Friday Fun

Porky and Bust

Submitted by Atlas Indicators Investment Advisors on May 31st, 2023

With the unofficial start to summer right around the corner, “Summertime” from George Gershwin’s opera Porgy and Bess which premiered in Boston in 1935 is frequently playing on the Atlas jukebox. This story centers around an African American couple living in South Carolina on Charleston’s impoverished Catfish Row.

Relax, It’s Friday

Submitted by Atlas Indicators Investment Advisors on April 27th, 2023

Stress is endemic in the American culture. For generations now, we’ve defined ourselves and frankly our value on the type of work we do and how many hours we spend doing it. Other exogenous stresses influence us from time to time and the medical profession doesn’t seem to think it is all that healthy at the individual level.

Doo-doo-doo-doo

Submitted by Atlas Indicators Investment Advisors on March 31st, 2023

Unsure if we could use the name of a Beatles song as a title for a note to our audience, Atlas went with Doo-doo-doo-doo, but make no mistake, here comes the sun. Our planet’s original energy source is spewing solar winds our direction and a second round of them could be arriving today! Just last week scientists at NASA’s Solar Dynamic Observatory spotted a coronal hole

Six Heads and a Whirlpool

Submitted by Atlas Indicators Investment Advisors on March 22nd, 2023

The Odyssey is an epic poem written by Homer, telling the story of Odysseus, a Greek warrior embarking on a long journey home to Ithaca after the Trojan War. Along the way, Odysseus faces many adventures and must battle monsters, gods, and the sea itself. He eventually makes it home, but not before enduring a series of obstacles and tasks set by the gods.

Some All-American Giddy Up

Submitted by Atlas Indicators Investment Advisors on February 23rd, 2023Jobsmacked

Submitted by Atlas Indicators Investment Advisors on February 23rd, 2023

/ˈjäbˌsmakt/

A description of the feeling a person gets after receiving a piece of shock news concerning their employment i.e. demotion, redundancy, loss of benefit, changes to working routines or dismissal. Often due to unforeseen circumstances which lead to the recipient ending up in said state. (www.urbandictionary.com)

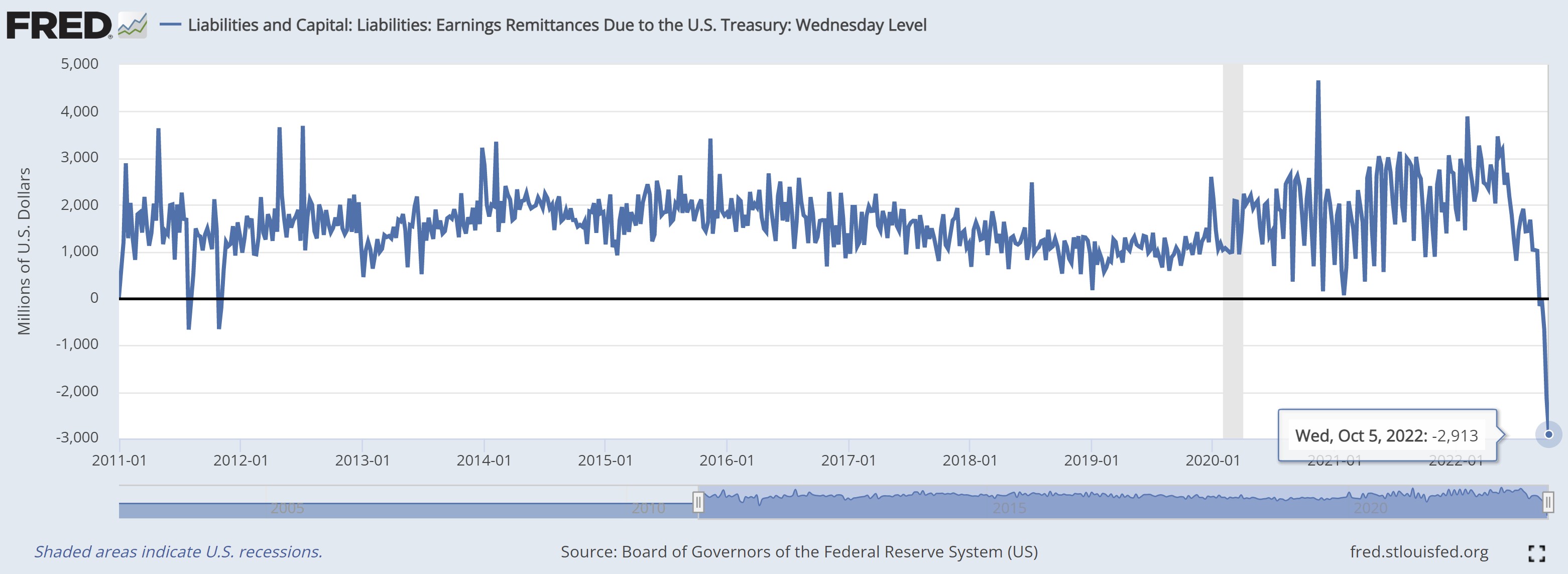

Savings Gripe

Submitted by Atlas Indicators Investment Advisors on November 6th, 2022Savings are going away. A few days ago, regular readers were sent a note on income and outlays from the Bureau of Economic Analysis which includes data on the savings rate. In the note, Atlas highlighted the dismal rate of savings (currently 3.1 percent). It is understandable that households are less able to stash cash when inflation is rising while markets crash. But ou

Playing Catch Up

Submitted by Atlas Indicators Investment Advisors on October 14th, 2022Antifeatures

Submitted by Atlas Indicators Investment Advisors on October 6th, 2022

Software runs our world. Whatever apparatus you’re reading this note on has programs and operating systems which allow you to receive and delete (hopefully not too quickly) this note. Some of the code runs in the background doing things I’ll never understand, but other parts of it create feature or functionality designed to be useful to us as users. Occasionally, a