Bitter Suite

Submitted by Atlas Indicators Investment Advisors on April 29th, 2025

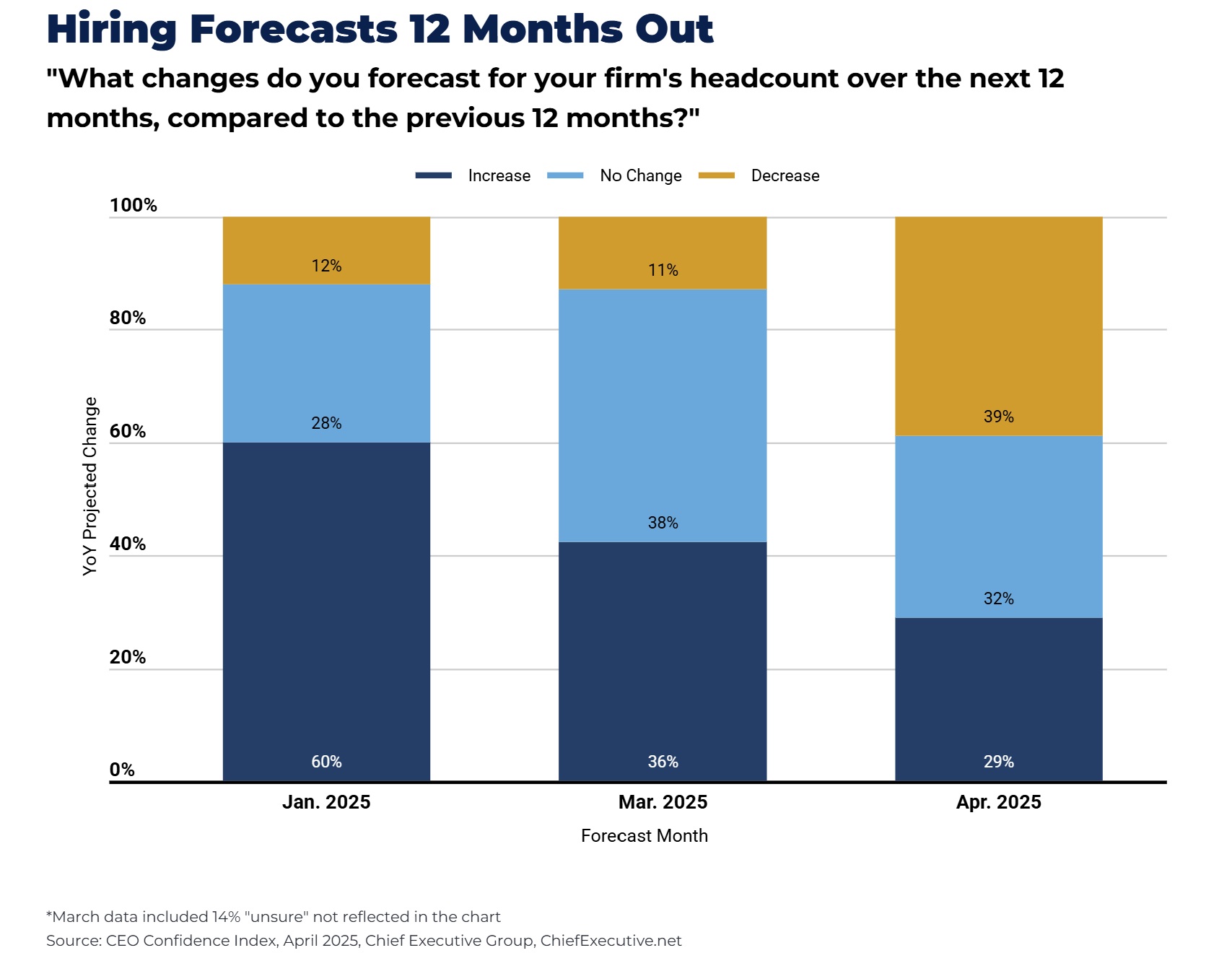

According to chiefexecutive.net, optimism remains stubbornly low in America’s C-Suites (the group of senior executives in a company whose titles typically start with "Chief”). Each month they conduct America’s largest monthly poll of CEOs. Their April 2025 survey reveals that confidence among chief executives is down 28 percent since the start of the year. The outlook for the next 12 months remains tepid, with CEOs rating their expectations for the period at just five on a scale of one to 10, matching the March figure and marking a 29 percent decline year to date. Persistent pessimism is fueled by mounting concerns over a potential recession, ongoing economic uncertainty, and the lack of clear signals for a robust recovery.

The survey highlights that CEOs are not only worried about the broader economy but also about the prospects for their own businesses. Many cite inflation, regulatory uncertainty, and geopolitical tensions as significant headwinds. Despite these challenges, some business leaders are attempting to maintain a steady course, focusing on cost controls and operational efficiencies to weather the storm. However, the overwhelming tone in the survey is one of caution, with most CEOs holding off on major investments or expansions until the economic picture becomes clearer.

This multi-year low in CEO confidence stands as a reversal of expectation from what has been a more optimistic period in recent years, articulating the level of current anxieties. The stagnation in outlook may take time to reverse even when economic indicators and geopolitical situations stabilize. Business leaders remain unconvinced that a strong rebound is imminent. As a result, companies may remain in a defensive posture, prioritizing resilience over risk-taking until clarity returns. This positioning does not seem constructive for America’s economic growth. While the news cycle is moving quickly these days and leaders of commerce can change their posturing, the April survey serves as a reminder that, for now, uncertainty and recession fears continue to cast a long shadow over the C-suite.