December 2019 National Federation of Independent Business

Submitted by Atlas Indicators Investment Advisors on January 23rd, 2020

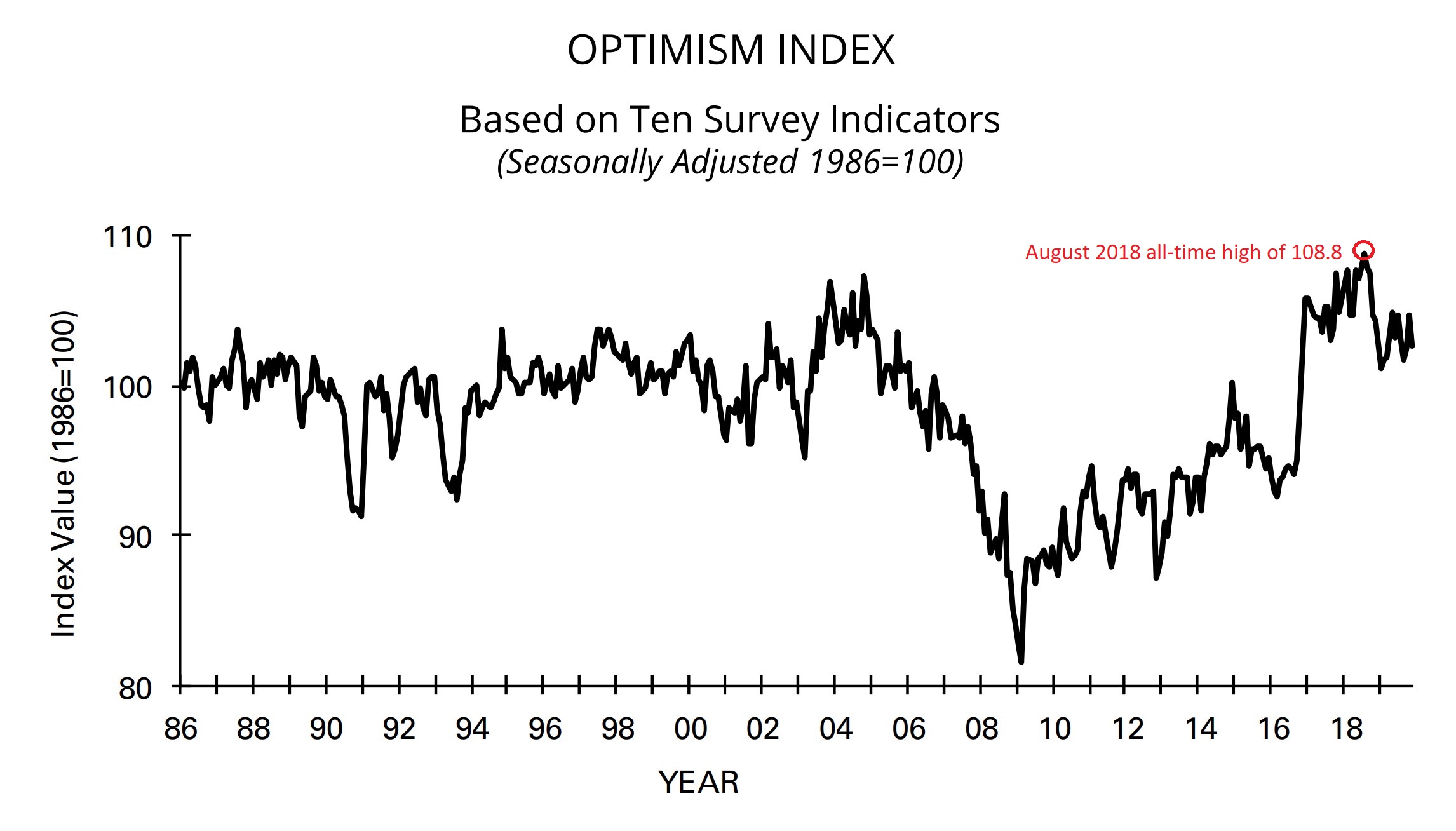

Small business confidence remains high by longer-term standards but has been waning relative to its all-time high. The National Federation of Independent Business’ Optimism Index declined two points in December 2019 to 102.7 after rising 2.3 points in November. Despite all the recent gyrations, this index has moved very little over the past three years.

Weakness was abundant as six of the 10 components declined, two were unchanged, and just two improved. On the losing end of things, categories like plans to increase employment and current job openings suffered. Likewise, the number of firms believing now is a good time to expand dropped along with current inventory levels. Finally, plans to make capital outlays headed lower, which could be explained by the sharp deceleration in earnings trends.

Things looked a little better for the other 40 percent of the categories. Plans to increase inventories held steady as did the future expectations for credit conditions. Fortunately, a few other expectations categories manage to increase. A growing number of small business owners believe the overall economy will improve further and anticipate increased real sales.

This indicator jumped a lot after the last presidential election. In the two survey periods following the election of President Donald Trump, this index rose 10.9 points to 105.8 by the end of 2016. Three years later it is a tad below that level but managed to reach an all-time high of 108.8 in August 2018. Small businesses are relatively happy with their current and expected situations, but they are a little less enthused than 17 months earlier. Nevertheless, it looks as if this portion of the economy has a strong foundation from which to grow in 2020.