November 2019 Income and Outlays

Submitted by Atlas Indicators Investment Advisors on January 9th, 2020

Income and outlays improved in November 2019 according to the Bureau of Economic Analysis. The headline count for income gained 0.5 percent. Similarly, disposable income (after-tax income) was also up 0.5 percent. Further, inflation adjusted income gained 0.4 percent. No matter how you dice it, Americans had more money to spend. And their spending increased. Personal Consumption Expenditures (PCE) rose 0.4 percent and real-PCE (inflation adjusted) rose 0.3 percent.

All four major categories of income improved. Wages and salaries, the largest source of income in America, rose for the sixth consecutive period, rising 0.4 percent. Proprietors’ income regained all the prior period’s loss (down 1.1 percent) and then some with a 1.9 percent uptick. Likewise, income on assets (interest and dividends) was up 0.8 percent after falling 0.7 percent in October. Finally, rental income increased 0.5 percent, matching the prior gain.

Outlays were equally strong. All three categories were higher. Spending on nondurable goods gained 0.1 percent. Durables made back all the prior period’s 1.0 percent loss, rising 1.2 percent in November. Finally, services (the biggest category) continued its steady path higher, rising 0.2 percent for a fifth consecutive period.

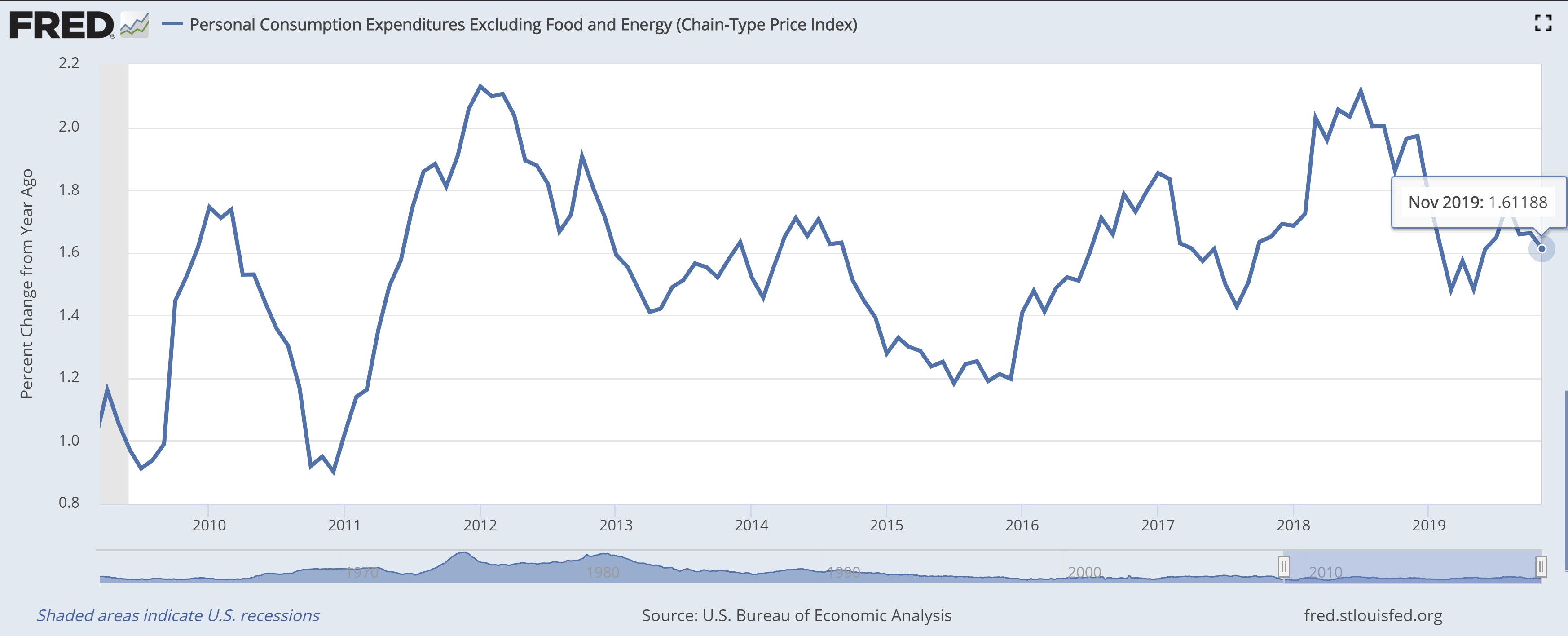

Price gains were also steady. The PCE-price index gained 0.2 percent and is up 1.5 percent year-over-year. The core version of this price proxy, which excludes food and energy, was up 0.1 percent for the fourth time in a row and is up 1.6 percent versus 12 months earlier.

America’s economy runs on consumption, so this is a big indicator. Consumer spending are over two-thirds of our nation’s output. From the look of things, the current expansion isn’t exhibiting signs of rolling over.