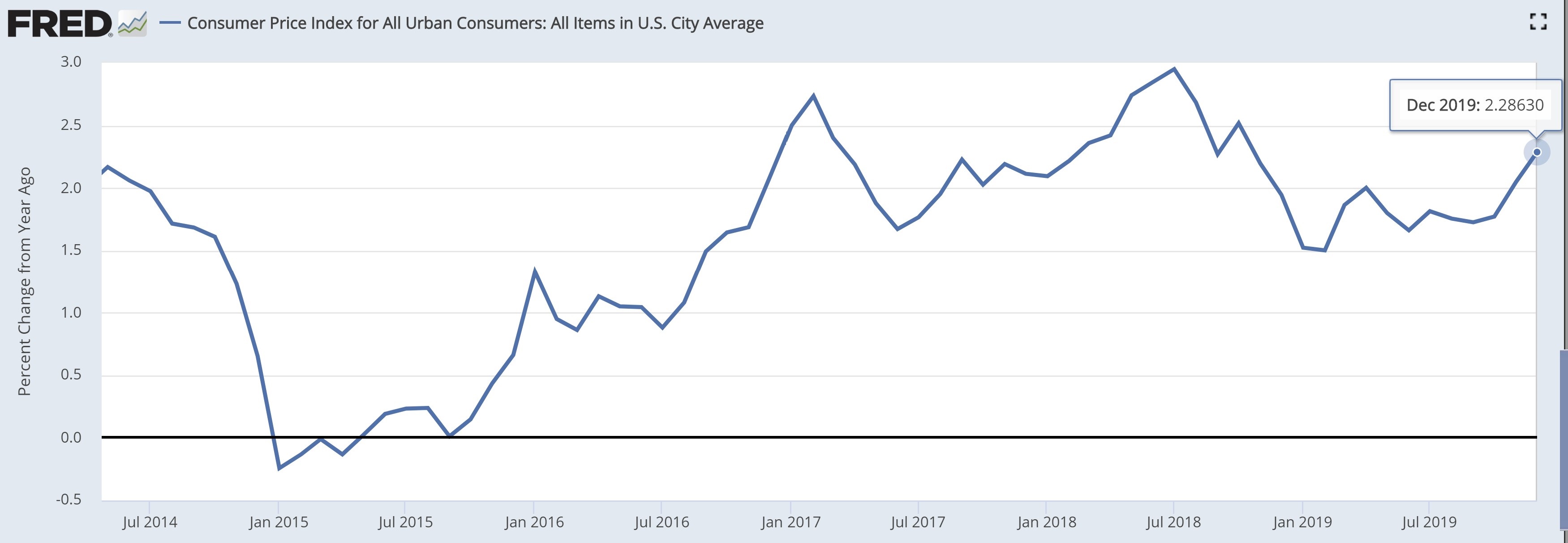

Prices continued rising at a moderate pace in December 2019 according to the Bureau of Labor Statistics. Their Consumer Price Index rose 0.2 percent in the final 31 days of the decade. This final uptick helped push the year-over-year tally to 2.3 percent which is faster than the 1.9 percent rate of change in 2018.

Three items accounted for most of the month’s gains. The gasoline index jumped 2.8 percent in December alone. Medical care also outpaced the headline uptick, rising 0.6 percent (up 4.6 percent for the year) and helped by prescription drugs’ surge of 2.1 percent. Finally, the shelter index increased 0.2 percent, putting its year-over-year count at 3.2 percent.

The core version of this indicator which subtracts food and energy was up just 0.1 percent for the month and matched the headline tally’s gain of 2.3 percent for the year. This subset’s monthly increase was obviously helped by not having the 2.8 percent pump from gasoline. Falling auto costs (down 0.8 percent) also kept this from moving faster, as did declining airline tickets and household furnishing costs.

Consumer price gains accelerated in 2019 according to this measure of inflation. The 2.3 percent increase was the fastest since a 3.0 percent rise in 2011. During the past ten years, the CPI rose 1.8 percent a year on average. From the looks of this indicator, inflation could be accelerating. However, it was considerably higher eight years ago, yet price increases never managed to accelerate beyond the 3.0 percent level. While not impossible, it seems unlikely that a new era of hastened inflation growth in upon us.