Inflated Dissonance

Submitted by Atlas Indicators Investment Advisors on March 9th, 2025

From time to time, Atlas will look at consumer attitude data. Recently, the University of Michigan’s Consumer Sentiment release caught our attention. In particular, inflation expectations made a dramatic move higher. Those surveyed in February 2025 believe inflation will climb 3.5 percent per year over the next five years. This is up from 3.2 percent in January and is the highest level since 1995. In the next 12 months, the expectation is for 4.3 percent inflation, a sharp uptick from 3.3 percent a month earlier and reaching an over one-year high.

Context is always helpful when looking at survey data. Since 1979, Michigan’s 5-year inflation expectation has averaged 3.19 percent. In 1980, this figure reached its all-time high of 9.70 percent. Its low was much more recent, hitting 2.2 percent in 2019. Expectations are far from extreme but are rising. Concerns over tariffs seem to be driving this attitude about inflation as roughly 40 percent of those polled mentioned them without prompting; this compares to 27 percent a month earlier and just 2.0 percent prior to last year’s election.

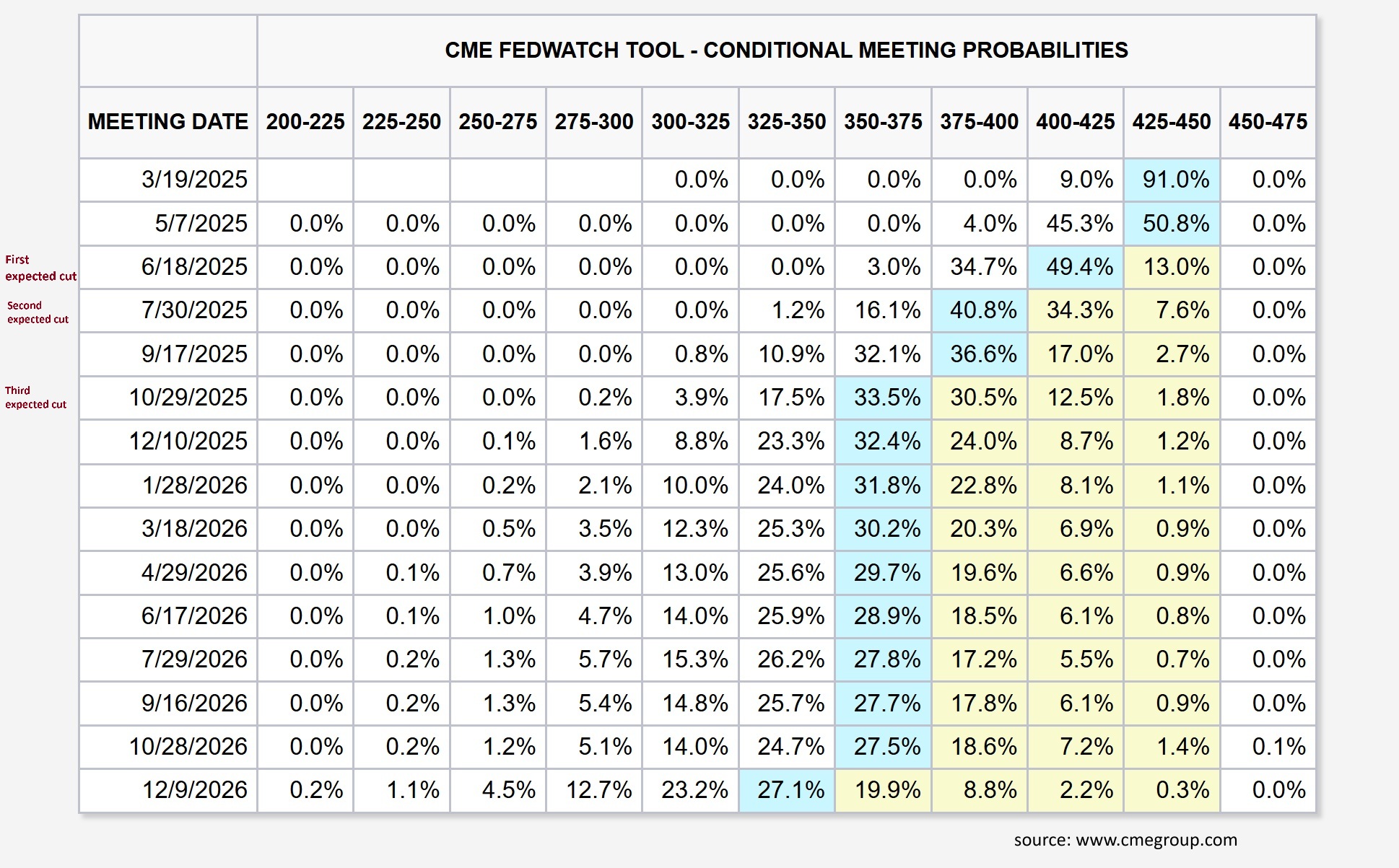

While those surveyed expect inflation to accelerate, market participants seem to have another narrative. Data from the CME FedWatch Tool has changed dramatically. It was recently pricing in just one interest rate cut from the Federal Reserve this year but, as of this writing, is anticipating three 0.25 percentage point cuts; the first arriving in June. Given the Fed’s determination to get price changes beneath its 2.0 percent target, this market expectation is at odds with those surveyed by the university.

This divergence between consumer expectations and market predictions highlights the complexity of America’s economy. Consumers brace for higher inflation, while the market anticipates multiple rate cuts. Dissonance is growing, yet only one reality will be revealed. As we navigate these conflicting signals, it will be interesting to watch to see if the two potential outcomes might yet converge into a more unified expectation.