December 2019 Employment Situation

Submitted by Atlas Indicators Investment Advisors on January 23rd, 2020

America’s labor situation has been one of the economy’s highlights since it began recovering after the Great Recession. Last year (2019) ended the decade by adding 2.11 million net new jobs, including December’s uptick of 145,000 according the Bureau of Labor Statistics (BLS). The unemployment rate held steady at 3.5 percent.

Our nation’s improving labor situation helps the consumers’ strength which is currently driving America’s economy ahead. Rising $0.03 an hour on average, pay increases added fuel to this fire. At first glance this might not seem like much, but it’s substantial when multiplied by 158 million workers. This marginal increase is the equivalent of an additional $4.74 million of income every hour of the average workweek. The average workweek held steady at 34.3 hours. When these hours are multiplied by an additional $0.03 an hour, that small wage uptick increases aggregate consumer income by a whopping $162.6 million each week.

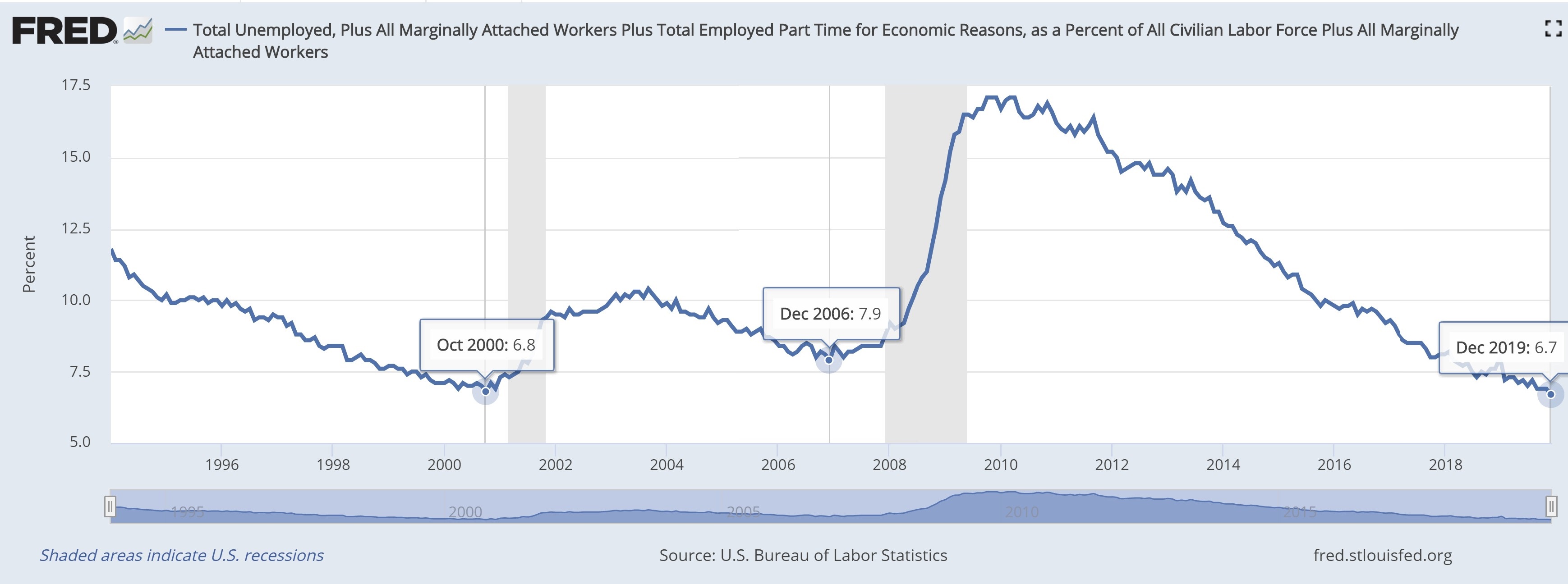

Other data points were strong as well. The BLS reports information regarding those who are “marginally attached” to the labor market. This cohort is neither working nor looking for a job, but they are open to working and have looked for employment at some point in the past twelve months. Additionally, the BLS tracks those working part-time even though they prefer a full-time position. When these two groups are added to the unemployed, it reveals a statistic known as the “real” unemployment rate, and this is now at just 6.7 percent which is lower than at any point during the prior two economic recoveries (see chart above). Impressive.

Labor conditions are favorable. Firms will likely continue adding to payrolls which will further support the virtuous portion of the business cycle in which America currently finds itself. If any other segments of output (e.g., exports or business investment) start to pick up, our economy might just accelerate further.