How Did We Get Here?

Submitted by Atlas Indicators Investment Advisors on January 31st, 2025

In recent years, America has experienced higher inflation than we've seen in a long time. To understand how we got here, Atlas thought it would be worth a look at a model we recently came upon. It was created by Steve Hanke, an economist and professor of applied economics at Johns Hopkins University. While no models are gospel, this one offers some perspective on why prices have gone up so much that doesn’t feel farfetched.

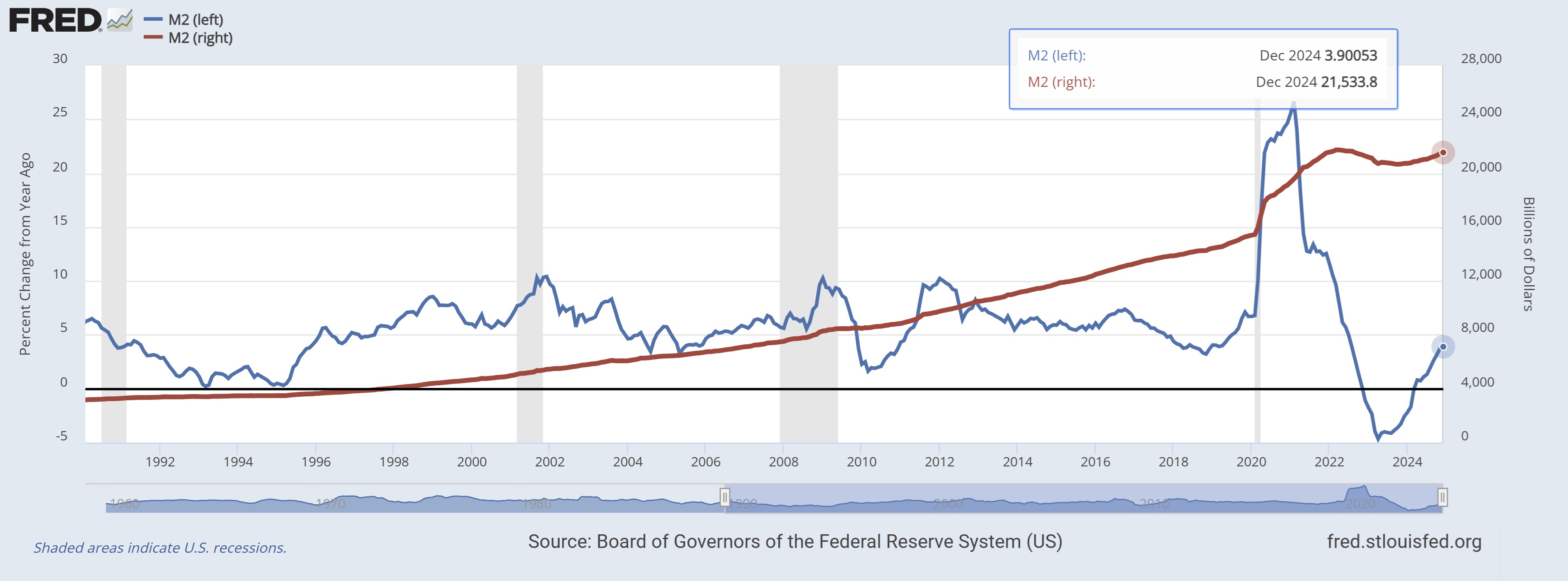

Hanke's model is all about the relationship between money and prices. It suggests that when the government and banks create a lot more money, prices tend to rise. More specifically, the model follows the rate of change of money creation, something we’ll mention again at the end. As the pace of money creation accelerates, future inflation follows suit with a lag. Likewise, if it slows, the model indicates inflation will also.

During the COVID-19 pandemic, the government wanted to help people who lost their jobs or were struggling. They did this by creating a lot of new money and giving it out through stimulus checks and other programs. At the same time, the Federal Reserve made it easier for banks to lend money using monetary policy. This meant that there was suddenly a lot more money in the economy.

According to Hanke's model, when the money supply is increased this quickly, inflation is bound to follow. And that's exactly what happened. All that extra money chasing the same amount of goods, a classic definition of inflation.

The situation we're in now is a result of these policies. While they were meant to help during a tough time, they also led to the inflation we're experiencing. Hanke's model suggests that to bring inflation back down, we need to slow the growth of the money supply, which is what the government and Federal Reserve are trying to do now. However, it takes time for these changes to have an effect, which is why we're still feeling the impact of those earlier decisions. Also, inflation measures price increases, so even when inflation is low, prices are rising. Outside of a major catastrophe, it seems unlikely that we’ll see pre-COVID prices, but Hanke’s model suggests it would be reasonable to anticipate some slowing in general price growth as money supply’s growth is now in line with the range America experienced in the decade before the pandemic.