Durable Goods Orders November 2019

Submitted by Atlas Indicators Investment Advisors on January 17th, 2020

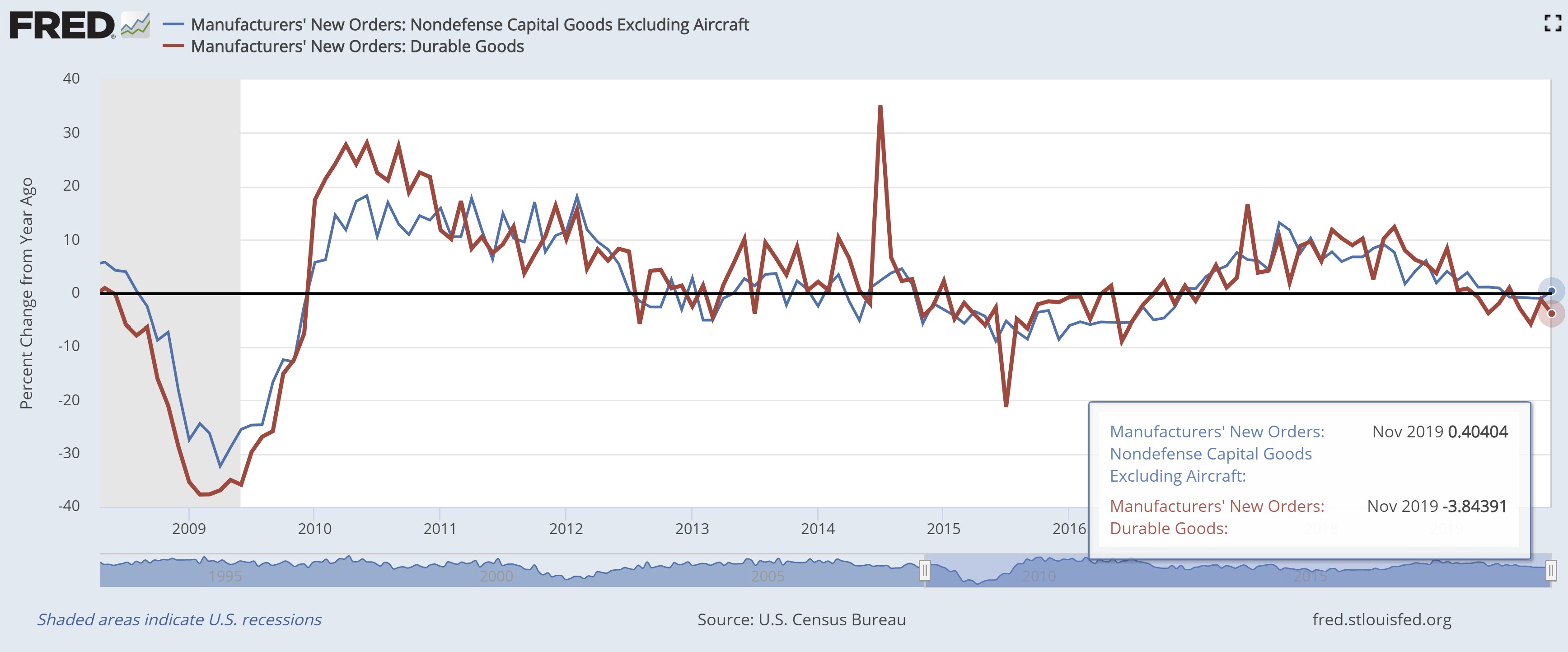

Durable Goods Orders declined in November 2019 according to the Census Bureau. This measure for orders of wares expected to last three years or longer fell 2.0 percent in the month alone. Year-over-year, the tally is even worse, down 3.8 percent. Ouch! However, it isn’t as bad as the headline suggests.

Defense orders, or the lack thereof, hurt the topline tally. Orders for military aircraft collapsed 72.7 percent which caused a 38.2 percent drop in overall defense requisitions. Regular readers know this on its own is not worrisome since military orders are not necessarily indicative of the economy’s direction. Additionally, aircraft orders (military or civilian) are expensive and can skew the overall tally up or down. Instead, Atlas pays attention to another line item that we believe is proxy for business confidence.

Firms spend money on capital when their optimism is up. They are more willing to part with cash and take on financing obligations when they feel good about their profitability prospects. These orders show up in the core-durable goods subset officially known as nondefense capital goods orders excluding aircraft. Atlas doesn’t want to oversell it, but the uptick of just 0.2 percent in November looks much better than the headline figure. Similarly, the year-over-year gain of 0.4 percent for core-durable goods orders isn’t explosive in an absolute sense but looks great relative to the minus 3.8 percent for the headline count.

Durable goods are moving forward despite the headline’s pessimistic print. However, the trend’s slope is shallow. Our economy and its growth rate would benefit greatly if the core portion of the indicator gained some additional momentum, helping the efforts of our country’s consumers to keep the current expansion alive.