Drying Out

Submitted by Atlas Indicators Investment Advisors on September 30th, 2023

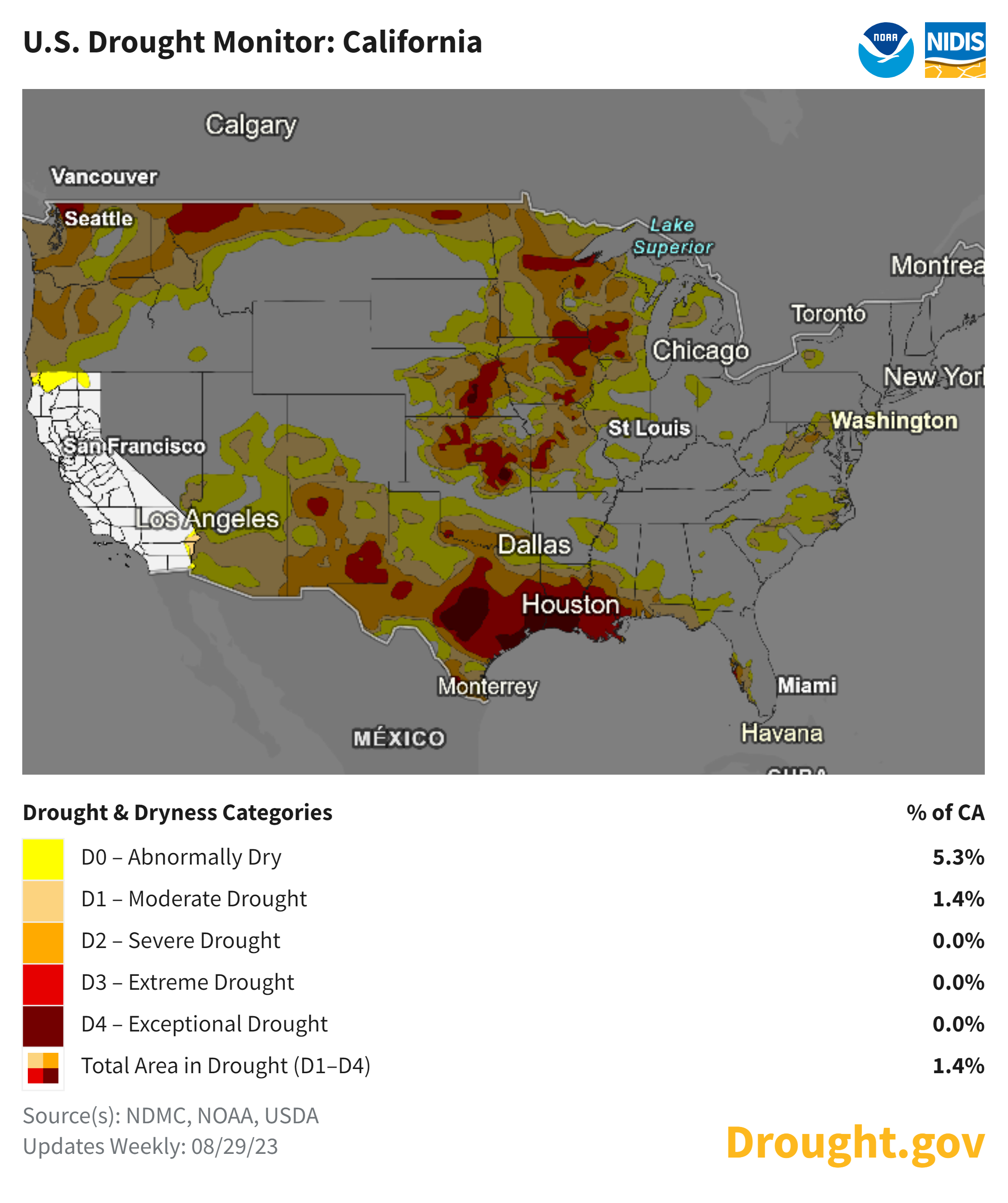

Are we in a drought or not? It depends on where you live. According to the map above, virtually all of California is not. Those living to the southeast of the Golden State are not so lucky. How did this come to be? An excess of rain last year in California helped. However, the West Coast probably shouldn’t act as if the current state of water will last